ERCOT last week released an updated version of an earlier report on generator outages during the February winter storm that indicates natural gas was the fuel source most susceptible to being knocked offline or derated.

The new report, shared first with the Technical Advisory Committee on Wednesday, says wind energy was a much smaller contributor to the outages that almost brought down the ERCOT grid.

Gas outages or derates jumped from about 12 GW in the early-morning hours of Feb. 15 to more than 25 GW before the day ended. The outages were still above 25 GW on Feb. 17 before eventually scaling down. Weather was the primary cause of the outages, with equipment issues and fuel limitations being the primary causes.

In comparison, wind outages peaked above 15 GW Feb. 14-18, when based on nameplate capacity. However, when based on estimated lost-wind output, those outages peaked at about 12 GW Feb. 12 and were less than 5 GW for most of the rest of the week.

“We were really focused on outages and outage causes with this report,” said Woody Rickerson, ERCOT’s vice president of grid planning and operations. “The only reason we went into how much wind was actually produced was to provide different basis when evaluating the overall scope of this event.”

Coal outages did not quite reach 6 GW, primarily because of fuel limitations. The system’s combined outages peaked at just over 52 GW at 8 a.m. Feb. 16.

ERCOT used only nameplate capacity in its preliminary report, because that is how outages and derates are reported to its scheduling software. In the first report, one chart appeared to show generation losses from wind as just slightly smaller than natural gas losses that week. (See ERCOT Blame Share: Weather (54%); Equipment (14%), Gas (12%).)

In the latest report, staff used backcasted information on a unit-by-unit basis to allocate the lost wind output to each cause code, based on the proportion of total outaged wind capacity assigned to each cause for each hour. The outage causes were further subdivided into more granular categories.

“We don’t consider the lack of wind to be an outage,” Rickerson said.

“I know you don’t, but the folks downtown [at the Legislature] do,” MSCI’s Clayton Greer said. “This is saying there was a serious problem with natural gas capability. I get it, but I’m not your only audience. I think we have to start thinking about the people who will be using these [slides]. They have less of a background to understand this offhand. We’ve got to help paint a bigger picture so they understand and they’re not making inaccurate statements downtown.”

Reliant Energy Retail Services’ Bill Barnes was among several TAC members complimenting staff on the report. He pointed to slides 18-21, which break out the net generator outages or derates by cause for natural gas, coal and wind resources, as telling the “true story.”

“This will certainly help our friends at the Legislature fix what needs to be fixed going forward,” he said.

Rickerson was asked whether ERCOT would provide the underlying data so that others could do their own analysis. He pointed out that much of the data would be redacted, but he did offer that a final version of the report would include data from Feb. 9-20, not just the week of the storm.

“I’m not saying we can’t do it, but it will be a very time-intensive effort to get that out,” he said.

Passport Pushed Back 18 Months

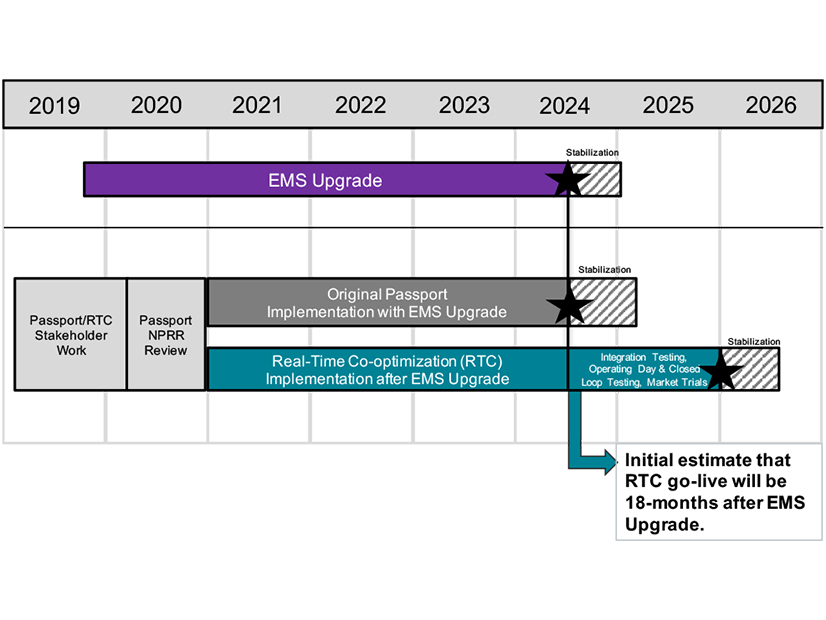

ERCOT notified stakeholders that “unresolvable” staffing constraints have led management to pull the energy management system (EMS) upgrade from the Passport Program, which will result in an 18-month delay for the implementation of real-time co-optimization (RTC) of energy and ancillary services.

