By Rich Heidorn Jr.

More than a week after President Trump directed Energy Secretary Rick Perry to prevent additional coal and nuclear plant retirements, the administration has provided no additional details on how it plans to implement the bailouts or how much they will cost.

With no answers coming from D.C., analysts and others have been left to speculate on the bailout’s potential impact. Here’s five important questions and possible answers.

Can the Trump/Perry Plan Survive Legal Challenges?

Trump’s directive came after the leak of a 40-page draft Department of Energy memorandum that said coal and nuclear plant retirements are a threat to national security, in part because natural gas pipelines could be subject to terrorist attacks. It called for keeping at-risk plants alive through capacity and energy payments for at least two years while the department studies the risks and then creates a “Strategic Electric Generation Reserve.”

The memo cited the Defense Production Act of 1950 (DPA) — enacted to aid the nation’s civil defenses and war mobilization at the beginning of the Korean War — and Section 202c of the Federal Power Act, which allows the energy secretary to issue emergency orders during energy shortages.

The DOE memo said the retirements threaten the electric supplies for the nation’s military bases, citing a 2008 Defense Science Board report that noted virtually all of the electricity supplying the nation’s more than 500 military installations is generated outside the facilities. “Backup power at military installations is based on assumptions of a more resilient grid than exists and much shorter outages than may occur and is not sized to accommodate new homeland defense missions,” the report said.

At the time, the bases’ backup power was almost entirely diesel generators. Since then, the Defense Department has begun investing in microgrids and solar generation to allow their critical operations to continue operating during grid outages.

Preview?

Attorneys general from nine states and D.C. offered a preview of legal arguments against the DOE plan in challenging FirstEnergy Solutions’ March 29 request to invoke 202c to prevent retirements of its coal and nuclear generation in PJM.

In a May 9 letter to Perry, attorneys general for Massachusetts, Connecticut, Illinois, Maryland, North Carolina, Oregon, Rhode Island, Virginia, Washington state and D.C. said 202c was never intended to rescue “inefficient generators.”

Perry testifying before the House Energy Subcommittee | © RTO Insider

“Section 202c explicitly authorizes the secretary to issue temporary orders only in wartime or other ‘emergency’ situations resulting from ‘sudden’ electricity demand spikes or supply shortages,” they wrote. “Though the Federal Power Act does not define the terms ‘emergency’ or ‘sudden,’ the plain meaning of these terms indicates that Congress intended Section 202c authority to be invoked rarely, in response to acute events that demand immediate response.”

DOE says it has deployed Section 202c on eight occasions, all in response to regional energy challenges. It has not previously been applied nationwide.

The department’s memo contends that “Congress contemplated the use of the provision not merely to react to actual disasters, but to act in a preventive manner. A variety of man-made and natural threat conditions require … a federal agency ready to do all that can be done in order to prevent a breakdown in electric supply.”

The AGs cited statements by FERC and PJM that potential plant closures do not pose an emergency. They also rejected a National Energy Technology Laboratory study cited by FirstEnergy that concluded PJM’s demand during the December 2017-January 2018 cold snap “could not have been met without coal.”

The study “mistakenly concludes that coal-fired generation was critical to reliability because coal-fired generation disproportionately increased during the cold snap,” the AGs said. The extreme cold caused a spike in natural gas prices, briefly making coal generators more competitive.

“That certain resources were dispatched is not evidence the system lacked (or will lack during future events) other resources that could have been called upon instead to meet market demand and maintain reliability,” the AGs said. “PJM has more than enough capacity to meet demand, even in extreme weather.”

FAST Act

In addition to the DPA and FPA, the memo cites a third law as apparent authority, the 2015 Fixing America’s Surface Transportation Act (FAST) Act, which amends the FPA to authorize DOE to order emergency measures to protect “defense critical electric infrastructure” following a presidential declaration of an imminent grid security emergency.

Peskoe | © RTO Insider

“Citing these three laws implicitly concedes that there is no single law that provides DOE with the authority to do what it wants to do,” Ari Peskoe, director of the Electricity Initiative at Harvard Law School’s Environmental & Energy Law Program, said in a podcast last week. “DOE’s argument is that the whole is greater than the sum of its parts.”

Peskoe said there are three paths opponents could take to attempt to block the bailouts, including a federal court suit to overturn the eventual DOE order and FERC complaints challenging individual wholesale contracts compensating the at-risk plants as not just and reasonable. “And separately you could also have more action at FERC arguing that these contracts are disrupting the larger market,” he added.

Prior 202c Invocations

DOE’s most recent invocations of 202c were limited to single generating plants and local reliability problems.

In December 2005, DOE granted the D.C. Public Service Commission’s request to order Mirant Corp. to continue running its Potomac River Generating Station despite its inability to meet EPA’s National Ambient Air Quality Standards, finding that the region otherwise faced a “reasonable possibility” of extended blackouts.

DOE noted that much of the district, including the FBI, State Department and other federal government agencies, were supplied only by the Mirant plant and two 230-kV lines connected to other generation. The loss of those sources also would threaten the city’s water treatment center, which would be forced to release untreated sewage into the Potomac River if it lost power for more than a day, the department said.

