ERCOT said “weather-related” issues accounted for the bulk of February’s widespread and lengthy outages in Texas, according to a report it filed Tuesday with the state’s Public Utility Commission.

The grid operator said frozen equipment, ice accumulation and other weather causes accounted for 54% of the generation capacity taken offline during the height of the storm, representing 27.5 GW. Another 14% was attributed to equipment failure or malfunction.

Power plant operators have said they were hampered by a loss of natural gas supplies, but fuel limitations were blamed for 12% of the outages, or about 6.1 GW.

Frequency-related problems were responsible for about 2% of the outages, or nearly 1.3 GW. Several generators also said they were knocked offline during a frequency drop.

The report shows aggregated data based on information provided by generators and reflects outages and derates between Feb. 14-19. ERCOT used generators’ nameplate capacity in compiling the information, noting that wind and solar resources typically produce at much lower than their nameplate figures, resulting in outsized outage values.

Responding to media criticism over the report’s use of nameplate capacity, ERCOT said its outage scheduler software uses that metric as a standard reporting method.

“This was used throughout the [winter] event for reporting aggregated outage amounts and is used in this report for consistency,” spokeswoman Leslie Sopko said.

In a Twitter thread, University of Texas energy researcher Joshua Rhodes said it “might be more useful” to look at what ERCOT expected to be online rather than “raw capacity numbers.” Wind was low, but not as low as the full chart implied, he said, noting that thermal outages were greater than expected.

The grid operator said some of its request for information is still outstanding. It expects to release a final report no later than Aug. 31.

PUC Tweaks Scarcity Pricing Mechanism

PUC Chair Arthur D’Andrea directed staff to draft a proposal for a make-whole provision within ERCOT’s scarcity pricing mechanism following stakeholder feedback on whether a rule change is necessary to adjust the low system-wide offer cap (LCAP) before the summer.

The commission last month asked for comments on adjustments to the LCAP, but staff said stakeholders did not provide a consensus recommendation. Several commentators did note the provision setting the LCAP at the higher of $2,000/MWh or 50 times natural gas prices would have actually increased prices far above the high systemwide offer cap (51871).

Saying the natural gas price provision did not make sense, D’Andrea asked staff to eliminate the metric and replace it with a make-whole provision. He said the commission could wait on market-design changes that could be coming.

Staff recommended a holistic review of the broader scarcity pricing mechanism but said that it “need not be rushed ahead of this summer.” The review should be conducted as part of a more formal rulemaking process, staff said.

D’Andrea, who resigned from the PUC last month, still sits as the agency’s lone commissioner until a successor can fill his seat. Gov. Greg Abbott last week appointed construction lobbyist Will McAdams to the PUC, but he must first be confirmed by the Senate. (See Abbott Taps ABC Texas President McAdams for PUC Seat.)

Board Adds Muni Representative

ERCOT filled the latest vacancy on its Board of Directors when the municipal segment last week elected Garland Power & Light COO Tom Hancock as its representative.

Hancock replaces Bob Kahn, who resigned from the board March 25 over a conflict of interest involving his position as general manager of the Texas Municipal Power Agency. Denton, one of the agency’s four member cities, has filed one of numerous lawsuits against ERCOT over the February long-term outages. (See Former ERCOT CEO Kahn Resigns from Board.)

Speaking to Austin’s local public radio station, Kahn said, “So, basically, my bosses sued me.”

Kahn had earlier replaced Austin Energy’s Jackie Sargent, who was among a wave of director departures in the storm’s aftermath. The 16-person board now lacks only the five out-of-state unaffiliated directors, who resigned or withdrew their nominations in February over concerns their lack of state residency was a distraction to legislators. (See ERCOT Chair, 4 Directors to Resign.)

ERCOT Record for Wind Generation

Wind power, the early scapegoat for ERCOT’s generation shortage during the February winter storms, provided a record 10.5 million MWh of energy in March, according to the grid operator’s latest demand and energy report.

March’s wind energy production surpassed ERCOT’s previous high, set in December, by more than 2 million MWh, and pushed its share of the market to 38.6%. Natural gas provided 25.7% of ERCOT’s energy in March and coal 14.8%.

Solar generation topped 1 million MWh during the month, a level it had only reached June-August 2020, the Institute for Energy Economics and Financial Analysis said.

Luminant to Keep Trinidad Running

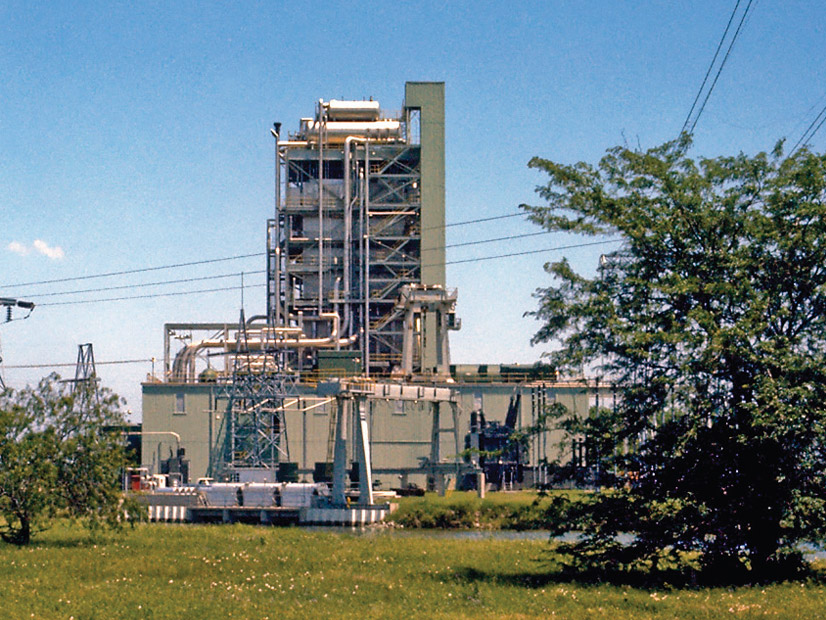

Luminant last week told ERCOT it is withdrawing its suspension notification for Trinidad 6, a 244-MW gas-fired plant energized in 1965.

Luminant, Vistra’s generation subsidiary, notified ERCOT late last year that it intended to retire Trinidad, effective April 29. (See Vistra to Shut down Another Texas Coal Plant.)

Vistra did not respond to an inquiry about the reason for the withdrawal. However, it has said it continually assesses its power plants based on real-time information and environmental compliance costs.