New York’s electricity policymakers were very busy in 2017, setting a U.S.-record offshore wind target, devising an outline for pricing carbon into wholesale markets and facing down legal challenges to efforts to rein in energy service companies and its nuclear subsidies. The state also agreed with Entergy on the staggered closing of its 2,311-MW Indian Point nuclear plant, which will retire the second of its two remaining generators in 2021.

2018 will be eventful as well. Storage targets will be mandated early this year, the technical details of carbon pricing will be ironed out in conferences and public hearings, and a master plan for offshore wind will be released.

Carbon Pricing

Prompted by the state Public Service Commission’s decision to subsidize upstate nuclear plants through zero-emissions credits (ZECs), NYISO commissioned a report by The Brattle Group on pricing carbon into generation offers and reflecting it in energy clearing prices. Released by NYISO and the state Department of Public Service in August, the report found that a $40/ton carbon charge in New York state would have “a relatively small impact” on customer costs, ranging from a −1% to +2% change in total customer electric bills. (See NYISO Study Sees Little Cost Impact from Carbon Charge.)

The ISO and the PSC in October established the Integrating Public Policy Task Force (IPPTF) to explore the carbon pricing issue. In the fall, the task force held public hearings and a technical conference to discuss issues, including the allocation of carbon revenues and border adjustment mechanisms to prevent “carbon leakage” — an increase in emissions in regions neighboring New York. (See New York Hashes out Details of Carbon Policy.)

The IPPTF will next meet Jan. 8 in Albany.

ZECs Win in Court

ZECs are part of the state’s Clean Energy Standard, which mandates reducing greenhouse gas emissions by 40% by 2030, from a 1990 baseline, and by 80% by 2050. It also calls for renewables to meet 50% of the state’s energy needs by 2030.

In July, a federal judge dismissed a challenge to the ZEC program by the Electric Power Supply Association and several of its members.

The plaintiffs argued that the program violates the Federal Power Act and the Constitution’s dormant Commerce Clause by intruding on FERC’s authority to regulate wholesale prices and favoring in-state generators. (See New York ZEC Suit Dismissed.)

In August, the plaintiffs appealed to the 2nd U.S. Circuit Court of Appeals to review the ruling. Oral arguments have been proposed for the week of March 18, but the schedule has not been finalized. (The 7th Circuit will hear a similar challenge to the Illinois ZEC program Jan. 3.)

Indian Point Closure and Reliability

The year began with Gov. Andrew Cuomo reaching an agreement with Entergy on his long-sought goal of closing the Indian Point nuclear plant, which the governor worries is too close to New York City. Under the deal, Units 2 and 3 will be deactivated by April 30, 2021. The agreement would allow the plants to operate for two additional two-year increments — with final closure slated for 2025 — if an emergency affected reliability in the New York City area. Unit 1 was shut down in 1974.

NYISO reported in December that gas-fired and dual-fuel generation coming online in the next few years will be enough to maintain reliability after the Indian Point closure.

The ISO report cited three generation projects totaling 1,818 MW under construction: the 120-MW Bayonne Energy Center II uprate in NYISO Zone J, and the 678-MW CPV Valley and 1,020-MW Cricket Valley plants in Zone G. (See New Builds to Cover Indian Point Closure, NYISO Finds.)

Distributed Energy Resources and ESCOs

New York’s utilities will use 2018 to continue developing the analytical tools to deal with distributed energy resources and transition from a one-way transmission system to a multidirectional grid.

The ISO’s DER Roadmap, issued in February 2017, outlines the grid operator’s plans for integrating DER into its ancillary services, capacity and energy markets over the next five years.

In September, the PSC approved an order implementing a new compensation structure for DER. (See NYPSC Limits ESCO Service, Sets New DER Compensation.)

In July, the commission expanded and extended Consolidated Edison’s Brooklyn-Queens Demand Management project and in August approved a Con Ed solar project dedicated exclusively to low-income customers.

In October, the PSC approved an implementation plan to allow municipalities to engage in community choice aggregation initiatives, and enacted the first consumer protection standards for DER. (See New York PSC Adopts DER Rules, Sanctions ESCOs.)

The PSC also faced legal challenges to its December 2016 order banning energy service companies (ESCOs) from serving low-income customers unless they obtain waivers by guaranteeing reduced bills or other benefits (Case 12-M-0476).

State and federal courts temporarily blocked the ban on several occasions during 2017. In November, the 2nd Circuit denied a motion for a stay pending appeal. On Nov. 22, the PSC issued an order setting dates for implementation of the December 2016 order on a rolling basis as contracts expire. In the meantime, the commission approved waivers on about half of the dozen requests it received from ESCOs.

Coming Storage Revolution

On Nov. 29, Cuomo signed legislation requiring the PSC to establish targets for energy storage by early 2018. (See NYISO Readies Market for Energy Storage, State Targets.)

In December, NYISO released a report detailing its plan for opening its wholesale markets to storage. The ISO report, “State of Storage: Energy Storage Resources in New York’s Wholesale Markets,” lays out three stages to facilitate storage participation — integration, optimization and aggregation with other DER. The ISO will allow storage resources to provide all the grid services that they’re capable of, while also reducing the minimum participation size from 1 MW to 0.1 MW.

Storage developers and utilities have been working with the ISO to establish ways storage can participate in both retail and wholesale markets. The ISO report distinguishes between storage in front of the meter and behind the meter, with the former more likely to participate in wholesale market transactions, although BTM storage could become a wholesale player when aggregated with other distributed resources. (See New York Sees Storage in Retail and Wholesale Markets.)

The ISO plans on having storage market rules ready for commercial use in 2020.

The PSC in May took actions to allow large commercial batteries in New York City, and in December approved a three-year, $7.5 million pilot program for Con Edison to control its New York City customers’ air conditioners to help shave peak demand in summer. Con Edison also is working with various companies on demonstration projects to use storage and software to shave peak demand.

Offshore Wind

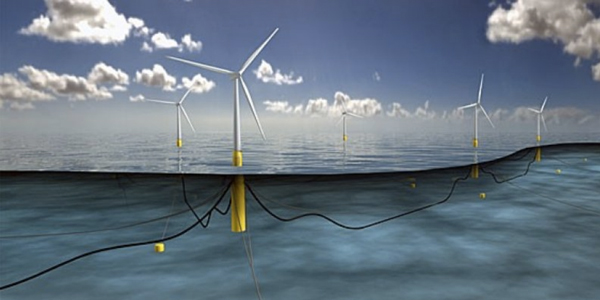

New York will be the biggest state player in offshore wind if it meets the target set by Cuomo in January 2017: 2,400 MW by 2030. State policymakers are embracing offshore wind for both its utility-scale generation, its ability to be developed close to the major load centers of New York City and Long Island, and its potential jobs. (See New York Seeks to Lead US in Offshore Wind.)

The first offshore wind lease for New York, a nearly 80,000-acre site off the Rockaways in Queens large enough to generate up to 1 GW, went to Norway-based Statoil in December 2016. Statoil says the project, which it has dubbed Empire Wind, is in early-stage development. It hopes to sign a power purchase agreement with a U.S. utility for the project by the end of 2018.

The first project in the water could be the 90-MW South Fork Project off Montauk, which was approved by the Long Island Power Authority in January. Developer Deepwater Wind says construction could start as early as 2019, with the wind farm operational as early as 2022.

The New York State Energy Research and Development Authority is drafting a master plan that will include an offtake transmission element, the crucial part of getting wind-generated power to shore. The master plan will include a timeline and recommendations on how to speed up the offshore planning and permitting process.