The order required Mirant to keep the plant operating at a low level that allowed a quick start-up if either of the lines were lost. “Mirant and its customers should agree to mutually satisfactory terms for any costs incurred by Mirant under this order,” the department said. “lf no agreement can be reached, just and reasonable terms shall be established by a supplemental order.”

Originally set to expire in 10 months, the order was twice extended for two months and once for five months. It was terminated on July 1, 2007, after the completion of new transmission.

Most recently, DOE in June 2016 granted PJM’s request to order Dominion Energy Virginia to continue running its coal-fired Yorktown Power Station for 90 days despite its violation of EPA’s Mercury and Air Toxics Standards. The department found that reliability in the Hampton Roads area of Virginia could otherwise be at risk during summer peaks.

PJM said it needed to keep the plant available because of delays in construction of the 500-kV Skiffes Creek transmission project, the subject of court fights because of the proximity of its James River crossing near historic sites.

DOE extended the 90-day order four times thereafter, most recently on June 8, 2018. That order expires on Sept. 9. PJM’s most recent extension request estimated the transmission project will be complete in August 2019 and that Yorktown will not be dispatched after May 2019.

What’s FERC’s Role?

The five FERC commissioners are due to testify Tuesday before the Senate Energy and Natural Resources Committee in a previously scheduled oversight hearing. But it is unclear how much they will say about the proposed bailouts.

FERC was given no advance notice of the Trump directive and had received no additional information on it as of last Tuesday, when Chairman Kevin McIntyre met with reporters after speaking at the Energy Information Administration’s Energy Conference. (See related story, FERC Blindsided by Half-Baked Trump Order.)

The draft memo had been prepared in advance of a June 1 meeting of the National Security Council, and DOE’s plan will be reviewed by the NSC’s Policy Coordinating Committees. FERC is not a principal in the process.

Tezak | ClearView Energy Partners

Although FERC has been excluded from policy deliberations thus far, the resilience docket the commission opened in January could play a role in any litigation, Christine Tezak of ClearView Energy Partners said in an analysis for clients Friday (AD18-7). FERC opened the docket after rejecting DOE’s Notice of Proposed Rulemaking calling for price supports for coal and nuclear plants with on-site fuel. (See FERC Rejects DOE Rule, Opens RTO ‘Resilience’ Inquiry.)

Evidence that FERC, RTOs and states are moving aggressively on resilience could undercut DOE’s legal standing, Tezak said. “We would expect the opponents of action … to reference the contents of this proceeding before FERC as evidence that the DOE’s conclusions regarding resiliency are misplaced or in error.”

If DOE’s order survives legal challenges, the FERC proceeding could provide a path forward after the two-year study, Tezak said. “We think there is the potential for the FERC’s resilience docket to provide information that could lead to DOE winding down if not ending altogether its potential market intervention.”

In addition, FERC will hear testimony at its annual technical conference on reliability July 31 to consider whether new NERC standards are needed to ensure “essential reliability services” (AD18-11). NERC has identified those services as including frequency and voltage support, ramping capability, operating reserves and reactive power. (See NERC Report Urges Preserving Coal, Nuke ‘Attributes’.)

Chatterjee, Glick Call for Mandatory PL Standards

In a perhaps unlikely pairing, Commissioners Neil Chatterjee, a coal-state Republican, and Richard Glick, a carbon-conscious Democrat, joined Monday in an apparent effort to reassert FERC’s role in the debate. In a joint op-ed, they called for mandatory reliability standards for natural gas pipelines like those FERC and NERC enforce on the grid.

They noted that the Transportation Security Administration, which has responsibility for securing natural gas, oil and hazardous liquid pipelines, relies on voluntary cybersecurity standards. “In May 2017, TSA confirmed that it had just six full-time employees” overseeing pipeline security, they wrote.

“Given the high stakes, Congress should vest responsibility for pipeline security with an agency that fully comprehends the energy sector and has sufficient resources to address this growing threat,” they continued. “The Department of Energy could be an appropriate choice: It is the sector-specific agency for energy security and recently created its own cybersecurity office.”

How Will it Affect Emissions?

Because the bailout would cover both coal and nuclear plants, there is disagreement on how it would affect carbon emissions.

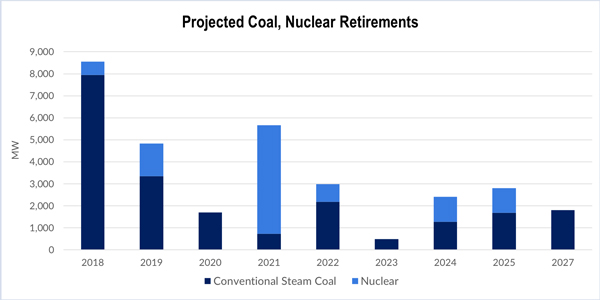

As of March, according to EIA, 21.2 GW of coal generation and 6.2 GW of nuclear capacity were scheduled to retire through 2027. EIA’s list does not include FirstEnergy’s announcement in late March that it will close its Davis-Besse, Perry and Beaver Valley nuclear plants, which total about 3.9 GW, by 2021.

