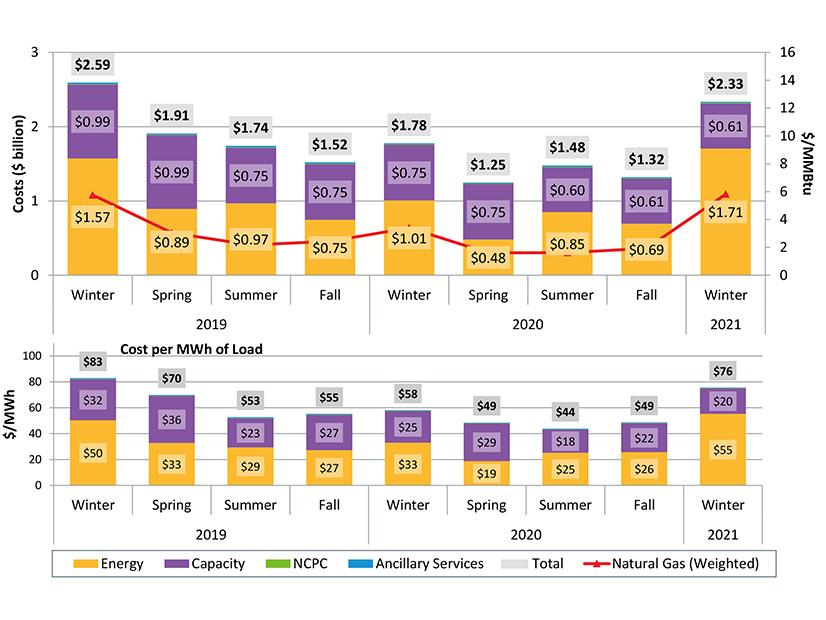

ISO-NE’s winter wholesale market costs totaled $2.33 billion, a 31% increase from the previous winter driven by higher energy costs, according to a quarterly markets report from the RTO’s Internal Market Monitor delivered to the NEPOOL Markets Committee last week.

Average day-ahead and real-time hub LMPs increased to $51.30 and $51.66/MWh, respectively, which were a 69% to 72% increase from $30.32 and $29.97, respectively, in winter 2020.

The average natural gas price was $5.83/MMBtu (or $45.47/MWh assuming a 7,800 Btu/kWh heat rate ), up 71% from last winter’s price of $2.42/MMBtu ($18.88/MWh). The average hourly load of 14,283 MW was up by 2%, primarily because of colder weather and less behind-the-meter solar generation.

On the capacity side, payments were down 19% to $607 million. Winter 2021 was the third quarter of the Forward Capacity Auction 11 commitment period, with clearing prices of $5.30/kW-month for Rest-of-System, compared with an FCA 10 price of $7.03/kW-month.

Gross real-time reserve payments totaled $2.1 million, a 23% increase from the same period a year ago, with all payments going for 10-minute spinning reserves (TMSRs).

The frequency of non-zero TMSR pricing in winter 2021 was similar to the prior year. However, the average non-zero hourly spinning reserve price increased relative to 2020, from $7.56/MWh to $9.75/MWh, because of higher LMPs, which increased redispatch costs to provide reserves rather than energy.

Energy market opportunity costs (EMOCs) were greater than $0/MWh for the first time this past winter as a sustained drop in average temperatures for seven days in February was sufficient to produce non-zero EMOCs for two small generators. The average EMOC was $7.54/MWh across that week.

Discussing Order 2222 Compliance

ISO-NE Director of Demand Resource Strategy Henry Yoshimura told the MC that the RTO has determined that several design elements of its FERC Order 2222 compliance proposal do not require changes. Still, parts are under review, with likely refinements ahead of the RTO’s requested filing extension.

Order 2222, issued last September, ordered RTOs and ISOs to open their markets to distributed energy resource aggregations, now limited mainly to providing demand response. Although FERC declined to allow local or state regulators to prohibit DERs from participating in the wholesale markets through an opt-out, the commission said regulators could prevent resources from participating in both retail and wholesale programs. (See FERC Opens RTO Markets to DER Aggregation.)

Yoshimura said that ISO-NE might modify participation models to include Order 745-compliant DR resources. The RTO has enabled thousands of DR resources to participate in its markets. As technology advances and small DR aggregators proliferate, some resources may be unable to meet minimum size and performance requirements. Order 2222 says that through aggregation, more of these resources might meet the requirements and be able to participate in wholesale markets alongside traditional resources to provide flexible services to the power grid.

As for metering and telemetry requirements, the RTO’s present configuration permits DERs to be metered directly at the device, provided that consumption or production are separately reported and do not also increase or decrease the facility’s load reported at the point of interconnection or retail delivery.

The Forward Capacity Market (FCM) design will need modification if Order 745-compliant DR resources are part of an aggregation. According to Yoshimura’s presentation, ISO-NE will need to specify the rules for determining the qualified capacity of an aggregation that includes both generation and DR. The provisions in the design applying the existing rules for overlapping interconnection impacts to DERs could also be revised following a review.

Possible changes to rules regarding delisting and retirement, treatment of new and existing capacity, and installed capacity requirement development would be handled through the Reliability Committee.

ISO-NE will seek votes on its Order 2222 compliance proposal, as developed in the stakeholder process, and any potential amendments at the December meetings of the Markets, Reliability and Transmission committees. The RTO will request a vote from the Participants Committee at its January 2022 meeting, with a filing at FERC by Feb. 2, 2022, if the commission approves the RTO’s compliance filing deadline extension request.