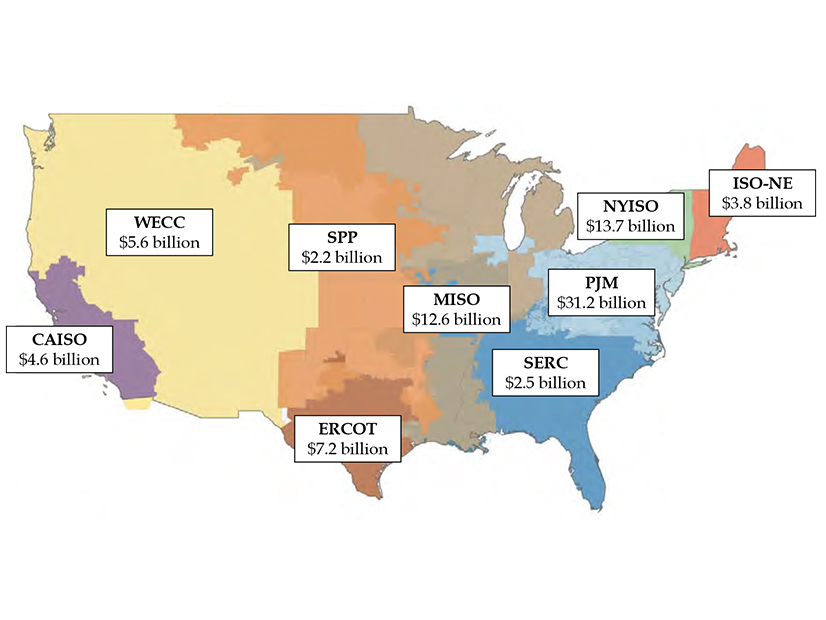

The $83 billion in transmission projects that have been approved by ISO/RTO boards or recommended to regulators would boost GDP by $42 billion and local spending by almost $39 billion during construction, according to a report released Tuesday by a transmission industry trade group.

The study, conducted for WIRES by London Economics International (LEI), also says the projects would create about 442,000 jobs in domestic manufacturing and installation and about 9,000 permanent jobs in operations and maintenance.

“To put these numbers into context, such impacts are the equivalent of a 14% increase in the contribution to GDP currently made by the utilities sector and equivalent to more than a doubling of current employment in the utilities sector,” it said.

WIRES, whose members include American Electric Power, PPL, FirstEnergy, Duke Energy and Exelon, released the analysis to bolster the industry’s request for policy changes and financial incentives.

“Introducing regulatory policies and economic stimulus measures that promote transmission investment offers a golden opportunity for accomplishing economic stimulus objectives, revitalizing local economies and moving the needle on transformative decarbonization goals,” the report says.

“We thought that approaching it on a focus of how transmission can play into helping to address economic recovery and jobs fit perfectly with the current circumstances of our time, where we are still in the process of recovering from the economic impacts of the pandemic,” WIRES Executive Director Larry Gasteiger said in an interview. “This gives concrete numbers associated with the kind of jobs you can expect to see generated from a large buildout on transmission planning.”

The report asks Congress to direct FERC to initiate a rulemaking on intra- and interregional planning to target identification of transmission to help decarbonization efforts “by incorporating dynamic generation queue data and trends into regional planning; incorporating local, state and corporate renewable energy targets and electrification assumptions into scenario planning; and considering the full range of net benefits that a transmission project provides, including the economic value of decarbonization, resiliency and achievement of other public policies (such as economic and environmental justice).”

It said FERC also should clarify and improve cost allocation frameworks to “avoid negotiating stalemates when multiple regions and constituents are involved” and that Congress should find ways to reduce delays in siting and permitting.

Citing the success of the investment and production tax credits in nurturing wind and solar generation, its asks for return on equity adders and other incentives to encourage the private sector “to tackle regionally significant but complex transmission projects, or projects delivering on targeted goals of decarbonization or other important drivers (e.g., resiliency).”

The report also takes issue with FERC’s proposal last month to limit the 50-basis-point ROE adder for transmission owners participating in RTOs/ISOs to the first three years (RM20-10). (See FERC Proposes to Narrow RTO Incentive.)

“Such a policy, if adopted, could inadvertently send a negative message to transmission owners about the benefits of remaining with an RTO/ISO, especially given the risks associated with relinquishment of control,” it said.