SPP staff said last week that they expect normal conditions and no extreme operation situations within the RTO’s balancing authority and reliability coordinator footprints this summer.

During a summer preparedness workshop Thursday, staff told stakeholders that their initial analysis indicates transmission constraints and mitigations will be “manageable” in maintaining reliability.

SPP has worked with MISO to ensure it has the latter’s updates applied to its models. As part of their analysis, SPP staff have also taken high-wind cases into consideration. A final summer assessment will be posted later this month, they said.

The grid operator has asked market participants to refrain from taking outages during the latter half of August in what is expected to be some “pretty hot temperatures” for the region, according to a Little Rock, Ark., television meteorologist. KATV’s James Bryant said while May showers will likely result in lower temperatures in June, “we probably make up that ground during July and August.”

The SPP system has lost 535 MW of capacity to retirements so far this year, staff said. However, the system has added 211 MW of mostly wind energy and some dynamic demand response resources since 2021 began. More than 5 GW of resources are expected to be brought online before the year is up.

M2M Settlements Return to ‘Normal’

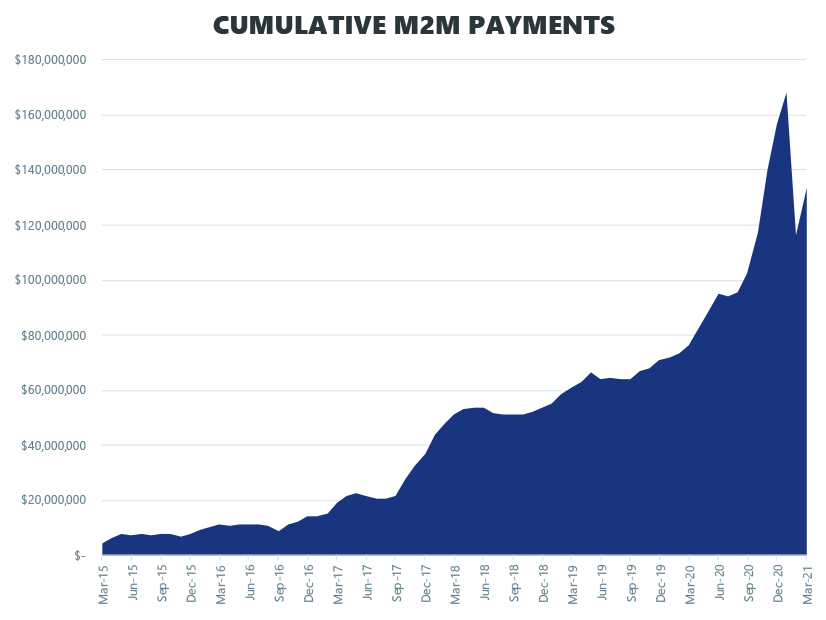

The market-to-market (M2M) process between SPP and MISO has returned to normal following February’s winter storm, which resulted in a massive $51.49 million settlement in MISO’s favor for that month.

The neighboring RTOs began a seventh year of M2M activities in March with SPP, as it had done in four of the previous five months, exceeding $10 million in accrued settlements from MISO. The $17.09 million settlement total left SPP in the black at $133.38 million, after peaking at $168.11 million in January.

“There’s nothing new here, really,” SPP’s Jack Williamson told the Seams Advisory Group on Thursday.

Temporary and permanent flowgates were binding for 1,581 hours during March after having bound for 1,639 hours in February. Four flowgates piled up more than $1 million in M2M settlements, as compared to nine during February. Congestion during the storm, when MISO and PJM exported power to SPP, resulted in increased shadow prices.

February’s settlement more than doubled the previous record of $22.87 million, set last November.

An SPP spokesperson confirmed that the winter storm created February’s large volume of settlements but declined to provide further detail. SPP expects to release a final report on the event in July.

The grid operators exchange M2M settlements for redispatch based on the non-monitoring RTO’s market flow in relation to firm flow entitlements. The settlements have been in SPP’s favor 16 of the last 18 months and 55 times in 73 months since the process began in March 2014.

Williamson pointed out to the advisory group that it took about three years for settlements to reach the $20 million mark.

“Now, we are seeing market-to-market settlements almost the same size every month,” he said. “A lot of it was to do with just the amount of wind added to SPP [and MISO] over the years.”

MMU: WEIS Market Congestion ‘Minimal’

SPP’s Marketing Monitoring Unit has released its first report on the fledgling Western Energy Imbalance Service (WEIS) market, finding that congestion was minimal during its first two months of operation.

The report covers February and March 2021, resulting in an outsized effect from the storm. Spot gas prices at some trading hubs in the WEIS market region exceeded $275/MMBtu during the storm, leading to average prices of $18.21/MMBtu at the Cheyenne hub during February. Although gas-fired resources only provide about 6% of the market’s generation, real-time prices averaged $92.87/MWh for February, the Monitor said.

The WEIS market went live Feb. 1. Its price-based, centralized real-time market allows market participants to submit offers to sell and buy imbalance energy, settling the net supply or obligation for an asset owner. SPP performs supply adequacy analyses to assess each participant’s scheduled operating capacity. (See SPP Successfully Launches Western Market.)

The number of intervals in both balancing authorities that failed their analyses dropped significantly from February to March. Most of the failed intervals occurred during the late morning or evening when the obligation range was above available capacity range for brief periods, the MMU said, yielding a minimal overall financial impact.

The market’s average load during its first two months was 2.5 GWh. Coal resources provided 65% of generation, hydro accounted for 21%, and wind followed at 7%.

The MMU said excessive penalties were allocated to resources carrying regulation megawatts for going outside their operating tolerance band without an exception, resulting in uninstructed resource deviations (URDs). It recommended the WEIS market design team review changes to exclude regulation megawatts when assessing URD charges.