FERC on Thursday rejected the financial transmission rights forfeiture rule PJM has been using for more than four years, saying it was overly broad and could discourage legitimate hedging activity.

The commission also dismissed FTR trader XO Energy’s complaint challenging the rule, saying its case is now moot (ER17-1433, EL20-41-001).

FTRs allow load-serving entities to hedge the risk of transmission congestion costs and permit financial traders to arbitrage day-ahead and real-time congestion. PJM implemented the forfeiture rule to prevent market participants from using virtual transactions to create congestion that benefits their FTR positions.

In January 2017, FERC ordered PJM to change how it implements the rule, saying the RTO’s focus on individual transactions failed to capture the impact of a market participant’s overall portfolio of virtual transactions on a constraint (EL14-37). (See FERC Orders Portfolio Approach for PJM FTR Forfeiture Rule.)

PJM responded with two compliance filings later that year and began billing forfeitures based on the new approach in September 2017 — retroactive to the beginning of the year — even though the commission had not approved the rules.

Refunds Possible

FERC’s ruling Thursday found PJM’s FTR forfeiture trigger unjust and unreasonable and ordered the RTO to propose a replacement within 60 days that uses “either a different threshold or an alternative approach to triggering forfeiture that strikes a more appropriate balance between deterring manipulative behavior and not burdening legitimate hedging activity.”

It said PJM’s compliance filing also must include information to help the commission to determine whether it should issue refunds and surcharges.

PJM triggered forfeitures if the net distribution factor (dFAX) between the transaction bus and the worst-case scenario bus is at least 0.75 — meaning at least 75% of the energy flowing between the two points is reflected in the constrained FTR path.

The commission said PJM’s filings complied with its January 2017 directive to use a portfolio approach when determining the impact of a market participant’s virtual transactions on constraints related to its FTR positions and that it apply the forfeiture rule to all FTRs, including counterflows. FERC also approved PJM’s use of the load-weighted reference bus and its treatment of all virtual transactions held by entities that share common ownership as part of the same portfolio.

But it rejected PJM’s 1-cent FTR impact test — which determines whether the net flow impacts the absolute value of an FTR by 1 cent or greater — as unjust and unreasonable because “it does not always reflect a material or significant increase in the value of an FTR to justify forfeiture of FTR profits.”

“The 1-cent threshold is in an overly broad application of the FTR forfeiture rule that is likely to disrupt legitimate hedging activity without providing an increased level of deterrence of manipulative activity,” the commission said.

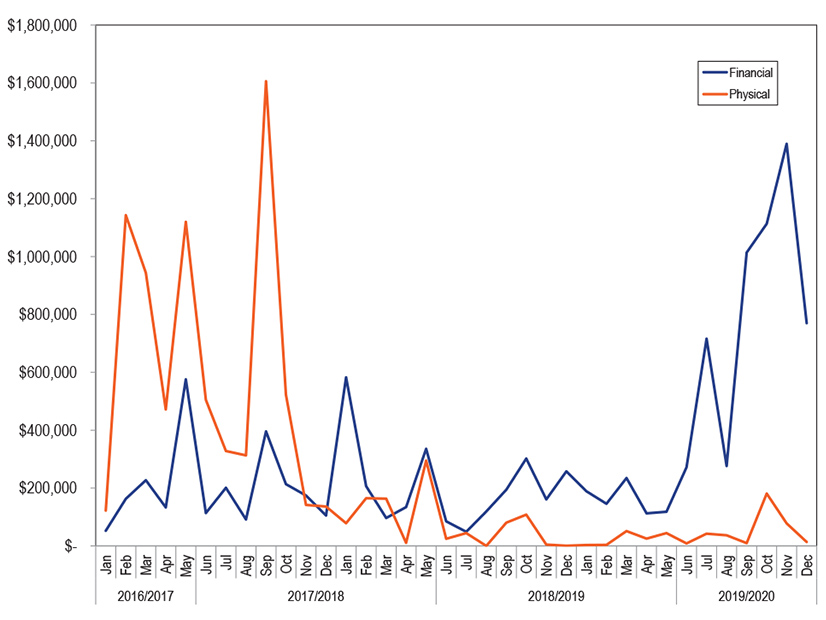

FERC cited a PJM sensitivity analysis that found the new rules were capturing far more transactions than the prior test and noted that from 2016 to 2017, forfeitures under the new rules increased by $9.1 million.

Protesters complained they were forced to curtail their virtual energy trading because the trigger caused forfeitures on electrically distant FTR paths that were difficult to predict in advance of submitting bids and offers.

1-Cent Threshold

“The de minimis 1-cent threshold may result in forfeitures from incidental overlaps between a virtual energy portfolio and FTR position that would not amount to cross-product manipulation,” FERC said. “PJM offers no support for a finding that such a de minimis impact creates the appropriate balance between identifying potential manipulation and not disrupting legitimate hedging activity.”

The commission acknowledged the difficulty in designing a test that avoids triggering any forfeitures because of legitimate hedging. “But while an appropriate balance may trigger some forfeiture due to potentially legitimate conduct, the record indicates that PJM’s method could be adjusted to affect significantly less legitimate conduct while at the same time still providing deterrence to manipulative conduct,” it said.

PJM violated the filed rate doctrine by implementing its compliance filings prematurely, FERC said. To consider whether refunds should be issued, the commission said PJM must provide it information on how the RTO would calculate refunds and surcharges; details of the parties who would receive refunds or be charged surcharges; and information on the magnitude of the refunds and surcharges. “We are reserving judgment as to whether or not to impose refunds; that decision will be informed by PJM’s subsequent filing,” it said.

XO Energy, of Landenberg, Pa., challenged the tariff changes in an April 2020 complaint, saying it quit PJM’s virtual market in December 2019 after receiving $4.3 million in forfeitures. The company asked FERC to order the RTO to change the forfeiture rules or abandon it and adopt “a structured market monitoring approach” like the one used by MISO (EL20-41).

Thursday’s order dismissed XO’s complaint as moot “as it challenges a rate that is not in effect.” The commission also rejected several rule changes requested by the protesters as outside the scope of PJM’s compliance filings.

XO released a statement through attorney Ruta Skučas of K&L Gates saying it is eager to work with PJM and other stakeholders “to develop a more thoughtful and balanced FTR forfeiture rule.”

“This rule will be particularly significant as the volume of renewable resources increases in the PJM footprint and asset owners begin to hedge their intermittent output in the FTR and real-time markets,” it said. “Further, XO believes that refunds will be a significant needed component going forward, as PJM unlawfully over-collected forfeitures for over three years.”