By Amanda Durish Cook

FERC on Wednesday approved the proposed $14 billion merger between Great Plains Energy and Westar Energy, ruling that it would not have an adverse impact on market competition or rates in SPP.

The deal is still subject to approval by Kansas and Missouri regulators.

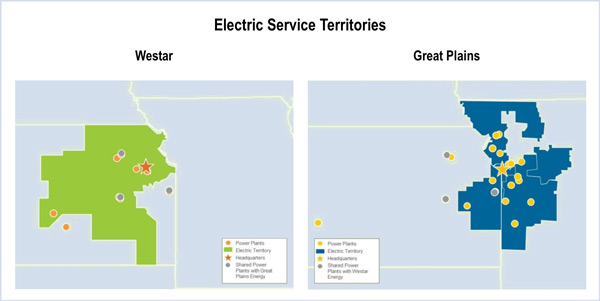

Missouri-based Great Plains owns Kansas City Power & Light, and Kansas-based Westar owns Kansas Gas and Electric. Kansas regulators last year pushed back on Great Plains’ original plan to buy out Westar, spurring the companies to recast the transaction as a “merger of equals.”

Under a revised plan filed with the Kansas Corporation Commission in late August, Great Plains proposed that the two companies would combine under a $14 billion holding company operating in both Kansas and Missouri. Westar shareholders would own about 52.5% of the company with Great Plains shareholders holding the rest, according to the amended merger application (18-KCPE-095-MER). The companies have pledged that the holding company will maintain separate debt and capital structures for each subsidiary. (See Great Plains, Westar File Revised Merger Plan.)

The deal would entail no cash exchange or transaction debt, and retail customers would receive $50 million in upfront bill credits across all rate jurisdictions. The combined company would serve about 1 million customers in Kansas and almost 600,000 customers in Missouri.

In approving the deal, FERC made clear that a five-year hold-harmless commitment agreed to by the two companies would not cover any costs related to Great Plains’ failed bid to buy out Westar (EC17-171). Under that commitment, Great Plains and Westar have agreed not to seek to recover any costs related to integrating the companies unless they can demonstrate, through a Section 205 filing, that a merger activity yielded savings in excess of costs incurred.

But the commission clarified that because Great Plains’ original acquisition strategy was “pursued but never completed,” costs related to the transaction “should not be included as part of the hold-harmless commitment and cannot be recovered from ratepayers pursuant to it. The costs related to the 2016 transaction are instead subject to the commission’s ordinary ratemaking principles under [Federal Power Act] Sections 205 and 206.”

Additionally, FERC said it was not persuaded by a protest by Kansas Electric Power Cooperative, which asked the commission to apply an equally strong hold-harmless commitment to wholesale customers as it would for retail customers, using pre-merger common equity levels to calculate rates, shielding the co-op from merger-based rate impacts. It also asked that all hold-harmless commitments be indefinite.

FERC said ordering extra hold-harmless protections without evidence would be “speculative” and noted that it doesn’t require merger plans to include hold-harmless commitments for market-based wholesale power sales.

The commission also declined the co-op’s request that Great Plains and Westar provide it with a detailed list of all merger-related costs through a new compliance filing.

The proposed merger is still in prehearing stages at the KCC until March 19, when the first evidentiary hearing is scheduled. A public comment period on the merger ends March 29.

The Missouri Public Service Commission is also reviewing the proposed merger and will hold evidentiary hearings March 12 to 16 (EM-2018-0012).