NYISO should focus on market enhancements to incent investment in flexible generation resources that will help integrate intermittent wind and solar resources and encourage the retirement of inefficient generators, Market Monitoring Unit Potomac Economics told the Management Committee on Wednesday.

“To the extent that retirements occur, they should be resources that provide the least value, particularly in terms of flexibility and reliability,” Potomac’s Pallas LeeVanSchaick said as he reported highlights from the 2020 State of the Market Report. “We think it’s critical to focus in this way because ultimately the market is going to be instrumental in determining whether state policy goals can move forward at the lowest possible cost and that minimizes market disruption.”

Mixed Signals

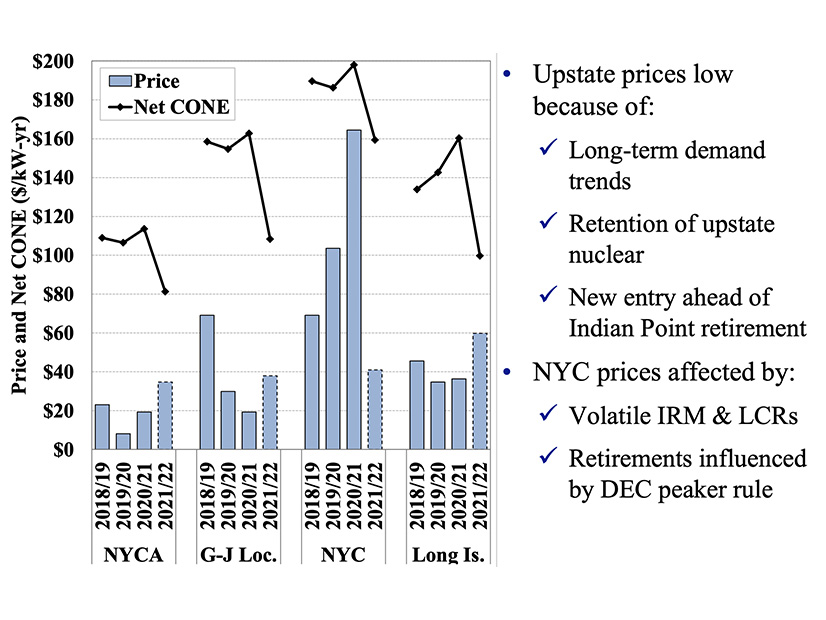

Last year saw lower energy and capacity prices across the state compared to 2019 because long-term trends, natural gas prices, mild weather and the pandemic-related economic slowdown, but slightly higher capacity prices in New York City reflected a smaller surplus than in upstate.

“The higher prices in New York City are affected a great deal by volatile locational capacity requirements [LCRs] and installed reserve margins [IRMs], and by some departure from the market of peaking units,” LeeVanSchaick said. “We have significant concerns about the volatility of these [capacity] requirements.”

It’s important to look at net revenues and see whether they are providing the market signals needed, according to the report. The capacity market does not provide adequate locational signals. For example, the lack of a Zone A-B capacity region has contributed to a higher IRM and low LCRs in 2021/22, the report said.

“The current framework isn’t sustainable in the long term, and at some point there needs to be a capacity market that provides appropriate locational signals,” LeeVanSchaick said.

A “more urgent” issue is that the capacity accreditation of some resources leads them to be under- or overcompensated for their capacity, such as duration-limited resources and intermittent generation, the values of which fall as penetration increases. But the current rules for valuing capacity do not adequately reflect that “these resources complement each other” because, for example, the value of battery storage can be increased by high penetration of solar generation … so there’s a number of factors there that the current rules don’t take into account,” LeeVanSchaick said.

The Monitor is emphasizing four enhancements for the energy and ancillary services market:

- Dynamic reserve requirements

- NYC locational reserve requirements

- Compensate reserves that increase transfer capability

- Reserve demand curve increases

“In terms of the first three [recommendations] … we’ve encouraged the NYISO to look at [them] in the context of [its 2021] Reserves for Constrained Areas project; that’s a study at this point, but I think it is looking at these three,” LeeVanSchaick said. “The fourth one is something that the NYISO recently” addressed in part with recent tariff changes. The ISO took “a step in the right direction with changes to the reserve demand curves for the larger regions … that were recently approved.”

Regarding capacity market enhancements, the high-priority recommendations are two-fold, he said.

“The first, in the short term, and in an urgent sense, we have a recommendation to revise accreditation rules to compensate resources in accordance with their marginal reliability value. This is important because with all of the new investment happening, we don’t have a sustainable set of efficient rules to help guide that investment” by compensating it in accordance with its marginal reliability value, LeeVanSchaick said. “Anything you do that waters down those incentives is going to hamper [efficient future] investment.”

The capacity accreditation also should address how the limited flexibility and availability of some long lead-time generators diminishes their reliability value. For example, just 30% of the 10.7 GW of fossil steam turbines were online in at least half of New York Control Area and Southeast New York reserve shortages in the last three years, he said.

“In the longer term, we still recommend the C-LMP [capacity locational marginal pricing], which would provide appropriate incentives for investment in each area as transmission bottlenecks shift over time; and finally, better alignment between the [New York State] Reliability Council’s IRM-setting process and other capacity market inputs would be beneficial,” he said.

LeeVanSchaick will address various topics of the report in coming Installed Capacity Working Group meetings: public policy issues June 3, capacity issues June 9, and energy and ancillary services issues June 17.