ERCOT CEO Bill Magness assured his Board of Directors on Tuesday that the grid operator is prepared for the summer heat, despite the retirement of 4 GW of coal-fired capacity since last summer.

Magness highlighted a plethora of meetings staff have held in recent weeks with regulators, media, information officers from state utilities, pipeline and gas companies, transmission owners and other stakeholders. He also noted new demand records set in May and June, which the ISO managed without emergency alerts or conservation appeals.

ERCOT recorded new monthly demand records of 67.3 GW on May 29 and 67.9 GW on June 1. Magness told the directors May was the hottest ever recorded in the United States, and the second-hottest in Texas.

“We saw it on the system,” he said. “We’re just getting into summer. Here we go!”

Staff has projected a new summer peak of 72.8 GW in August. It says it has 78.2 GW of capacity available and continues to expect to have enough resources to serve load. (See ERCOT Gains Additional Capacity to Meet Summer Demand.)

Senior Meteorologist Chris Coleman pointed out that heat records in May don’t necessarily equate to a “blazing” summer. He said Texas’ hottest May in 1996 was followed by the 76th hottest summer on record. Of the 20 hottest Mays dating back to 1895, only five were followed by one of the 20 hottest summers.

“We’ll be hotter than last summer, which won’t take a lot,” Coleman said, referring to the 50th hottest summer on record.

Coleman said the expected rains from Gulf of Mexico and Pacific storms over the next week will help tamp down temperatures in the weeks that follow.

“We’ll always take more rain, but substantial rain leads to soil moisture and water in the reservoirs,” he explained. “That will tone down the extreme heat this summer. That’s the type of thing that prevents 2011 from happening again.”

That year remains the state’s hottest on record. The Dallas-Fort Worth Metroplex recorded 40 straight days of 100-degree temperatures — and 71 overall — in 2011.

Coleman is looking at 2013 and 2006 — Texas’ 21st and 42nd hottest summers — as indications of what to expect this summer, and he said there is a two-in-three chance that temperatures will end up between those two years.

He also predicted less hurricane activity than last year, when Hurricane Harvey dumped 52 inches of rain on the Houston area. Coleman said without the La Nina of 2017 or an El Nino, overall activity will probably be at the lower end of the National Oceanic and Atmospheric Administration’s predicted range of 10 to 16 named storms and five to nine hurricanes.

The good news with May’s summer heat?

ERCOT’s year-to-date net revenues have a favorable variance of $8.3 million, and a favorable year-end forecast of $12.3 million.

IMM’s Garza Calls for Evaluation of Local Signals

Beth Garza, director of ERCOT’s Independent Market Monitor, said the ISO should evaluate the market’s ability to send local signals.

As she reviewed the Monitor’s annual State of the Market report, Garza reminded the board that price signals that incent new generation are a fundamental aspect of a “sustainable, ongoing market.” She said that net revenues (revenues in excess of assumed production costs) over the past six years are far less than the costs of building a new peaking unit, a result of the market’s capacity surplus.

“We have a market that continues to grow and with requirements continuing to increase, which requires sufficient resources to meet those,” Garza said. “But since the start of the nodal market in 2011, the net revenues have not been sufficient to pay the fixed costs of new generation.”

Net revenues in the market were around $110/kW in 2011, but only broke $40/kW last year — and only in the Houston region. The Monitor has estimated the cost of new entry between $80 and $95/kW, based on the value of simple cycle gas turbines.

“I don’t have a lot of precision, hence the range,” Garza told the board. “We’ve been so far under for so long, it’s hard to get focused on whether [the point of entry] should be $82/kW or $95/kW. I don’t know what that ratio is, but we have certainly seen a half-dozen years or so of very low contributions toward net revenues.”

Garza said congestion costs increased 95% to $967 million over 2016 because of wind generation exports from the Texas Panhandle, construction of the Houston Import projects and Harvey’s aftermath. She expects the Panhandle congestion costs to continue to increase as more wind is built in West Texas without a commensurate addition of transmission infrastructure.

“The Panhandle … contributes to those high costs because of the large differential in generation costs on either side of that constraint,” Garza said. “Wind generation in the Panhandle is at zero or below. The average cost on the ERCOT side is at 20, 30, 40 dollars. That spread is much higher than other constraints.”

The Monitor again included real-time co-optimization on its annual list of market improvement recommendations. (See “Monitor Says Wholesale Market ‘Performed Competitively’ in 2017,” ERCOT Briefs.)

