By Amanda Durish Cook

WEC Energy Group’s 2017 earnings surged 28% to $1.2 billion, boosted by a late-year cold snap and federal tax cuts.

The frigid temperatures “particularly between Christmas and New Year, added 2 cents/share, and drove us above the top end of our guidance range,” CEO Gale Klappa said during a Jan. 31 earnings call. The company earned $3.79/share.

WEC’s strong performance was key in electronics manufacturer Foxconn’s decision to connect a massive proposed plant to the southeastern Wisconsin grid, Klappa said.

“Our track record of reliability and competitive rates was a factor in the decision by Foxconn Technology Group to invest $10 billion in a high-tech manufacturing campus here in Wisconsin. This is one of the largest economic development projects in American history,” he said.

MISO is expected to render a decision by March on American Transmission Co.’s expedited request to build the interconnection project to link Foxconn’s manufacturing plant to WEC subsidiary We Energies’ supply. The RTO found the project would have a low economic benefit over the next 20 years, making it an unlikely candidate for wider cost allocation. (See MISO Seeks Stakeholder Input on Foxconn Decision.)

Although Milwaukee officials are questioning the impact of the project on residential bills, the Wisconsin Public Service Commission last year approved a settlement that will maintain a flat base rate for WEC’s utilities for the next two years.

“In total, this will keep base rates flat for four consecutive years and essentially gives us our customers’ price certainty through 2019,” Klappa said.

The project is slated to go in service in December 2019.

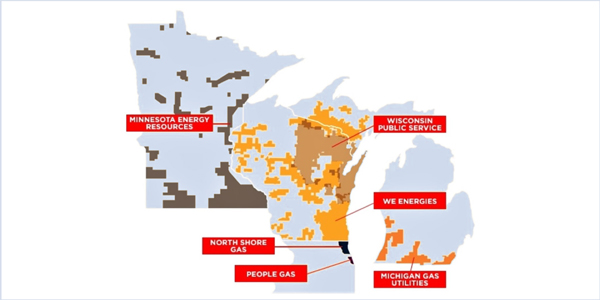

Klappa also said WEC will continue work on its Peoples Gas subsidiary’s system modernization plan in Chicago, replacing 2,000 miles of at-risk mains and upgrading 300,000 customer services lines over the next three decades, possibly requiring excavation of half the city’s streets. Illinois regulators last month ended a two-year investigation into the $6.8 billion project, which had been criticized for runaway costs and poor management.

“This program is literally critical to providing our Chicago customers with a natural gas delivery network as modern, safe and reliable,” Klappa said. “For many years to come, we will need to replace outdated natural gas piping — some of which was installed more than a century ago and is rusting — with state-of-the-art materials.” He added that WEC is working with the Illinois Commerce Commission on a “plan to flow savings from the new federal tax law back to customers in Chicago.”

Klappa also said subsidiary Minnesota Energy Resources will work the impact of tax reform into a pending rate case before the Minnesota Public Utilities Commission, which seeks to raise natural gas base rates by $12.6 million, or approximately 5%. The PUC has approved an interim rate increase at $9.5 million (3.8%) since late November, and a final decision is expected by the end of the year.

WEC’s 2017 results include earnings from recurring operations of $3.14/share and the net impact of a one-time gain of 65 cents/share from December’s federal tax reform law. This compares to 2016’s year-end earnings of $2.96/share.

For the fourth quarter alone, WEC recorded net income of $432.6 million ($1.36/share), compared to earnings of $194.4 million ($0.61/share) for the fourth quarter of 2016.