By Robert Mullin

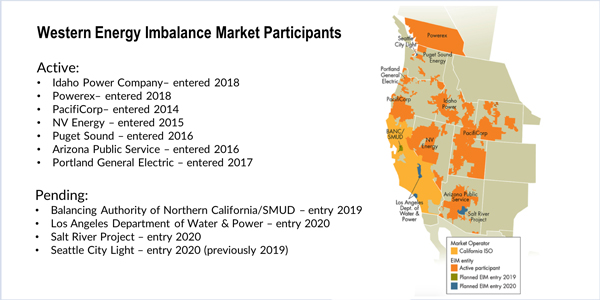

Idaho Power and Powerex began transacting in the Western Energy Imbalance Market (EIM) on Wednesday, bringing to eight the number of members participating in CAISO’s regional real-time market.

The expansion equips the EIM to serve imbalances for about 55% of load in the Western Interconnection, according to the ISO. It and the market’s seven other members serve more than 42 million customers in an area stretching from the U.S.-Canada border south to Arizona, and from the West Coast east to Wyoming.

| CAISO

“The Western Energy Imbalance Market continues to demonstrate that coordination of energy over a large area can lower costs for electric customers and reduce the cost of the transition to a more renewable-based grid,” CAISO CEO Steve Berberich said in a statement. The market has yielded more than $288 million in benefits for its members since being launched in November 2014.

Idaho Power

Boise-based Idaho Power serves about 542,000 customers across a 24,000-square-mile territory in southern Idaho and eastern Oregon. The core of the utility’s generating portfolio is 17 low-cost hydroelectric projects that serve most of its demand. The company also operates about 4,800 miles of transmission.

“We believe customers will see benefits from the EIM over time, and we expect those benefits to increase as more utilities join the market,” Idaho Power Vice President of Power Supply Tess Park said in a statement.

The utility’s service territory is adjacent to the balancing areas of EIM members NV Energy and PacifiCorp-East (PACE), providing increased transfer capability with the wind-rich area of western Wyoming in the remote northeastern corner of PACE.

Although wind developers see the region as a promising source of exports, transmission constraints — and California’s restrictions on renewable imports not delivered directly into an in-state balancing area — have impeded development of large-scale projects to serve the state. Idaho’s entry into the EIM could open the door for development, expanding renewable portfolio standard eligibility for a larger pool of resources.

Participation in the EIM will also allow Idaho Power to more easily unload the output of excess wind power the utility has been required to contract for under the 1978 Public Utility Regulatory Policies Act. In 2010 — before tightening PURPA eligibility rules — the Idaho PUC received applications for 500 MW of such projects. The minimum system load for Idaho Power, the state’s largest utility, is about 1,100 MW. The utility is still contending with wind developers moving projects across the state line to its service territory in Oregon, where PURPA avoided-cost rates are higher. (See FERC Conference Debates PURPA Costs, Purchase Obligations.)

“Covering a broad territory with a wide variety of resources will help Idaho Power manage our operations and integrate the growing volume of renewable energy sources on our system,” Park said.

Powerex

Vancouver-based Powerex, which markets the surplus generation of parent BC Hydro, becomes the first non-U.S. member of the EIM. (See Power Slated to Become First Non-US EIM Member.) While the company does not directly bring any generation assets into the market, its access to BC Hydro’s ample hydroelectric resources positions the company to provide EIM participants with the flexible ramping capacity needed to firm up the growing number of variable renewable resources coming into the region’s grid.

The company also holds transmission rights on lines throughout the West, including the California-Oregon Intertie, a key transfer point between the Pacific Northwest and California. Constraints on that line periodically isolate the PacifiCorp West and Puget Sound Energy balancing authority areas from the rest of the EIM, resulting in prices that diverge from the rest of the market.

Powerex has actively participated in CAISO’s five-minute market since 2005 through a dynamic scheduling arrangement, but its membership in the EIM will allow it to engage in sub-hourly transactions across multiple balancing authority areas. The ISO worked with Powerex to develop an EIM participation framework addressing the company’s unique situation as a Canadian entity, which FERC approved last year. (See FERC Approves Powerex EIM Agreement.)

Also slated to join the EIM are the Sacramento Municipal Utility District in April 2019 and Salt River Project, Seattle City Light and the Los Angeles Department of Water and Power in April 2020.

CAISO last year proposed to extend its day-ahead market across the EIM, a move that would fall short of creating a full RTO and require members to relinquish control of their transmission assets. (See Peak/PJM Enter Western Market ‘Commitment Phase’.)