The COVID-19 migration of remote workers from major coastal cities to smaller cities and rural areas has been a boon for Duke, as the utility continues to see growing residential demand and an encouraging rebound in commercial and industrial markets, said Steven Young, executive vice president and chief financial officer.

“Nearly all of our large commercial and industrial customers have resumed operations, and the sector is showing signs of optimism,” Young said. “We continue to expect 1 to 2% load growth in 2021. We operate in four of the top eight states for population migration, a testament to the attractive business environments of our service territories and electricity rates.”

Young was referring to Duke utilities in Florida, North Carolina, South Carolina and Tennessee. He also pointed to Apple’s recent decision to build its first East Coast campus in North Carolina, bringing $1 billion in investment and an estimated 3,000 jobs to the state.

Duke Energy CEO Lynn Good | Duke Energy

CEO Lynn Good reeled off a list of clean energy actions and initiatives, including the closure of a 270-MW coal plant in North Carolina in March and the “accelerated closure of our Gallagher station in Indiana, bringing the retirement forward a year and a half to June of 2021.”

Duke’s commercial renewable business, Duke Energy Renewables, powered up the 350-MW Frontier 2 wind farm in Oklahoma, also in March, while the company’s regulated utilities added 220 MW of solar in Florida and the Carolinas, Good said. Overall, the utility intends to triple the amount of renewables on its system by 2030, with investments that will add 15 to 20 GW of clean power, backed up with coal retirements totaling 7 GW, she said.

Capital expenses will total $59 billion through 2025, and then increase to $65 billion to $75 billion for 2025-2029, she said.

The numbers underneath Good’s positive picture of recent accomplishments and future growth were equally upbeat. Young reported first-quarter earnings per share of $1.25, up just 1 cent from $1.24 in the same period last year, and adjusted earnings per share of $1.26, up from $1.14 last year.

Projected earnings per share for 2021 remain unchanged, at $5 to $5.30/share, with a mid-point of $5.15, he said, while the company is predicting 5 to 7% EPS growth over the next five years.

Growth Indicators

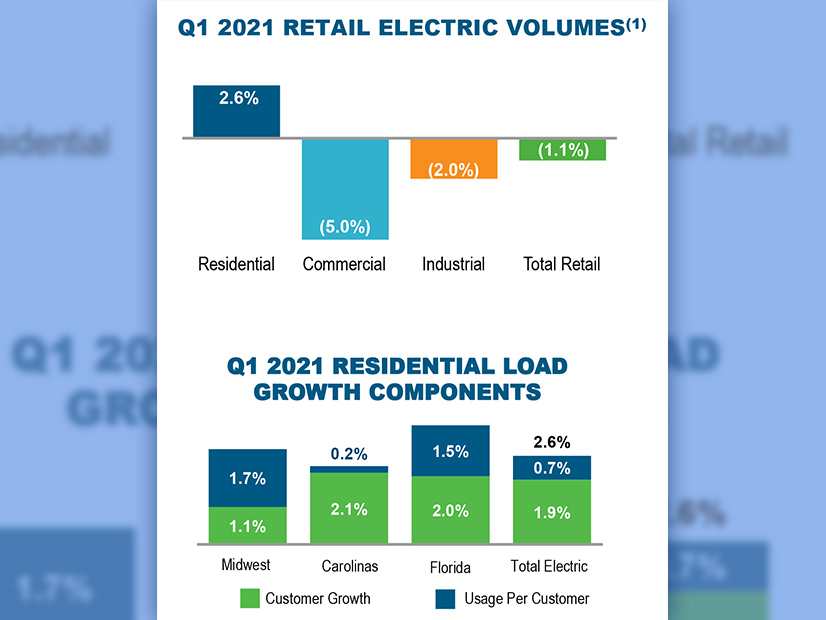

The ongoing evolution in Duke’s customer and load figures is perhaps one of the more significant signs of a post-pandemic economic recovery. While overall demand was down 1% from Q1 2020, Duke sees the 2.6% growth in the utility’s residential business, especially in the Southeast, as a marker for future expansion, Young said.

