The NYISO Market Monitoring Unit on Monday discussed its report on the Class Year 2019 buyer-side mitigation (BSM) evaluations, including some of the technical assumptions used.

Raghu Palavadi Naga of NYISO Market Monitoring Unit Potomac Economics presented the analysis — intended as a high-level overview of the MMU’s content-heavy, main CY19 evaluation — to the Installed Capacity/Market Issues Working Group.

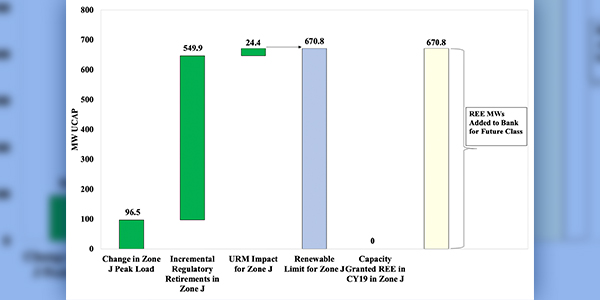

Low capacity margins and regulatory retirements were the chief drivers for Part A exemptions and renewable entry exemptions (REE), Naga said. “Additional retirements, for example from the state Department of Environmental Conservation’s peaker rule, could enable more exemptions.”

The BSM rules are intended to avoid artificial suppression of capacity prices below competitive levels due to subsidized entry of uneconomic resources, and the new capacity resources can seek four different types of exemptions.

The REE exempts renewable technologies that NYISO determined to be weak instruments for the exercise of buyer-side market power because of their low capacity value and high fixed costs. The competitive entry exemption exempts unsubsidized merchant facilities that enter based on their own expectation of market conditions.

The Part A test exempts a resource when its capacity will not lead the capacity surplus of a locality to exceed 4 to 6%; and the Part B test ensures that a project is not mitigated when it would be economic for the project to move forward.

The “peaker rule,” which became effective last January, phases in nitrogen oxide (NOx) limits for all single cycle combustion turbines in New York City and Westchester, Rockland and Nassau counties during the summer ozone season.

Revenue Estimates

However, Naga said two issues with the REE limit should be evaluated further. Acceptance of NYISO’s Part A enhancements would not have affected the outcome of the CY19 final determinations, but it could facilitate additional entry in future class years by prioritizing public policy resources ahead of other resources (ER16-1404-007).

FERC Backtracks on NYISO BSM Exemptions.)

The MMU’s reference in the review of distribution level reliability benefits to “benefits” and “revenues” are intended to refer to the same thing, as there are different revenue streams in the BSM evaluations, said Pallas LeeVanSchaick of Potomac Economics.

“In some cases, for revenue streams that come from non-wholesale market products or from contracts [for energy, capacity, and/or ancillary services] the NYISO is going to use proxy values based on an estimate of the value of a particular revenue stream,” LeeVanSchaick said.

One stakeholder said he understood the ISO requires a developer to identify a revenue stream in order for it to consider these benefits in the BSM evaluation of an energy storage resource.

The difficulty comes if a developer submits a contract covering multiple services, LeeVanSchaick said. “The ISO is looking in its evaluation to estimate the value of the distribution reliability benefit portion, and if the information presented doesn’t clearly identify the portion of the overall revenues that can be applied to that, then the ISO is going to have to come up with a reasonable estimate.”

The Part B test of the BSM rules involves estimating future streams of energy, ancillary services and capacity when there may be no contract in place, he said.

The MMU suggested improving the alignment of an actual project entry date with the date used in the Part A test. This improvement was included with the proposed Part A enhancements, but he stated that fixing this in the Part B test would require additional tariff changes.

LCR Values

One stakeholder cited the main report as saying if the locational minimum installed capacity requirement (LCR) had been higher, results would have been similar, and asked what that signified, as the LCR assumed for the study was higher than the LCRs that were being set for the market at the same time.

“When we talk about higher LCRs, we were comparing it with what the prevailing values were,” Naga said, adding that the Zone J (New York City) LCR used was 85.5% for the first year of the study, i.e., the 2022-2023 capability year.

The report has a lot of factual information, LeeVanSchaick said, and given some stakeholder concerns about the LCR values used for the evaluations — slightly higher than the previous historical record — “we are planning to present some information in the not too distant future about some of the things we think are going on with the LCR optimizer and why it’s producing erratic results in these mitigation evaluations. That’s something we’re working on understanding better.”