By Rich Heidorn Jr.

One thing is certain about the fuel security study PJM has begun: Many will be upset with the results no matter how it turns out.

In fact, just about everyone seemed unhappy with the scope and assumptions PJM officials outlined Thursday during a special Markets and Reliability Committee conference call.

Exelon’s Sharon Midgley urged PJM officials to broaden its proposed scope, while Calpine’s David “Scarp” Scarpignato lobbied for a narrower focus. James Wilson, a consultant for state consumer advocates, expressed concern that RTO officials were already moving on to potential “solutions” before understanding the problem.

The range of comments echoed the larger resilience debate sparked by the Trump administration’s bid to provide subsidies to struggling coal and nuclear plants.

The RTO said the goal of the study is identifying locations with fuel delivery risks, evaluating how resources can reduce them and determining the need for additional mitigation efforts.

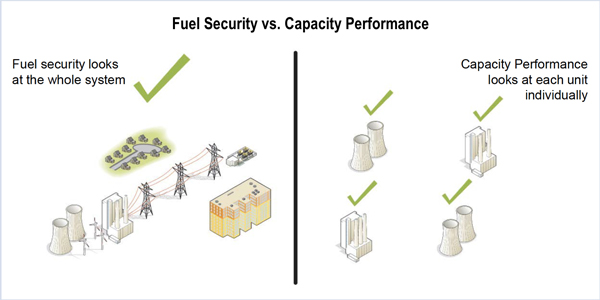

PJM Vice President of Operations Mike Bryson and other RTO officials told stakeholders the study is a continuation of resilience efforts since the 2014 polar vortex, which led to tougher nonperformance penalties under Capacity Performance.

Comments

Several stakeholders filed written comments in response to PJM’s April 30 scoping paper. (See PJM Seeks to Have Market Value Fuel Security.)

Under the revised plan described by officials last week, PJM will use a base load scenario with a 50/50 peak for winter 2023/24 (134,435 MW). The extreme winter case will be based on the three cold spells in the past 45 years that each lasted for 14 days (1989, 1994 and 2017/18).

It will look at two “credible” pipeline disruption scenarios: a “medium impact” disruption that cuts downstream capacity by 50% and a “high impact” event eliminating downstream flows.

During last week’s two-hour meeting, Exelon, the nation’s largest nuclear operator, and Calpine, the largest natural gas generator, took opposing views of the appropriate scope.

Exelon’s Midgley said PJM’s analysis should look at the entire winter period rather than just a two-week cold spell. For example, she said, if oil inventory is depleted during a cold snap, the system may have difficulty meeting load later in the season. “We don’t want to cast the net too narrow … as we’re trying to think about the realm of possibilities,” she said.

Calpine’s Scarp responded that PJM should avoid overly extreme scenarios. “If you want to get really extreme, you can say it’s really cold out, a meteor strikes and there’s a tsunami that hits all at once,” he said. “At some point you’ve got to draw a line. [Consumers are] only willing to pay so much for this.”

Midgley said exclusively focusing on extreme weather would be too narrow. “Cyber and physical attacks can create fuel disruptions far more catastrophic than those caused by the recent bomb cyclone,” she said.

9/11 Invoked

In its written comments last month, Exelon invoked the terrorist attacks of Sept. 11, 2001, to make a similar point. “Constraining the study assumptions to the severity and duration of recent historical weather events is the equivalent of what the government and the airline industry did on Sept. 10, 2001, and fails to reflect all realistic potential scenarios that PJM could face,” it said.

It also said PJM should analyze “simultaneous weather and man-made infrastructure/cyber events,” suggesting that terrorists might wait for a lengthy cold spell to launch an attack. “The highest stress resilience scenarios arise when extreme weather co-occurs with an infrastructure disruption. Therefore, any baseline scenario should jointly consider the extreme weather scenario as occurring simultaneous with a high-impact, 90-day infrastructure disruption scenario.”

And it asked the RTO to evaluate “a realistic but extreme” scenario “that disrupts 80% of the natural gas pipeline infrastructure across the entire PJM region for six months,” representing “the severe threat that a major state adversary might pose.”

An Exelon spokesman said later that PJM’s proposed scope “gravely underestimates the resilience risks facing” the region.

“At a minimum, PJM needs to look at a case where all financially stressed nuclear units will retire to better understand and potentially mitigate resilience risks,” he said.

Premise Questioned

In their joint written comments, the Sierra Club and four other environmental organizations questioned the focus on fuel, noting that most outages result from transmission and distribution problems, not generation.

