By Michael Kuser

Dominion Energy could be one step closer to winning state financial support for its 2,111-MW Millstone nuclear plant in Connecticut.

The Department of Energy and Environmental Protection and Public Utilities Regulatory Authority on Monday issued a draft final report on the economic viability of the plant and signaled their support for state procurement of its energy output under a program reserved for renewable energy resources such as large-scale hydropower, wind and solar (S.B. 106).

The regulators concluded that the public procurement process for Millstone should “go forward” and asked industry stakeholders to submit comments on the report within three days — by Jan. 25 — so they can deliver a final report on Feb. 1.

“The competitive solicitation process created by the legislature is reasonable, and we will propose to the General Assembly that they pursue that process,” DEEP Commissioner Robert Klee said in a teleconference with reporters.

The legislature failed to pass a bill last June that would have allowed the Waterford plant to bid into the procurement process, unlike Illinois and New York, which last year voted to support nuclear plants through zero-emission credits.

The regulators said the procurement should go forward “with certain conditions to ensure that the state’s ratepayers are protected from paying above-market costs for resources that are not verified to be at risk of retirement.”

Conflicting Advice

Gov. Dannel Malloy in July ordered the agencies to assess the current and future viability of the Millstone plant and determine whether the state should provide financial support (17-07-32). In reaching their preliminary conclusion, regulators said they considered confidential documents from Dominion, and stakeholder comments on a study by Levitan Associates that found the plant will likely remain profitable through 2035. (See Millstone Likely Profitable Through 2035, Conn. Consultant Says.)

In the past few months, state regulators have heard conflicting advice on the issue. The Electric Power Supply Association earlier this month filed comments with the state contending that Millstone’s profitability made any ratepayer subsidy unnecessary. EPSA cited a study by Energyzt Advisors that characterized Millstone as “perhaps the most profitable nuclear plant in the United States.”

The General Assembly submitted comments in January encouraging PURA and DEEP to “hedge against natural gas by opening a bidding process to receive bids from nuclear generating facilities, including Millstone, to purchase power directly by long-term contract.” (See Conn. Regulators Hear Conflicting Advice on Millstone.)

DEEP Analysis

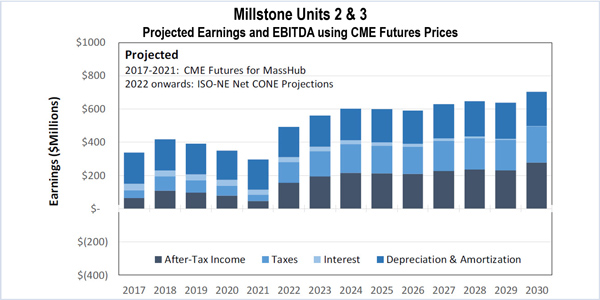

The draft report said the current and projected economic viability of Millstone hinges on energy market revenues and plant operating costs.

PURA Chair Katie Dykes said the Levitan study used the best available public information to develop cost assumptions for the two Millstone units but lacked precision because of the absence of cost information from Dominion. The company submitted a two-page summary of short-term, forward financial projections in November and a longer, redacted document on Jan. 10.

While Millstone’s retirement would not trigger the need for new capacity in Connecticut specifically, it would spur a need for new generation capacity in New England as a whole. Replacement capacity procured through ISO-NE would likely be natural gas-fired, exacerbating security and system reliability issues because of the region’s heavy reliance on gas for power generation.

“It’s important that we are issuing this report just a few days after ISO New England released their own evaluation of the region’s exposure to risks of rolling blackouts if facilities like Millstone or Seabrook or LNG facilities were to be offline for a prolonged period or retire,” Dykes said. (See Report: Fuel Security Key Risk for New England Grid.)

A Regional Issue

If Millstone’s two units stopped operating, CO2 emissions for the entire New England electric sector would increase by 80 million short tons, or 25%, through 2035, according to the regulators’ report. Replacing at least 25% of Millstone’s output with hydropower, demand reduction, energy storage and zero-emission renewable energy would be necessary for Connecticut not to backslide on its statutory greenhouse gas emissions reductions targets, and would cost the state’s ratepayers an estimated $1.8 billion, it said.

Even with that investment, regional emissions would increase by 20%. Replacing 100% of Millstone’s output with zero-carbon resources would cost Connecticut ratepayers approximately $5.5 billion, the draft report said.

In theory, regulators could use a variety of mechanisms to provide revenue stability for new and existing zero-carbon resources, including long-term power purchase contracts and ZECs.

At present, there are no mechanisms to retain Millstone and allocate the costs regionally. The RTO has indicated in this proceeding that Millstone would not be eligible for a reliability-must-run contract on a transmission security basis. And FERC earlier this month rejected the U.S. Energy Department’s Notice of Proposed Rulemaking that would have required RTOs to compensate nuclear and coal-fired facilities on a cost-of-service basis.

“It’s been unfortunate that the regional discussions at [the New England Power Pool] and at the ISO have not produced any actionable mechanisms to date that could ensure that the region’s ratepayers would be able to do their share in paying to retain these kinds of critical facilities, given that the entire region shares an incentive,” Dykes said.

Klee said the General Assembly would have 30 days to respond to the agencies’ proposal and that details of any forthcoming request for proposals would be worked out in the standard regulatory process.