The COVID-19 pandemic and record hurricane and wildfire seasons made 2020 “a unique and at times challenging year,” FERC said in its State of the Markets report Thursday.

Electricity prices dropped for the second consecutive year, with record-low prices in some regions, thanks to the pandemic, low gas prices and a mild 2019/20 winter, the Office of Energy Policy and Innovation’s Division of Energy Market Assessments reported.

Energy Prices

The pandemic reduced average electricity demand by 4 to 10% in commission-jurisdictional ISOs during the spring, and daily load patterns changed as commercial and industrial demand dropped and residential use increased, resulting in a more gradual morning peak than in the past.

Change in annual average day-ahead on-peak price from 2019 for select hubs | S&P Global Market Intelligence

Average day-ahead on-peak prices declined in 2020 at all but two nodal pricing hubs, CAISO SP15 and Palo Verde.

The biggest price reduction was in ERCOT, reflecting high prices in the summer of 2019. Large declines were also seen in the Northeast and Mid-Atlantic, with prices in NYISO Zone J (New York City) down 27%.

The drops were bad news for power plant operators. Net revenue — total revenue less short-run marginal cost — for a hypothetical new natural gas combined cycle power plant in PJM was down 23% in the first three quarters of 2020 compared to a year earlier.

Annual average day-ahead on-peak price at ISO and Non-ISO pricing nodes in 2020 | Hitachi Powergrids Velocity Suite

But not all regions benefited, as Long Island and the western shore of Chesapeake Bay saw higher prices than neighboring areas because of transmission congestion. FERC also noted price separation between SPP and MISO along the Kansas and Missouri border, citing “inefficiencies that prevent the economic transfer of energy between regions including insufficient transmission capacity.”

Storms, Fires

Stay-at-home orders reduced commuting and contributed to an 8% year-over-year drop in U.S. oil production. (See World Puts Gasoline in the Rearview Mirror.) Natural gas production, buoyed by increased liquified natural gas exports and power plant demand, was down only 2%, by comparison.

A severe heat wave led to load shedding in California last summer. The state also experienced five of the 10 largest wildfires on record in 2020. In August and September, CAISO’s solar electricity generation dropped by one-third from July as offshore winds pushed wildfire smoke into Southern California.

The 2020 Atlantic hurricane season was the most active in history, with 30 named storms. MISO’s Gulf Coast was hit with three storms, which caused severe damage to transmission and distribution lines.

Generation Shift Continues

Natural gas and renewable generation resources accounted for most new capacity additions while nuclear and coal generation resources accounted for most retirements.

The continental U.S. added more than 41 GW of new capacity — dominated by 32 GW of renewables (nameplate) and 7.5 GW of natural gas — and retired 14 GW, including 9.6 GW of coal.

Within commission-jurisdictional wholesale markets, MISO led with 5.9 GW of new wind and 2.4 GW of natural gas, while PJM had the most retirements at 2.6 GW, mostly coal.

NYISO was the only jurisdictional market to see a net decrease in capacity, caused by the April 2020 retirement of the 1-GW Indian Point Unit 2 nuclear plant. SPP added 5.4 GW of wind, and CAISO added 1.9 GW of solar and 1.4 GW of natural gas.

Battery storage additions almost quadrupled last year from 152 MW to 733 MW, including 626 MW in CAISO. By 2023, CAISO projects adding more than 3.6 GW of storage, while ERCOT and NYISO plan to add over 1.2 GW each.

The Energy Information Administration reported that natural gas was responsible for 39% of electricity net generation in the continental U.S. in 2020, up from 36% in 2019. Coal-fired generation dropped to 20% from 24%.

Daily solar generation in CAISO | FERC

Wind and solar operating capacity shares increased in all jurisdictional markets, with wind boosting shares in SPP and MISO and solar up in CAISO. The combined share of wind and solar rose from 9% to 11%, EIA reported.

Market Developments

There were several noteworthy market developments, with the Western Energy Imbalance Market expanding to 11 members with the addition of Salt River Project and Seattle City Light on April 1. Another five utilities are expected to join or expand their participation in the EIM this year.

SPP’s Western Energy Imbalance Service was approved by FERC and began operations on Feb. 1 with participants including Basin Electric Power Cooperative, Municipal Energy Agency of Nebraska, Tri-State Generation and Transmission Association and three Western Area Power Administration marketing regions.

Transmission Additions

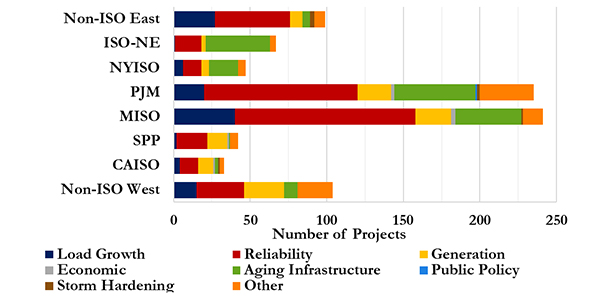

FERC said more than 800 line-related transmission projects went into service in commission-jurisdictional transmission planning regions in 2020, citing data from The C Three Group. Most additions were in MISO and PJM.

New line-related transmission projects: Transmission projects with 2020 in-service dates within FERC order 1000 planning regions | The Three C Group

Only four of those projects were selected via competitive bidding processes under Order 1000, and only one of them was completed by a merchant transmission developer, the Harry Allen-Eldorado Desert Link in WestConnect constructed by LS Power.

FERC noted two interregional developments: MISO’s approval of an interregional project previously approved by PJM near the Indiana-Michigan border and the announcement by MISO and SPP of a Joint Targeted Interconnection Queue Study to find cost-effective projects along the seam between Nebraska and Kansas in MISO and Iowa and Missouri in SPP. “This study comes after four prior efforts were unable to find projects both regions were willing to pursue,” the commission said.