By Michael Kuser

RENSSELAER, N.Y. — NYISO stakeholders last week backed joint proposals by North America Transmission (NAT) and the New York Power Authority to build two 345-kV transmission projects while several losing bidders cried foul.

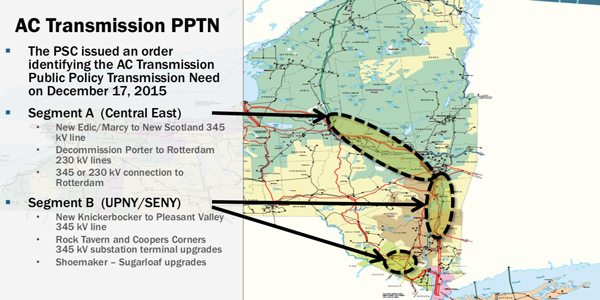

In an advisory vote, the Business Issues Committee urged the Management Committee on Wednesday to recommend the Board of Directors approve the ISO’s draft AC Transmission Public Policy Transmission Planning Report. Dawei Fan, manager for public policy and interregional planning, said the report contains analysis of seven proposals to address persistent transmission congestion at the Central East (Segment A) electrical interface and six proposals for the Upstate New York/Southeast New York (UPNY/SENY, or Segment B) interface.

NYISO staff analyzed seven proposals to address persistent transmission congestion at the Central East (Segment A) electrical interface, and six proposals for the Upstate New York/Southeast New York (UPNY/SENY, or Segment B) interface. | NY PSC

Advised by consultant Substation Engineering Co. (SECO), ISO staff recommended two 345-kV transmission projects proposed jointly by NAT and NYPA. The BIC voted 76.33% in favor of the report and its recommendations.

Project T027 is a double-circuit 345-kV line from Edic to New Scotland for Segment A. Project T029 for Segment B is a standard 345-kV line from Knickerbocker to Pleasant Valley.

NYISO’s analysis was driven by a December 2015 order by the New York Public Service Commission on “Finding Transmission Needs Driven by Public Policy Requirements.”

T027 had higher costs than other Segment A proposals, but staff determined them warranted by benefits provided by the double-circuit design, including “significant increase in Central East voltage transfer capability, increased production cost savings, and excellent operability and expandability.”

T029 provides similar transfer incremental and production cost savings with the second-lowest cost, and demonstrates excellent operability, staff said. More important, the report said, “T029 poses the lowest siting risk due to the low structure height increase and more than 50% of its new structures with reduced height.”

Staff also said that T027 and T029 would result in cost savings when being built by the same developer simultaneously.

The ISO estimated T027 will cost $577 million to $750 million, the higher figure including a 30% contingency. T029 is estimated at $324 million to $422 million. Staff projected the in-service date for the selected projects in April 2023, “assuming the developer will start the Article VII preparation immediately following the approval of this report by the NYISO board.”

Challenges to Planning Process

Stakeholders abstaining or opposing the motion June 20 included utilities, transmission owners and other developers whose proposals were not selected for recommendation. Several of them submitted comments to the BIC or read statements.

John Borchert, senior director of energy policy and transmission development for Central Hudson Gas & Electric, which abstained, said his company wanted the benefits of improved transmission capability for its service area but was “dissatisfied with the NYISO’s work and its project evaluation.”

He said “the lack of transparency, the way that the aspects of the projects were treated during the evaluation, effectively disqualified projects, and the way that the local TO upgrades were handled during the process have led to frustration and confusion for both those developing projects and for those interconnecting transmission owners.”

Consolidated Edison and its subsidiary Orange and Rockland Utilities voted against the motion, and O&R submitted written comments.

“We don’t feel confident that the recommended selection for Segment B is in the customer’s best interest due to a lack of transparency in the selection process, and deficiencies in evaluation,” said Jane Quin, director of Con Ed’s energy markets policy group. “We are concerned that … NYISO has not considered the full costs associated with the proposed Middletown upgrades, which are local upgrades on the Orange and Rockland system … and could cost as much as 20% of the Segment B project cost.”

The ISO “failed to make clear the technologies and project attributes it would or would not consider, and the reasons for such decisions, and it did not consider stakeholder input on the matter,” Quin said.

Fan responded that the Middletown transformer “is just one of the distinguishing factors for Segment B projects … [for which] the major drivers are the magnitude of the power delivery and the structure design.” He said SECO had included $16 million for the Middletown transformer costs, which it deemed adequate.

Fan said the ISO had already had two meetings with developers and six meetings with the Electric System Planning Working Group and Transmission Planning Advisory Subcommittee to consider comments from stakeholders.

