VALLEY FORGE, Pa. — PJM stakeholders at last week’s Market Implementation Committee meeting approved two problem statements and issue charges presented by Exelon, over objections from the Independent Market Monitor.

Exelon’s Sharon Midgley presented both proposed investigations. The first problem statement and issue charge focused on PJM’s rule for forfeiting revenue from financial transmission rights if a market participant’s portfolio of day-ahead virtual bids creates a larger LMP spread in the day-ahead market than in real-time auctions.

Midgley argued that changes PJM implemented last year in response to FERC’s order to revise the forfeiture rule have made the rule overly restrictive, which Exelon says resulted in forfeiture of substantially more revenue from legitimate positions. A year-over-year comparison of monthly forfeitures before and after the rule changes took effect in 2017 shows as much as a $1.8 million difference in a single month.

The Monitor’s Howard Haas said that, while the rule changes have yet to be approved by FERC, they follow the commission’s guidance on the required changes. Given all the changes in the rule, he said, it was expected that the forfeiture numbers would be different than under the old rule, and the results under the old and new rule are not directly comparable. He said the observed level of forfeitures to date are in large part a result of the retroactive application of the new rule. Since information has become available under the new rule, participants have changed their behavior and forfeitures numbers are down dramatically. (See FERC Orders Portfolio Approach for PJM FTR Forfeiture Rule.)

PJM attorney Jen Tribulski agreed with Haas that the revisions the RTO filed for approval are in line with FERC’s order, but she said that Exelon’s concerns are “probably worth a discussion here” and that the commission’s order doesn’t prevent stakeholders from discussing and seeking approval for additional revisions. PJM’s Asanga Perera later noted in response to a stakeholder question that others have complained about the rule, though he didn’t have an exact number.

“It’s not only Exelon. We have seen other parties express concerns with the forfeiture rule,” he said.

Some stakeholders were unconvinced by Exelon’s argument but also reluctant to buck the tradition of supporting each other’s requests to analyze market procedures.

“I don’t know what we see that there is a problem, but I don’t know that we have much objection,” said Dave Mabry, who represents the PJM Industrial Customer Coalition.

Direct Energy’s Marji Philips said she would support the request but that it “seems premature” given the amount of work already teed up in stakeholder committees and the lack of clarity on how many market participants have been negatively impacted.

On Midgley’s second problem statement and issue charge on the exemption process for the must-offer rule, Monitor Joe Bowring said the focus of the analysis should expand to include how capacity interconnection rights (CIRs) would be handled for units that transition from capacity to energy. Midgley welcomed the revision.

Exelon’s request comes in response to difficulties the company has experienced with the timing of the current exemption approval process, specifically that it may be physically impossible to install dual-fuel capability within the three months between the third Incremental Auction and the start of the corresponding delivery year. Sites without winter fuel supplies may need to construct onsite oil storage, which can’t be completed in the three-month period. Midgley said it’s unclear what documentation needs to be submitted to receive approval for an exemption on such grounds.

The proposal would have stakeholders consider revising the guidelines for documentation required by the Monitor and PJM to grant an exemption, implementing process reforms to improve efficiency and establishing a process for resources with an existing must-offer requirement to become energy-only resources.

Both investigations were endorsed by stakeholders.

Hardware to Improve Day-ahead Performance

PJM announced it had purchased several new computer servers to address issues with delays in posting day-ahead auction results. The hardware was acquired as part of an ongoing two-year cycle to upgrade equipment, so there was no additional budget impact, PJM’s Todd Keech explained.

“We’re right into one of those refresh cycles now, so it was good timing,” he said.

Chantal Hendrzak, who chairs the MIC, acknowledged requests to expand the bidding window but said the RTO is focusing on posting the results sooner rather than increasing flexibility.

