By Jason Fordney

CAISO last week kicked off an effort to implement major changes in the way it procures backstop generation needed to maintain grid reliability, in the face of growing stakeholder dissatisfaction over increased use of the practice.

The ISO is reviewing its reliability-must-run (RMR) and capacity procurement mechanism (CPM) programs and considering combining the two. It considers both backstop procurements to be “last resorts” to guarantee adequate capacity when it identifies generation deficiencies, as well as to prepare for unexpected events on the grid.

CAISO is undertaking the effort “to address concerns identified by the ISO and by other stakeholders” in light of recent RMR and CPM designations, it said in a Jan. 23 straw proposal and issue paper.

“This initiative will review the RMR tariff provisions, pro forma agreement and procurement process, and seek to clarify and align the use of RMR procurement and backstop procurement under the CPM tariff,” CAISO said.

CAISO has recently increased its reliance on RMRs and CPMs for gas-fired power plants, which are unpopular with owners of other resources competing in the market, as well as state regulators who favor non-fossil-based resources. The ISO in recent months has inked contracts with gas plants, citing misalignments with state resource adequacy programs as one reason for doing so.

The initiative will also look at reworking the ISO’s Condition 1 and Condition 2 classifications for RMR units, which have different payment structures. The former recover only a portion of their revenue requirement, while the latter operate under a full cost-of-service payment methodology.

Following recommendations from the ISO’s Internal Market Monitor, the proposal seeks to remove certain limits on market participation currently imposed on Condition 2 resources and make both types of units subject to must-offer obligations for energy and ancillary services. In a protest of the Metcalf RMR filed at FERC, the Monitor said consumers are currently bearing full costs for Condition 2 facilities that are barred from CAISO markets in many hours.

The grid operator’s Board of Governors in November approved the latest RMRs, with Governor Ashutosh Bhagwat saying: “I am going to hold my nose very, very hard” while voting in favor. (See Board Decisions Highlight CAISO Market Problems.)

But the California Public Utilities Commission responded on Jan. 11 by fast-tracking a nullification of the RMRs. (See CPUC Retires Diablo Canyon, Replaces Calpine RMRs.) Representatives from the CPUC and Pacific Gas and Electric told the ISO board in public meetings that they opposed the contracts.

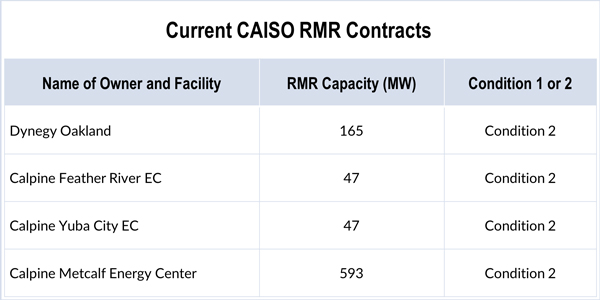

Grid planners are being pushed into backstop procurements to maintain longer-term reliability as gas generators fail to obtain contracts under California’s resource adequacy program. CAISO has 852 MW of capacity under RMR, including Dynegy’s Oakland units and Calpine’s Feather River, Yuba City and Metcalf Energy Center plants, all of which were signed in September-November 2017.

The involuntary RMRs receive a negotiated rate, and CPMs receive a market-based price subject to a cap. The cost of the contracts eventually falls on retail ratepayers, which must shoulder tens of millions of dollars, often with relatively short notice.

Some power marketers say the rapid growth of community choice aggregators has further scrambled the procurement picture as customers depart from investor-owned utilities, leaving a small rate base to shoulder the costs.

CAISO said it wants to develop the first phase of the new program enhancements in time for May approval by the board. A second phase would be in place this fall to be used in 2019 and would clarify when RMR is used instead of CPM and explore whether the two designations can be merged.

The ISO has already posted a detailed presentation for a Jan. 30 stakeholder meeting to be led by Keith Johnson, manager of infrastructure and regulatory policy.