Looking for Fatal Flaws

Zach Smith, NYISO vice president for system and resource planning, noted that “any project recommended for selection does go through our interconnection process … there has been a system impact study that’s been done that’s up at [the Operations Committee] tomorrow for consideration.”

The next step after that is a facilities study, and “what’s key here to our evaluation is to understand whether there are any fatal flaws in our assessment,” Smith said.

Borchert said, “There was no reason why an interconnecting transmission owner should not be consulted if these solutions are talking about equipment that’s going to be installed in their service territory. And the process needs to be done if it’s part of the overall selection and it has an impact on the selection, and it needs to be done prior to the selection being made.”

Carl Patka, the ISO’s assistant general counsel, said, “When we designed the overall planning process, we did not require, and FERC did not approve requiring, a complete interconnection-level analysis for proposed projects. That was proposed during the Order 1000 process, it was proposed during the stakeholder process, and it was rejected. And the reason for that is people did not want to create a barrier to entry and proposal of new projects based upon information that competing developers could not have from the incumbent utility.”

Brian Duncan of NextEra Energy Transmission NY (NEETNY) made a presentation arguing that NYISO was picking winners for a $1 billion project “despite a virtual tie on project benefits” among competing projects, which included NEETNY’s T022 in Segment B.

The ISO “did not provide analysis on cost-contained pricing … and three other project combinations that are virtually identical, provide all the quantifiable and quantitative benefits [and] are within 1 to 5% of the cost estimate using SECO’s numbers,” Duncan said. He also questioned why NYISO made tower height a big issue in its selection when its solicitation made no mention of the factor.

Patka said the PSC order did not mandate the ISO to use cost-contained pricing but required developers to provide two sets of costs, “one based on raw construction costs and one on 80%/20% cost overrun/cost underrun language. … They said they hoped that FERC will adopt cost containment when they address the rate issue, but their words were exactly, ‘The NYISO should evaluate the costs based on raw construction costs.’”

Patka also said that tower heights were considered by NYISO as a risk of project delay and to project completion, as visual impact is a key environmental impact of transmission, and that the ISO had reviewed its analysis with New York Department of Public Service staff.

Duncan also took issue with the concrete pole installation cost estimates, saying that SECO used a metric of dollars per pound on the weight of the pole rather than a more logical figure of total costs, including labor. He also said the ISO’s estimate of 5% in synergy savings on the combined projects by one developer was “overstated.”

“If those issues are addressed, project T022 would be the lowest-cost project by millions of dollars, probably tens of millions of dollars,” Duncan said.

SECO Vice President Joe Allen said he agreed “there would be no synergy” between the two upgrades.

Smith said NYISO could “take that back, but it won’t affect the ranking at all.”

Kathleen Carrigan, New York Transco general counsel, read comments the company jointly submitted with National Grid.

Losing bidders cried foul last week over NYISO’s selection of North America Transmission and the New York Power Authority to build two 345-kV transmission projects to address public policy needs identified by the New York Public Service Commission. | NYISO

The two companies submitted proposal T019 for Segment B, including “a basic controllable series compensation element to preserve the proposed 345-kV transmission line physical designs that the commission deemed the most environmentally and siting friendly in the underlying AC transmission proceedings.”

Carrigan said series compensation technology is widely used across the U.S., and she submitted a study showing no detrimental system impacts from it. NYISO and SECO “considered proposal T019 as too risky due to the inclusion of the series compensation, despite no technical analysis in support of their conclusion,” she said.

Smith said that while the ISO does not oppose the use of series compensation as a technology, it did see potential problems with its application in the National Grid/NY Transco project. In a FAQ document posted with the BIC meeting materials, the ISO cited potential subsynchronous resonance and damage to generators as the major risk of series compensation technology.

Carrigan said NYISO’s own metrics show the National Grid/NY Transco proposal paired with T029 produces consistently better performance results than the ISO’s favored project.

For example, when combined, T027 and T019 increase voltage transfer across Central East by 875 MW and UPNY/SENY by 2,100 MW. “This is a far greater increase than the combination of T027 and T029, which only increases transfer capability along Central East by 825 MW and UPNY/SENY by 1,325,” she told RTO Insider after the meeting.

“Projects T027 + T019 have the highest Central East N-1-1 voltage transfer capability of any studied project combination and far surpass combination T027 and T029 with respect to the incremental UPNY/SENY N-1-1 thermal transfer capability. The baseline 20-year incremental energy produced by projects T027 and T019 nearly doubles that of projects T027 and T029 (40,089 GWh vs. 27,524 GWh); and finally, T027 and T019 produce the highest production cost savings than any other Segment B combination,” Carrigan said.