Duke’s energy sales were down about 1% from Q1 2020, but its residential customers and sales continue to grow. | Duke Energy

“Keep in mind that we are comparing [first quarter 2021] sales to a quarter last year that had little impact from COVID-19,” Young said. “Residential volumes were up 2.6% over last year, driven by continued strong customer growth in our service territories and ongoing remote learning and work-from-home policies.”

Duke anticipates customer numbers will grow 2.1% in the Carolinas and 2% in Florida this year.

Transportation electrification is another driver for load growth and infrastructure investment, and Duke is positioning itself as a “key enabler of mass electric vehicle adoption,” Good said. The utility has won regulatory approvals in Florida and the Carolinas to invest a total of $100 million in pilot programs to support decarbonization of the transportation sector across the Southeast, she said.

Duke has pledged to convert 100% of its light-duty vehicles to electric and 50% of its medium-duty, heavy-duty and off-road vehicles to EVs, plug-in hybrids or other zero-carbon alternatives by 2030. The utility is also partnering with the city of Charlotte, N.C., on a pilot program to add 18 electric buses to the city’s public transit fleet.

Energy Policy Updates

Good also provided an update on federal and state legislation that Duke is following. In North Carolina, Duke is working with stakeholders on a comprehensive energy bill aimed advancing the state’s clean energy goals while also ensuring “regulatory reforms that provide timely recovery of these investments,” she said.

Analysts tried to tease out further details on potential North Carolina legislation, but Good’s answers remained general.

“Our optimism is really centered on the broad support for comprehensive energy legislation that exists within the state,” she said. “The administration, the environmental community, solar developers, industrial customers, Duke Energy and others have been at the table, and there is broad support to move forward in 2021.”

An unnamed source close to the stakeholder process confirmed that a cross-industry group is working on issues related to the energy transition in the state and, echoing Good, was “guardedly optimistic” that a bill might be drafted in the coming weeks.

The North Carolina Clean Energy Plan includes a reduction in electricity sector carbon emissions of 70% over 2005 levels by 2030 and a net-zero system by 2050.

Without referring directly to President Biden’s $2 trillion infrastructure package, Good said, Duke sees “great alignment between our vision of a net-zero clean energy future and the policies that are being discussed,” such as support for research and development and tax policies.

“We see permitting reform as a solution to help streamline the process to build infrastructure, without compromising community involvement and environmental protection,” she said.

It’s All About the IRPs

But much of Duke’s progress toward its stated goal of a net-zero system by 2050 will depend on if and when regulators in different states take action on the company’s integrated resource plans, which have faced strong public opposition in both North and South Carolina. According to the IRP posted on Duke’s website, the coal plant retirements announced and planned could still leave more than 3,000 MW of combined coal and gas generation on the system through 2035, as well as add up to 9,600 MW of new natural gas generation.

Speaking at a recent virtual hearing before the North Carolina Utilities Commission, environmental advocate Eliza Stokes said, “The next decade is the absolutely most important one in the fight against climate change. We simply cannot continue business as usual by bringing on any more gas plants in North Carolina.”

Stokes participated in one of six virtual hearings the NCUC scheduled when 211 individuals and organizations signed up to speak at a hearing in March. The next virtual hearing on the IRP is scheduled for May 12. (See Outspoken Public Pushes for Duke to Lead on Climate.) The NCUC does not approve the IRP, rather it provides comments to the utility.

Good herself faced a proxy proposal at Duke’s Annual Meeting on May 6, aimed at replacing her seat as chair of the utility’s board of directors with an independent chair. The proposal, from the New York City Office of the Comptroller representing four city pension funds holding about 1 million Duke shares, was voted down 65% to 35%.

The board argued that a separate chair was unnecessary because it had created a strong “independent lead director in order to independently oversee management.” (See Duke Shareholders Reject Proposal to Require Independent Board Chair.)