FERC on Thursday rejected GreenHat Energy’s contention that the commission erred in its November ruling in a dispute between the company and Shell Energy North America following GreenHat’s 2018 default (EL20-49).

The November order partially granted Shell’s petition for declaratory order, finding that, under the PJM tariff, entry of data into the Financial Transmission Rights (FTR) Center for bilateral trades “does not automatically establish standalone bilateral contracts at the stated price, absent a separate agreement by the parties.” The FTR Center is PJM’s tool that market participants use for submitting bids into the auctions prior to it going live.

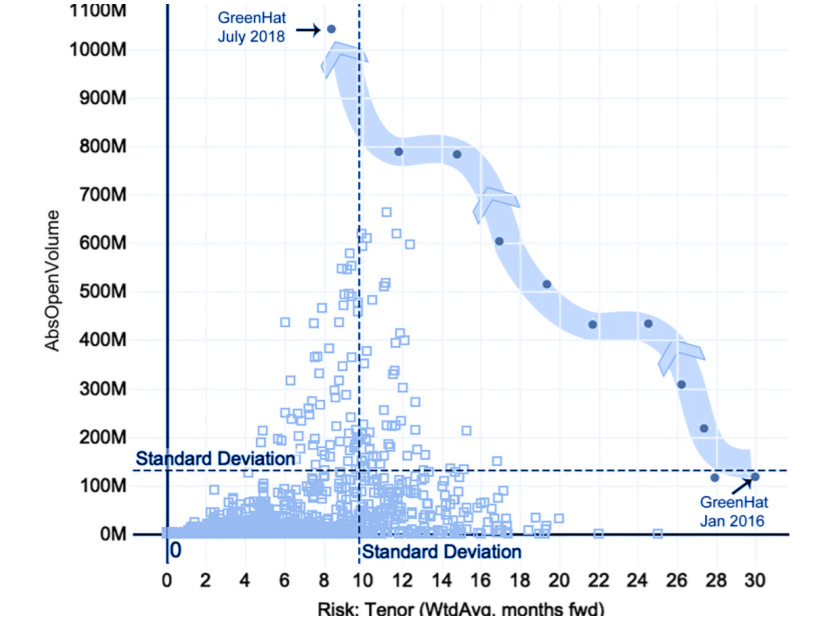

Shell petitioned FERC in May to intercede in a Texas state court case in which GreenHat filed a breach-of-contract claim against the energy company regarding bilateral contracts to transfer FTRs, saying Shell owed $68 million based on entries in the price field of the FTR Center for trades of around 3,870 FTRs. (See Shell Energy Seeks to Avoid Liability in GreenHat Trades.)

The commission in November declined Shell’s request to assert “primary jurisdiction” to resolve the dispute under Texas law as to whether the two companies entered into contracts that Shell would make payments based on entries in the FTR Center, allowing the case to proceed.

In its rehearing request to the November order, GreenHat asked that the commission “clarify that it is not prejudging the merits of either the Texas state litigation or any subsequent commission enforcement proceeding” in its order, including the question whether “parties can bilaterally contract on FTR Center without any other express contractual agreement beyond what occurred on FTR Center.”

GreenHat stated that the commission’s description of the FTR Center as “merely a reporting mechanism that would require a separate agreement to establish payment obligations” could be interpreted as prohibiting the FTR Center from “serving as anything beyond a reporting mechanism.” The company requested that FERC clarify that it had “neither opined on state contract law nor restricted parties who enter prices into the FTR Center from being bound contractually pursuant to state contract law.”

The rehearing request was automatically denied when FERC did not act on it within 30 days. In Thursday’s ruling, the commission said it disagreed with GreenHat’s arguments that it “prejudged or interfered with the Texas state litigation,” and that it “appropriately interpreted the PJM tariff, a matter squarely within the commission’s jurisdiction.”

“The commission has long recognized that state courts have concurrent jurisdiction to consider contract interpretation issues,” FERC said.

The commission also reiterated its defense of FERC’s Office of Enforcement, which is investigating whether GreenHat violated the commission’s Anti-Manipulation Rule.

GreenHat alleged that one or more members of the office’s investigative team had met with Robert Anderson, an independent third-party expert retained by PJM’s board to prepare the Report of the Independent Consultants on the GreenHat Default. The company said that FERC officials had a draft copy of the report and asked Anderson to “alter or remove language in the draft favorable to GreenHat.” (See GreenHat Maneuvers to Remove FERC from Shell Case.)

In the November order, FERC said the Department of Energy’s Inspector General investigated the allegations and concluded there was “no merit.”

In its rehearing request, GreenHat argued that the commission denied the company due process in rejecting “without explanation,” its June motion to bar FERC enforcement staff from participating in Shell’s request for a declaratory order. GreenHat also petitioned the commission to disclose the findings in the Inspector General’s investigation, saying that the “fairness of this proceeding and the reasonableness of the commission’s denial of GreenHat’s motion to bar are in doubt as long as the commission has failed to disclose the scope of the Inspector General’s investigation.”

FERC said it “has long held that a declaratory order proceeding is not an adjudication subject to separation of functions. … The commission did not need to impose such protocols in this case because the instant proceeding concerns a dispute among the parties to this proceeding rather than between Enforcement Staff and any of the parties to this proceeding.”

The commission said the Inspector General labeled its report “Official Use Only” and did not authorize the commission to disclose its findings other than to say there was no merit to the allegations.

“It is consistent with the Administrative Procedure Act (APA) and the commission’s separation of functions regulations and policy for commission staff across offices to advise the commission,” the order said. “In any event, regardless of GreenHat’s allegations with respect to the Inspector General’s investigation and report, enforcement staff’s participation in this proceeding is proper under the commission’s regulations and the APA.”