The 2021 capacity, energy, loads and transmission (CELT) forecast will have a reconstituted methodology for passive demand resources (PDRs), ISO-NE’s Jon Black and Victoria Rojo told the Planning Advisory Committee Wednesday in “a high-level update.”

In October, FERC accepted tariff changes to base the calculation on the capacity supply obligations (CSOs) acquired by PDR resources in the most recent Forward Capacity Auction.

Previously, values for PDRs — mostly energy efficiency — were based on the resources’ performance. The new methodology exhibits a lower level and slope, resulting in a lower gross load forecast.

Additionally, Black mentioned the forecasted impact of heating and transportation electrification on state and regional energy and demand, which ISO-NE began including in the 2020 CELT. The heating forecast focuses on the winter months only (October through April) and looks at consumer adoption of air-source heat pumps (ASHPs) across New England. Black said the RTO updated its methodology to account for the energy and demand impacts of both partial and full heating applications, taking advantage of state-level adoption forecasts that separate the two categories. He added that ISO-NE also consulted with electrification specialist Sagewell, Inc. to use recent advanced metering infrastructure data to isolate the impact of each ASHP category better.

Transportation electrification has focused on light-duty vehicles to date, but Black said freight vehicles and electric buses, trains and trolleys could be considered in the future. Updated assumptions regarding state forecasts for adopting electric vehicles have been implemented, including direct input from Maine, Massachusetts and Vermont. According to Black, EV adoption forecasts for Connecticut, New Hampshire and Rhode Island reflect a blending of the Transportation and Climate Initiative projections of electrified light-duty vehicles stock growth and ISO-NE’s 2020 EV adoption forecast.

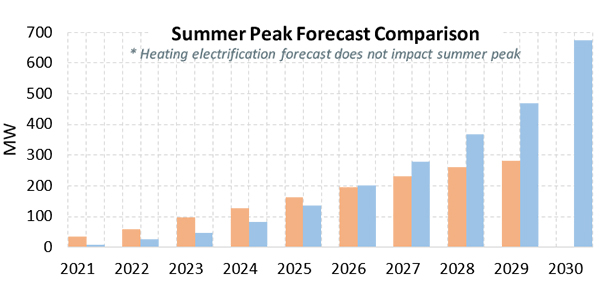

Forthcoming updates to the 2021 CELT forecasts will finalize energy efficiency and solar PV forecasts and incorporate Moody’s February 2021 macroeconomic outlook and final FCA 15 results for PDR CSOs. Black and Rojo said that additional discussion on regional gross and net forecasts for energy and summer and winter demand is slated for the PAC meeting on April 14.

Tx Planning Assumptions for Battery Storage

Meena Saravanan, transmission planning engineer for ISO-NE, presented the RTO’s proposed assumptions for battery storage in transmission planning. She said that decreasing energy storage costs and an increase in intermittent resources will drive a proliferation of battery storage installations in New England.

Saravanan said there was only about 20 MW of battery storage installed in the region until last year. However, there is 3,000 MW of stand-alone battery storage in the interconnection queue, and more than 600 MW of battery storage cleared FCA 15, compared to only 5 MW in FCA 14. According to Saravanan, state initiatives such as Massachusetts’ 1,000-MWh energy storage target by 2025 will further accelerate battery storage projects. Massachusetts also incentivizes electricity supply from clean energy technologies during seasonal peak demand periods through the Clean Peak Energy Standard.

Saravanan split batteries into two categories based on their participation or nonparticipation in the wholesale electricity market: market-facing and non-market-facing.

Market-facing and non-market-facing batteries will have different rules and financial incentives for operation. Market-facing batteries are expected to respond to locational marginal pricing (LMP), provide capacity through the Forward Capacity Market and be exposed to Pay-for-Performance penalties and incentives. Conversely, non-market-facing batteries are not expected to respond to LMP or participate in the FCM, which gives the RTO much less visibility and control over those batteries. Some battery installations are co-located with renewable resources and may not have interconnection rights to charge from the grid in the absence of renewable production. Saravanan asked for feedback on the assumptions by April 1.

Eversource Replacing Wood Structures in NH

Christopher Soderman of Eversource Energy laid out the utility’s plan to replace 546 laminated wood structures across eight 115-kV transmission lines in New Hampshire with weathering steel monopoles at an estimated cost of $98 million.

Soderman said the steel monopoles offer compliance with current clearance and strength code requirements, improved reliability and storm resilience and increased strength to support larger conductor sizes in the future if needed. He added that Eversource would coordinate these replacements with ongoing projects to take advantage of mobilization, permitting and outreach efforts, and access to shared rights-of-way. Remaining lines with laminated wood structures in New Hampshire would be assessed in the coming months, he said. Additional structure replacement projects will be presented to the PAC if necessary. There is potential for all laminated wood structures to require replacement. The in-service dates for the work range between the end of this year and December 2022.