The environmental groups also challenged PJM’s proposed base capacity portfolio, which assumes an installed reserve margin of 16.6% — the minimum requirement in the RTO’s 2017 Reserve Requirement Study — rather than the 23.9% margin that resulted from the 2017 Base Residual Auction or the 22% margin from the 2018 BRA.

PJM also proposed a “stressed portfolio” that would have included additional coal and nuclear retirements beyond the base case and a “high-stressed” portfolio with still more coal and nuclear retirements that are replaced with natural gas.

Casey Roberts, senior attorney in the Sierra Club’s Environmental Law Program, said she was relieved that PJM has eliminated, for now, the “high stress” portfolio scenario “that had no basis in fact.”

“However, PJM couldn’t give a clear answer as to whether fuel-free resources (renewable energy and demand-side) would qualify as fuel-secure,” she said in an email after the meeting. “They also don’t seem to be taking stakeholder input seriously, as demonstrated by their lack of plans to respond to specific comments, and failure to reach out to groups with expertise on demand response and [energy efficiency resources] that participate in wholesale markets.”

The environmentalists and Advanced Energy Economy said that while PJM promised a “fuel-neutral” analysis, its proposal favors solid and liquid fuels and ignores the resilience contributions of renewables and demand-side resources.

Use of Confidential Intelligence

Roberts and consultant Rob Gramlich of Grid Strategies also questioned PJM’s plans to incorporate in the analysis confidential information from the Department of Energy on cyber and physical threats to fuel delivery infrastructure.

“The suggestion that DOE’s natural gas disruption scenarios will not be reviewable by stakeholders or even all of the PJM staff involved is also highly concerning, particularly if those disruption scenarios will be the basis for profound changes to [the capacity market] with enormous impacts on consumers,” Roberts said.

“There is a ‘credible’ scenario and then a DOE scenario,” said Gramlich, who coauthored a study asserting that resilience is more a function of transmission and distribution than generation. (See Report: Customer Needs Should Lead Resilience Effort.)

“I don’t think DOE should get to plug in assumptions if other interested parties don’t — certainly not ones the consumers who might be forced to pay more don’t get to see,” he said.

Consultant James Wilson said that although PJM’s approach to the analysis is appropriate, “they seem fixated on a particular approach to addressing the problem that may be costly and inefficient.”

In later comments to Bryson, Wilson questioned PJM’s statement in a FAQ document that the study will identify “the adequate level of required fuel security.”

“The study cannot do this,” Wilson said. “Only policymakers can make this call.”

Wilson said fuel security risks can be broken into three groups: plant outages, weather-related load levels and others “for which there is substantial historical data”; a second group regarding whether plants have firm gas transportation or oil backup, which he said “are uncertain but … are rather easily influenced by incentives”; and a third group that includes pipeline failures and cyber or terrorist attacks.

“There is no history upon which to base any assigned probability” to the third category, Wilson said.

Thus, he told Bryson, PJM should focus on evaluating scenarios and potential resilience metrics, “and not try to quantify unconditional risk (you can’t), or identify a ‘required level’ of something, or otherwise get too far ahead in selecting a particular extreme scenario for planning purposes.”

Exelon Seeks Distance from Coal

Like Exelon, FirstEnergy Solutions also argued in its written comments that PJM should consider more extreme scenarios, including a “pipeline failure impact on a large number of plants.”

“Any criteria to assess fuel security that are broad enough such that resources of all technologies and fuels can qualify as being ‘fuel secure’ will likely result in a system less secure than the status quo with natural gas as an even more dominant fuel source,” said FES, whose coal and nuclear plants could benefit from fuel security payments.

Exelon, however, called for a broader resilience focus that does not lump coal and nuclear together, saying fossil fuels “stand to exacerbate the severe weather events that are interrupting electric service to customers in the first place.”

“If PJM plans to meet its fuel security challenges by retaining resources that burn coal or by incentivizing the addition of oil storage, it will be contributing to the very problem it is trying to solve,” Exelon said. “Planning a generation system that is resilient must include planning for a system that is both able to withstand interruptions and also does not contribute to interruptions by exacerbating climate change.”

Next Steps

PJM officials said they hope to complete Phase I of the study — the identification of potential system vulnerabilities and development of criteria to address them — by late July or early August. They will provide an update on their progress at a special MRC meeting July 26.

The completion of the initial analysis will lead to Phase II, a stakeholder process expected to run through October to develop methodology to incorporate vulnerabilities into PJM’s markets “if needed.”

In Phase III, the RTO said it will seek to address specific security concerns identified by federal and state agencies. Officials said any proposed capacity market changes would need to be filed with FERC by January to be in effect for the 2019 BRA.