Texas lawmakers are considering securitization to help market participants and customers saddled with billions in costs from the February winter storm.

A Wall Street investment bank last week pitched a refinancing product that would help cooperatives manage the costs of buying and transmitting high-priced energy during the storms and the ensuing outages that lasted days. Other bills would use the same process to address an ERCOT market shortfall that has been whittled down to nearly $2.9 billion and its downstream effects on participants.

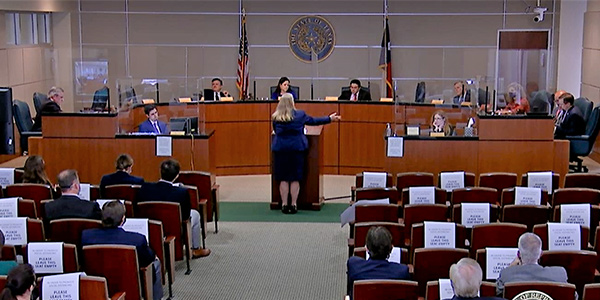

Jim Schaefer, a senior managing director with a global investment and advisory financial services firm Guggenheim Partners, told the House State Affairs Committee on Thursday that securitization is a “cheap form of financing” that spreads out the monetary pain over decades. He suggested legislators take a “more elegant approach” by creating a state-level “special purpose entity” that could raise a significant amount of money and fund “those that have been damaged by this event.”

The securitization product is essentially a AAA bond, offering buyers a revenue stream that is collected from charges on customer bills while market participants benefit from having the storm’s debt moved off their balance sheets. The AAA rating provides a low financing cost, Schaefer said.

“There’s significant capital available to us at a low cost,” he said.

Schaefer likened the financial distress to a spider web that is “spreading faster than you can move on this.”

“There’s unintended consequences from letting this issue fester. The spider web continues to grow,” he said. “Stay big picture; try to get the system back to where it was pre-crisis. Get liquidity into the system.”

Guggenheim has used similar vehicles in Chapter 11 bankruptcy cases involving Pacific Gas and Electric and Enron, Schaefer told the committee. He said his staff have determined that a $10 billion package spread out over 20 years at 3.5% interest would result in about a $1/month surcharge for residential customers, with commercial and industrial customers paying more.

Under House Bill 3544, cooperatives would be able to use securitization to recover “extraordinary” costs and expenses incurred from 12 a.m. Feb. 12 to 12 a.m. Feb 20.

Witnesses representing the cooperatives welcomed the suggestion. Farmers Electric Cooperative General Manager Mark Stubbs, one of Rayburn Country Electric Cooperative’s four member co-ops, told legislators that Farmers “did everything possible to keep the lights on, with no thought of the economic consequences.”

The result was energy purchases 13,000 times above normal Feb. 14 to 20 and residential customer bills of $3,300, rather than the normal $200 for using 200 kWh/month, Stubbs said.

“We’re member-owned. We cannot send out $3,300 electric bills,” he said.

Rayburn owes almost $575 million to the ERCOT market. It has filed a petition with the Texas Public Utility Commission that it suspend invoicing, billing and collection of charges related to February’s high prices (51812).

“The amount of money is not only staggering to the ratepayer but to the cooperatives themselves,” said Carl Lyon, an attorney with Orrick and a long career representing rural electric cooperatives in financial matters.

State Affairs Committee Chair Chris Paddie (R) is offering his own legislation (HB 4492) that would securitize costs and expenses during the energy scarcity conditions, when prices were capped at $9,000/MWh. A similar bill (HB1520) and its Senate companion (SB1579) have been drafted for the natural gas industry.

“If we don’t do anything, the costs lingering in the ERCOT system … will fall on ratepayers in an unbearable lump sum,” Paddie said.

Katie Coleman, speaking for the Texas Association of Manufacturers, said her organization has concerns over whether securitization would allocate costs only to consumers, instead of the entire market.

“The costs of securitizing can be big, but if it’s a big amount and over a long enough period, it can be justified. It’s a low-cost vehicle for financing big costs you’re going to have to pay anyway,” she said. “It’s not a good option if it allows a reallocation of costs that customers might not otherwise be on the hook for.”

“Obviously, that’s not the intent of the bill,” Paddie said, noting there’s still some work to do on the legislation.

Catherine Webking, representing electric retailers through the Texas Energy Association for Marketers, said ERCOT is approaching a 55-day settlement period in mid-April and faces a 90-day deadline to uplift short-pay amounts to the market. The grid operator’s protocols limit market uplift to $2.5 million a month, meaning it would take nearly a century to complete the process.

“We’re hoping for a very surgical and specific piece of legislation that could allow this securitization to move forward quickly,” Webking said. “We hear from the financial people that the availability of capital is not the issue. It’s just coming forward with [a proposal].”

For his part, Schaefer urged the legislature to decide quickly how to move forward on securitization.

“My point is, cut it off. You can’t be picking winners and losers at this point,” he said. “You’ve effectively created winners and losers because you’ve let this carry on. It’s horrible that people who didn’t have anything to do with this will pay, but it was a system failure.”