About 21.2 GW of coal generation and 10.1 GW of nuclear capacity are at risk of retirement through 2027 | FirstEnergy Solutions, Energy Information Administration Electric Power Monthly, March 2018

Bloomberg New Energy Finance said in a report last week that emissions might be lower than the status quo if at-risk nuclear plants are kept running. It said that although capacity payments would keep coal plants available for backup, they may not actually run more under the Trump plan. Thus, the nuclear plants “could displace millions of tons of carbon dioxide a year” from coal plants, analyst Will Nelson said.

Sivaram | © RTO Insider

While nuclear plants have capacity factors of more than 90%, many at-risk coal plants operate less than 50% of the time.

But Varun Sivaram, fellow for science and technology at the Council on Foreign Relations, told Axios last week that freezing coal and nuclear generation at their 2017 levels — preventing them from the drops forecast by EIA — would mean coal-fired production would be 24% more than the additional nuclear generation in 2025. That would translate to between 0 and 5% higher emissions in 2025 relative to 2017, depending on the relative displacement of gas and renewables, he said.

How Will it Impact RTO Markets?

RTO officials told RTO Insider last week that, like FERC, they had received no information from DOE on the plan or when it might be finalized. (See More Questions than Answers for FERC, RTOs on Bailout.)

“We don’t know if it will be a week, two weeks or months” before DOE acts, said one RTO official.

Craig Glazer, PJM’s vice president of federal government policy, told the EIA conference last week that Trump’s directive will “probably complicate” his RTO’s struggle to deal with state nuclear subsidies. He said he fears a “half slave/half free” industry in which generators dependent on market revenues increasingly compete with those receiving cost-of-service payments or subsidies.

While RTO officials may not lead the legal challenges, their insistence that there is no emergency won’t help DOE’s defense. They point out that they have been successful in keeping plants running temporarily beyond their retirement dates when needed to prevent reliability problems. ISO-NE, for example, has asked FERC to waive its Tariff to keep Exelon’s Mystic generating station running to address fuel security concerns. (See Mystic Waiver Request Spurs Strong Opposition.)

Prest | Resources for the Future

Palmer | Resources for the Future

Brian C. Prest and Karen L. Palmer, fellows with nonpartisan think tank Resources for the Future, wrote last week about the questions raised by DOE’s proposed Strategic Electric Generation Reserve. Among them: the size of the reserve, how generators would be procured and whether those selected be permitted to participate in or return to the energy markets.

Although the DOE memo provided no details, the fellows looked to the strategic reserve Germany is considering as it continues its phase out of nuclear power. The country has retired more than half of its nuclear generation since 2008 while more than tripling its non-hydro renewable capacity. It now gets half its capacity from non-hydro renewables versus 27% coal and nuclear and 14% gas.

Germany’s reserve will be initially capped at 2 GW, about 2% of peak load, rising to as much as 5 GW (5%) after 2020. The reserve capacity will be procured through technology-neutral competitive auctions and open to demand response. The capacity would be used only as a last resort.

“It is not clear from the scant description in the memo how the SEGR would be procured, but the heavy-handed approach for the electricity purchase mandates suggests that competitive auctions are probably not under consideration,” they wrote. “It seems more likely that plants would be chosen in the same way that they would be chosen for the electricity purchase mandates — based on a federally determined list of ‘fuel-secure’ generators (best interpreted as coal and nuclear plants).”

They note that Germany plans to address concerns the reserve will discourage new capacity investment by prohibiting reserve generators from re-entering the market. “Unfortunately, DOE’s proposed order is specifically designed to send the message that government policy will find a way for unprofitable plants to return to the market, even calling its own order a ‘stop-gap measure.’”

How Much Will it Cost?

Because so many details about the administration’s plan are unknown, no one has produced an analysis of how much it will cost — including DOE itself. (See related story, Dems Hit Coal, Nuke Bailout at House Hearing.)

But some analysts produced estimates on the DOE NOPR rejected by FERC. It would have given cost-of-service payments to coal and nuclear plants in RTOs with capacity markets if they have 90 days of fuel on site.

ICF estimated the NOPR would cost ratepayers $1 billion to $4 billion per year between 2018 and 2030. The estimate was based on contracts for differences bringing money-losing generators to break even.

ICF caveated that the analysis might have underestimated the cost because it did not include recovery of and on capital. But it said the analysis also didn’t account for the likelihood that wholesale electricity and natural gas prices will be lower than they would have been had the plants retired.

Orvis | Energy Innovation Policy & Technology

Energy Innovation Policy & Technology, which supports policies reducing greenhouse gas emissions, said the NOPR would have cost from $311 million to $900 million annually in PJM, ISO-NE, NYISO and MISO alone. The low estimate represents the out-of-market payments needed to bring units with negative net cash flows up to zero. The upper limit adds capital recovery and a rate of return on undepreciated capital and future capital expenditures.

“There are, of course, important differences between the resilience NOPR and the 202c actions being discussed by the Trump administration, but our study is a good rough estimate of the cost to keep the same group of uneconomic plants online,” said Robbie Orvis, director of energy policy design for the group.