Passport Director Matt Mereness said there are not enough available personnel to deliver both EMS and Passport, which was to bundle EMS, RTC and several other high-profile initiatives. Passport had a 2024 deadline, based on an EMS critical path.

“We had a plan, which was a big bang for everything,” Mereness said.

ERCOT’s plan was to refresh the EMS software’s language this year and then build everything else — including RTC, battery energy storage, contingency reserve service and distributed generation improvements — on top of that. Passport has an $85.5 million budget, with $51.6 million dedicated to the RTC effort and $27.1 million allocated to the EMS upgrade.

At issue is EMS’ complexity. Mereness said the system was last upgraded in 2016; since then, staff have added an operating system, databases and other software that are no longer supported by vendors.

“The EMS refresh is the backbone and heartbeat of ERCOT,” Mereness said. “The EMS upgrade is non-negotiable.”

Staff will now develop an updated delivery schedule for EMS without Passport’s scope and re-evaluate its options for completing the program’s other initiatives. Mereness said that as the winter storm-related work picks up, staff may yet have to defer other parts of the program.

“It’s a smaller problem to solve,” he said. “We want to be honest and open where we defer a certain amount of work … it won’t be a quick and easy thing. We have these multiple projects we’re trying to reweave together.”

ERS Quickly Exhausted During Storm

Mark Patterson, ERCOT’s manager of demand integration, told the committee that the grid operator has purchased more than $20 million of emergency response service (ERS) since January because of the February winter storm, about half of what has been set aside for the annual program that ends in November.

ERCOT spent $12.5 million procuring ERS during Feb. 1-23 alone, 30.4% of the $41 million available this program year. It then purchased an additional $7.7 million to take the grid through May.

The grid operator procures ERS by selecting qualified loads and generators, including aggregations, to make themselves available for deployment during a grid emergency. It procures the service three times annually for four-month contract terms and two different response times: 30 minutes and 10 minutes.

Patterson said the ERS fleet response “generally” met or exceeded its aggregate obligation, most significantly when ERCOT began shedding load Feb. 15. Most of the fleet was deployed and exhausted its obligation within 12 hours of the first deployment, he said.

“Because of the [winter] event, a lot of businesses could open. Certain processes shut down because the cold weather kept them from operating,” Patterson said.

Almost half of the grid’s 107.5 GW of installed capacity was knocked offline; generators were able to meet only about half of their combined obligation, while loads met about 70% of their obligation, he said.

“We’re paying a lot of money every year for them to curtail, and they had already curtailed,” Greer ruefully remarked.

Virtual External Meetings Through Summer

Staff told stakeholders to plan for virtual meetings through the summer as they continue to monitor COVID-19 case counts and vaccination rates.

“Gathering in large groups in [ERCOT’s Austin facility] is not a good recommendation at this time,” ERCOT’s Kristi Hobbs said.

The grid operator is making plans to accommodate additional staff on site to handle summer operations. Another update is expected later this month.

Slim Combo Ballot Approved

The TAC’s combination ballot passed by a hefty 29-0 margin and included two Nodal Protocol revision requests (NPRRs) and single changes to the Nodal Operating Guide (NOGRR) and the Retail Market Guide (RMGRR):

- NPRR979: incorporates the Other Binding Documents’ (OBDs) “state estimator standards” and “telemetry standards” into the protocols.

- NPRR1062: adds advanced meters to the metering requirement for premises connected at transmission voltage and/or with a peak demand greater than 700 kW/700 kVA, which currently require an interval data recorder (IDR) meter.

- NOGRR199: realigns references to state estimator and relevant telemetry standards with their move from OBDs to the protocols.

- RMGRR164: removes language from the guide predating the implementation of advanced metering systems (AMS). It defines the business rules and processes to be followed when transitioning a customer from an IDR meter to an AMS profile type.