Five-Minute Settlements to Begin

PJM’s Ray Fernandez reminded stakeholders that units have until March 16 to sign up for five-minute settlements, which go into effect April 1. After that, resources will have to alert the RTO at least three days ahead of the desired change-over date before submitting five-minute revenue meter data.

Maintenance in Cost-Based Offers

PJM’s Tom Hauske said the RTO is considering whether to include maintenance costs in cost-based offers. Special sessions on variable operations and maintenance (VOM) costs produced three proposals, among which stakeholders will be asked to choose at next month’s meeting.

Cost-based offers created through current Manual 15 rules do not allow for inclusion of any maintenance costs. PJM’s proposal would allow for maintenance attributed to running the unit and directly tied to electricity production by including FERC accounts minus labor costs. Generators could also add operating costs, such as lubricants, chemicals and other consumables, into incremental energy offers, but not VOM.

Energy-only resources or units that didn’t clear the delivery year’s Base Residual Auction could add their avoidable cost rate (ACR) fixed costs (such as staffing, taxes, fees, insurance and fuel availability) into their VOM, but capacity resources could not because they should recover those expenses through their capacity payments.

PJM also presented another proposal that would give resources the option of using its package or default resource-class VOM values calculated using U.S. Energy Information Administration data.

The Monitor’s package would replace “incremental” with “short-run marginal” in the Operating Agreement and would operate under the premise that all maintenance and labor costs are included in a unit’s capacity offer. The net cost of new entry (CONE) for each resource class would be modified to include maintenance and labor costs. Manual 15 would be stripped of all costs except short-run marginal ones: fuel, emissions, water, chemicals and consumables. A unit’s ACR would encompass everything else, including project maintenance expenses.

“The IMM package is based on what a competitive offer in the market should be,” the Monitor’s Catherine Tyler said. “We also think this is the most straightforward and simple to implement.”

Once a proposal is approved, stakeholders would discuss implementation and time frame, Hauske said.

PJM ICC’s Mabry said “one of the big heartburns we have” is that overhaul and major inspection costs are included in VOM rather than ACR.

“That frankly weighs into the decision … should I go buy a new resource?” he said.

PJM’s proposal operates under the theory that VOM is recovered after it’s been spent, while ACR is what’s projected to be spent, Hauske said. He pointed out that if gas prices go up and a unit decides to run — and therefore performs maintenance — less often, it would have already received recovery for the higher amount of maintenance if it was recovered through ACR.

A representative of a transmission owner who asked not to be named said the default values are “pretty conservative” and should be based on actual costs, not averages. Tyler said the Monitor publishes its own defaults, but the TO representative said they’re not explained.

Long-term FTRs Undercut Annual FTRs

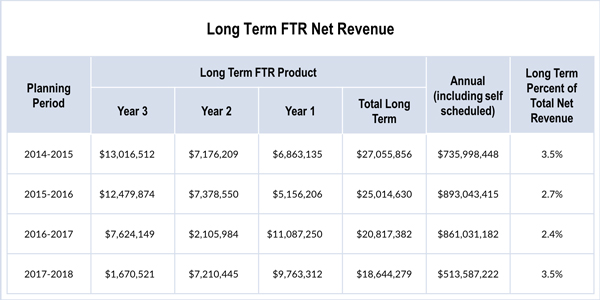

The Monitor appears to have won over PJM regarding its concerns about long-term FTRs. Haas presented analysis requested by stakeholders that showed the cost to auction revenue rights holders from the long-term FTRs market construct. Among other findings, Haas showed that over the past four planning periods, FTRs sold in the long-term market have been undervalued by more than $337.2 million compared to the annual FTRs for the corresponding delivery year. (See PJM Stakeholders Decline to Change Market Path Rules.)

The current long-term market construct doesn’t allow ARR holders to directly benefit from the sale of congestion rights, despite owning the rights to congestion, Haas said.

“I think we’re on the same page with [the Monitor] about most of the issues,” PJM’s Brian Chmielewski said.

— Rory D. Sweeney