RENSSELAER, N.Y. — NYISO power prices averaged $35/MWh in April, up from $29.91/MWh in March and $31.06/MWh the same month a year ago, Rana Mukerji, ISO senior vice president for market structures, told the Business Issues Committee on Wednesday.

The ISO’s year-to-date monthly energy prices averaged $54.82/MWh in April, a 48% increase from a year earlier. April’s average sendout was 390 GWh/day, compared with 413 GWh/day in March and 377 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $2.79/MMBtu for the month, down less than 1% compared with last month and the same period last year.

Distillate prices gained 8 to 9% compared to the previous month but were up 32.6% year over year. Jet Kerosene Gulf Coast and Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $14.94/MMBtu and $14.85/MMBtu, respectively.

The ISO’s local reliability share was 12 cents/MWh in April, compared with 19 cents/MWh the previous month, while the statewide share fell from -51 cents/MWh to -57 cents/MWh. Total uplift costs were lower than in March.

Broader Regional Markets

Reviewing the Broader Regional Markets report, Mukerji highlighted two items.

The first concerned NYISO’s effort to clarify the minimum requirements for delivering external capacity from PJM into the installed capacity (ICAP) market. The ISO will continue to evaluate whether it needs to impose additional performance requirements and obligations for deliverability to the New York Control Area border, and it will work to ensure that external capacity resources provide a comparable reliability value for consumers as internal resources. At a combined Installed Capacity/Market Issues Working Group meeting April 24, the ISO discussed the current Supplemental Resource Evaluation process for external resources, as well as the existing consequences for external ICAP supplier nonperformance.

The second item concerned possible refinements to locality exchange factors (LEFs). At an August 2017 ICAPWG meeting, Atlantic Economics presented an alternative approach for calculating LEFs, prompting the ISO to engage GE Energy Consulting to investigate the viability of potential refinements to its current methodology.

GE presented a review of its assessment of three potential alternative approaches for calculating LEFs at the May 9 ICAPWG/MIWG meeting, developed by GE, the New York Transmission Owners and Consoldiated Edison.

The ISO on Wednesday delivered to the BIC a position statement that it “has become convinced that the stability and transparency of the current [deterministic] approach is preferable to a probabilistic approach and, therefore, recommends that we terminate further evaluation … [and] recommends not spending any additional resources on exploring LEF probabilistic techniques at this time.”

Con Ed also delivered a statement that it “has performed a ‘proof of concept’ of a [probabilistic] LEF that would save customers tens of millions of additional dollars beyond the savings resulting from the use of the [deterministic] LEF.”

The utility added that it was “disappointed that the proposal is being rejected and the project terminated without a full vetting of the proposal through the stakeholder process.”

The ISO said stakeholders are free to make their own presentations to market participants through the stakeholder process.

Potomac Economics 2017 State of the Market Report

The BIC on May 16 heard the first of three planned presentations to NYISO stakeholders this month from Potomac Economics, the ISO’s Market Monitoring Unit, on its 2017 State of the Market Report, including recommendations to improve performance.

Wednesday’s presentation pointed to a notable divergence in energy prices and congestion between NYISO’s Central and East, “and of course that’s driven by the Central-East Interface, which limits flows from the central part of the state to the capital region,” Potomac’s Pallas LeeVanSchaick said. The same interface was highlighted earlier this month in the ISO’s 2017 Congestion Assessment and Resource Integration Study (CARIS). (See NYISO Study Identifies Key Areas of Tx Congestion.)

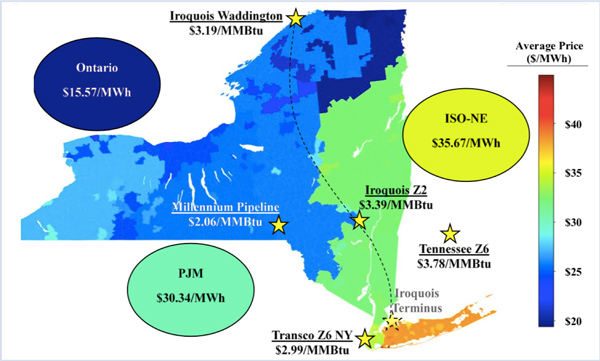

The price discrepancies were largely driven by differences in regional natural gas prices, which averaged $2.06/MMBtu on the Millennium Pipeline in the West and $3.39/MWh on the Iroquois Pipeline Zone 2 in the East.

“In 2017 we saw about an average of a $7/MWh price spread between those two regions, and that was driven principally by the large difference in gas prices,” LeeVanSchaick said.

Congestion also exists between the northern and central areas of the state, with an average price spread last year of $6/MWh, he said.

Long Island had the highest energy prices last year (with a $6/MWh price spread between it and the Lower Hudson Valley), in part because of “the higher heat rates of thermal resources there as well as somewhat higher gas prices for the Iroquois Pipeline,” LeeVanSchaick said.

He noted that the report carries over several criticisms and recommendations from last year, such as its assertion that the ISO’s markets do not provide incentives for efficient transmission investment.

Priority on Market Efficiency

“You may get congestion in New York City or in eastern New York because you’re using [phase angle regulators] in the eastern part of the state to manage congestion in the western part, [which is] why it’s important to use the market models so it can be done as efficiently as possible,” he said.

To address transmission constraints, the MMU recommends compensating merchant investors for the capacity value of transmission upgrades and reforming CARIS to better identify potential economic transmission.

Benefits would include cost savings achieved by lowering barriers to entry, which favor generation and demand response over transmission, and by substantially reducing the need for out-of-market public policy investment, the report said.

“NYISO has made a lot of progress on this issue this year, so I’m crossing my fingers that by the end of the year, the ISO will be modeling these 115-kV constraints, or at least the vast majority of them,” LeeVanSchaick said.

The MMU designates a recommendation as high priority by assessing how much the change would likely enhance market efficiency.

“To the extent we are able to quantify the benefits that would result from the enhancement, we do so by estimating the production cost savings and/or investment cost savings that would result because these represent the accurate measures of economic efficiency,” LeeVanSchaick said.

Modeling NYC Local Reserve Requirements

One of the MMU’s new performance incentive-related recommendations is for the ISO to model local reserve requirements in New York City load pockets.

The ISO is required to maintain sufficient energy and operating reserves to satisfy N-1-1 local reliability criteria in the city. However, these local requirements are not satisfied through market-based scheduling and pricing, making it necessary to satisfy them with out-of-market commitments in the majority of hours, the report said.

The costs of out-of-market commitments are recouped through make-whole payments, the routine use of which distorts short-term performance incentives, as well as incentives for new investment that can satisfy the local requirements, LeeVanSchaick said.

Wednesday’s presentation provided just an overview of the MMU report. Capacity results and related recommendations will be presented at the May 23 ICAPWG/MIWG meeting, with energy and ancillary services results and recommendations to be presented May 31.

— Michael Kuser