Garza said that real-time co-optimization would make better use of the system’s resources, lower costs, allow for efficient shortage pricing when the market can’t satisfy any of its energy or reserve needs, and allow all supply to participate in the ancillary services markets.

$327M in Tx Projects will Meet Permian Basin’s Load Growth

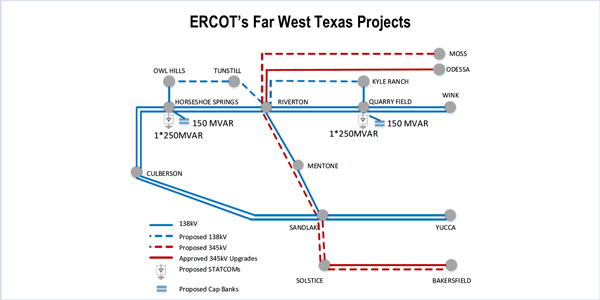

The board unanimously approved $327.5 million in West Texas transmission projects to address congestion from increasing oilfield load growth in the Permian Basin.

The Far West Texas Regional Planning Group Projects include new construction and upgrades of three 345-kV lines — Riverton-Sand Lake, Sand Lake-Solstice and Solstice-Bakersfield — that staff recommended be designated as critical to system reliability. The board agreed with the recommendation.

Jeff Billo, ERCOT’s senior manager of transmission planning, told directors the projects will allow the region to handle up to 1.7 GW of load. Staff’s independent review of the two Oncor projects indicated local load projections of 880 MW and 1,013 MW for 2019 and 2022, respectively. A year ago, load projections for 2021 came in at 553 MW.

Billo said the region has added 80 rigs in the last year. “It’s the hot spot of hot spots,” he said.

IHS Markit, a global data firm, has predicted the Permian Basin in Texas and New Mexico will become the world’s third-largest producer of oil, behind only Saudi Arabia and Russia. The firm projects production will double to almost 5.4 million barrels a day between 2017 and 2023.

Construction on the Far West Texas projects is expected to begin next year, with completion in 2023.

Board Approves 8 Change Requests

The board remanded back to the Technical Advisory Committee a nodal protocol revision request (NPRR) incorporating an intraday or same-day weighted average fuel price into the mitigated offer cap.

The City of Dallas’ Nick Fehrenbach, representing the commercial consumer segment, had the change pulled off the consent agenda, saying its language was unclear. “I think at best the language is vague and confusing. At worst, it’s an unenforceable clause,” he said.

Fehrenbach said he was unable to come up with a solution with ERCOT staff. Market participants won’t be harmed, he said, because the ISO already uses a manual workaround for exceptional fuel prices.

NPRR847, which cleared the TAC unanimously, is meant to ensure resources are capped at the appropriate cost during high fuel-price events and that LMPs reflect the true incremental cost of fuel.

The board also tabled an accompanying verifiable cost manual revision request (VCMRR021), which aligns the manual with NPRR847 by removing language providing for make-whole payments for exceptional fuel costs.

The board approved four other NPRRs, a pair of other binding document revisions (OBDRRs) and two changes to the Planning Guide (PGRRs):

- NPRR837: Updates the Regional Planning Groups’ tier classification rules, among other related improvements and clarifications, to ensure the RPG and ERCOT are reviewing the most appropriate subset of transmission projects.

- NPRR851: Establishes a clearly defined disconnection process within the market rules applicable to a transmission voltage connection to the grid that uses one electrical connection for both generation and load services.

- NPRR867: Caps the amount of each counterparty’s available credit limit locked for congestion revenue rights auctions at the pre-auction screening credit exposure amount.

- NPRR870: Deletes the gray-boxed requirement for ERCOT to post a forward adjustment factors summary report on the Market Information System’s certified area. The information in this report is already provided on each counterparty’s estimated aggregate liability summary report.

- OBDRR004: Revises the risk-weighting factors available for assignment to each emergency response service (ERS) time period; describes the process for updating the ERS time period expenditure limits for any subsequent standard contract terms (if money is needed to fund) and the ERS renewal contract period; and updates a table to reflect the risk-weighting factors’ proposed changes.

- OBDRR005: Revises the generic transmission constraint (GTC) shadow price cap that is used in security-constrained economic dispatch for base case constraints from $5,000/MWh to $9,251/MWh. The revision also updates the associated examples in SCED and makes an administrative edit to a protocol reference.

- PGRR059: Includes RPG-related changes intended to improve and clarify existing processes.

- PGRR060: Updates the reliability performance criteria by defining a DC tie’s unavailability as a new contingency and clarifies the voltage level of transformers referred to in the reliability performance criteria.

— Tom Kleckner