By Michael Kuser

How should New York set carbon prices — and who should be tasked with doing it?

Those were questions the state’s Integrating Public Policy Task Force (IPPTF) began to tackle Monday in “Track 3” of the group’s effort to integrate carbon pricing into NYISO’s wholesale electricity market.

The group also touched on issues related to “Track 4,” which covers the specific interactions of carbon pricing with other state and regional programs, such as the renewable energy credit (REC) and zero emissions credit (ZEC) programs, as well as the Regional Greenhouse Gas Initiative (RGGI).

The effort to price carbon into the state’s wholesale electricity market is a joint effort by NYISO and the state’s Department of Public Service (DPS) (17-01821).

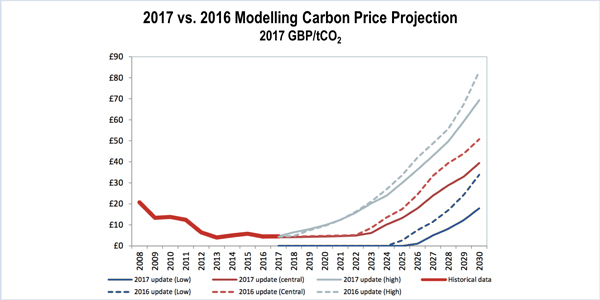

On pricing, stakeholders at the IPPTF debated whether to use a nominal value of $1/ton or $40/ton in their calculations for a carbon charge — or whether the debate was a waste of time given that the state’s Public Service Commission (PSC) would ultimately decide the number.

Representing New York City, Couch White attorney Kevin Lang suggested participants examine different sources for a social cost of carbon, both international and national.

“If we’re trying to get something that is valid through time, not just through two or three years, but over a longer time period, hopefully we can look at what the different sources are and come up with something that is a little bit more rational and perhaps a little more stable or less volatile than politically influenced numbers,” Lang said.

Ben Carron, National Grid’s senior analyst for regulatory strategy and integrated analytics, said the price should be based on the cost of abating emissions, since abatement is the goal of the public policy.

“Doing a locational analysis would also be appropriate because in order to get an abatement cost, obviously it will cost different amounts to build renewable generation than to abate carbon in different areas, like upstate,” Carron said.

Carron said his company could envision “something like a renewable net [cost of new entry] with a renewable demand curve that sets the cost of carbon in a given area, which would not only provide a more efficient price, a locational cost of carbon abatement but also provide the price signal for transmission build that would be necessary to truly evaluate whether or not it was an efficient investment.”

Marc Montalvo, of the DPS Utility Intervention Unit, said it makes sense for stakeholders to “seed our thought process” with various sources related to social cost of carbon, but that the price would ultimately come down to “the minimum charge that achieves the [Clean Energy Standard] objectives. … and analytically we should be trying to determine what that number is.”

New York City Deputy Director for Infrastructure Susanne DesRoches said, “Those goals and objectives from the CES need to be clearly defined as to what the carbon charge is trying to solve for. You can look at other models and look at what their goals are, what they were trying to solve for, and how those structures supported that end goal, but without a clear understanding of what this effort is trying to solve for, I think it will be difficult to put a number on the cost of carbon.”

Warren Myers, DPS chief of regulatory economics, said the PSC would be setting the price of carbon in another forum.

“So, debating abatement versus damage costs, I don’t think is that relevant here [and is] only [relevant] to the extent that it influences the straw level of carbon pricing we use for our modeling efforts,” Myers said, adding that the PSC is at least likely to “listen to our arguments about abatement costs.”

REC, ZEC, and RGGI

Speaking about how pricing carbon might interact with other state and regional programs such as REC, ZEC, and RGGI, Power Supply Long Island Director of Wholesale Market Policy David Clarke, asked whether RGGI impacts would diminish the effect of carbon pricing in New York.

“We would need to reduce the RGGI targets to reflect the impact of the carbon pricing as well as CES … otherwise, RGGI itself would see a lower price, absent a ratcheting down of the RGGI requirements,” Clarke said. “Other folks outside of New York would be able to emit more, taking back some or all of the requirements. This is one where you need to think through this and make sure we don’t have the takebacks associated with not reflecting any carbon pricing in the RGGI requirements.”

Representing a coalition of large industrial, commercial, and institutional energy customers, Couch White attorney Michael Mager said, “From a consumer perspective it’s a clear windfall on double payments. Despite arguments by some parties, including us, the commission time and time again has gone ahead and forced customers to bear the brunt of 20-year fixed contracts, where we are paying for carbon-free emissions under contract.”

One of the main purposes of the PSC moving to competitive electricity markets is to shift the risk of generation ownership from consumers to developers and owners, who willingly choose those risks, he said.

“There will be risks, there always will be, but lately one by one a lot of these risks are being shifted back onto consumers, despite the original intent,” Mager said.

If the RGGI system shifts all New York’s carbon reductions to the other RGGI states “and there’s essentially zero or hardly any carbon reduction from this, then whatever the price tag is, it’s probably too high,” Mager said.

Myers said one stakeholder concern is that “we add through policies, regulations, and government an externality price to the wholesale market … if the development community doesn’t know if they can trust this policy to hang around for more than a year or two, you could be kidding yourself on not paying twice even with future contracts.”

IPPTF Co-Chair Nicole Bouchez, NYISO market design specialist, said the group would next meet to discuss Track 3 on April 16 and Track 4 on May 14, with the goal of delivering recommendations by October.

Bouchez also noted that there would be no IPPTF meeting March 5 but that the task force would next reconvene at NYISO headquarters on March 12.