By Rory D. Sweeney

FERC has signaled that it’s done dealing with PJM’s concerns about market participants selling “paper capacity” to arbitrage price differences between the Base Residual and Incremental Auctions.

The commission issued an order Tuesday rejecting changes to the Incremental Auction (IA) structure and terminating a longstanding proceeding on the issue (ER18-988, EL14-48).

PJM voiced concerns with FERC about capacity auction arbitrage as far back as March 2014, when it filed for approval of auction revisions that would have made the activity harder. It would have created a sell-back offer floor at the relevant Base Residual Auction’s clearing price and eliminated two IAs, along with increasing charges and penalties and making it more difficult for generators to represent capacity that is unlikely to materialize.

FERC rejected the revisions as “beyond what was reasonable to ensure that offers are supported by physical resources” but initiated a proceeding under Section 206 of the Federal Power Act to hold a technical conference on the issue. PJM asked to defer it four times, including in its current filing on IA changes.

In that filing, PJM asked for the authority to change the IAs in which it can offer excess capacity commitments — and to determine the allowable volumes. During the PJM stakeholder process, some stakeholders, represented by Direct Energy’s Marji Philips, argued the issue had been “subverted into a lot of other interests” and “is actually worse than the status quo at this point.” (See “Incremental Auction Revisions Endorsed” in PJM Markets and Reliability Committee Briefs: Dec. 21, 2017.)

FERC agreed, saying PJM’s proposal resembled several other proposals the commission rejected.

“On three separate occasions, the commission has rejected as unjust and unreasonable PJM’s proposals to value sell-back offers at a level that differs from the valuation of excess of capacity reflected by PJM’s capacity demand curve,” the commission said. “We again find PJM’s proposal to submit sell-back offers at the relevant Base Residual Auction clearing price to be unjust and unreasonable, as it fails to establish a reasonable price for excess capacity as the commission has found in the prior orders, and, as a result, the Incremental Auctions would not adequately correct for PJM’s over-procurement of capacity in a Base Residual Auction and would not produce prices commensurate with load’s value of the over procured capacity.”

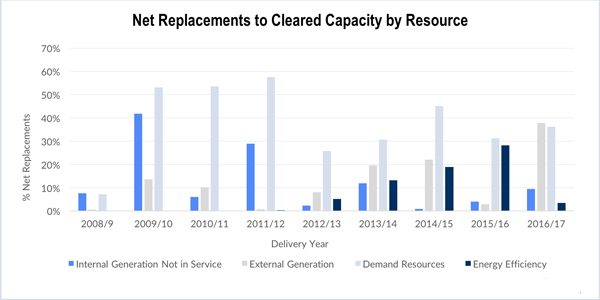

PJM’s Market Monitor had attempted to provide some support, developing a report to argue that “the lack of a specific requirement that all capacity resources be demonstrably physical assets when offered into PJM capacity auctions continues to provide strong incentives to offer speculative paper capacity.” (See PJM Monitor Asks FERC to Act on ‘Paper Capacity’.)

However, the commission argued that “in recent years, PJM has implemented reforms that reduce the likelihood of speculative offers,” including documentation to verify offers.

“For these reasons, we find that there is no need for the commission’s further consideration of solutions to address potential speculative behavior” in the auctions, the commission said, and with that, terminated the proceeding.