By Michael Kuser

Fuel security was at the top of the agenda during the annual summer meeting of the New England Power Pool Participants Committee, which also featured presentations by ISO-NE’s external and internal Market Monitors.

Members attending the June 26-28 committee meeting at the Water’s Edge Resort and Spa in Westbrook, Conn., also voted to change NEPOOL rules to formalize the policy of banning the press from their meetings. NEPOOL is the only RTO/ISO stakeholder body in the country that bars the public and press from meetings.

The vote, which approved changes to committee bylaws and the Second Restated NEPOOL Agreement, passed with 79% in favor in a sector-weighted vote, according to a notice of action taken at the three-day meeting. The changes add a definition of “press” and bar anyone working for the news media from becoming a NEPOOL member or alternate for a participant.

Three members of the Members Subcommittee disagreed with the Participants Committee’s recommendation on the changes and made a dissenting proposal that would have made the press eligible for a non-voting membership for a $5,000 application and an annual fee. It failed with only 27% in support, with only the end-user sector strongly in support.

RTO Insider prompted the vote by having a reporter who lives in Vermont apply for committee membership as an end-user customer in March. NEPOOL has not acted on the application.

“As you know, your application raised some interesting issues for the Participants,” Day Pitney attorney Pat Gerity, who serves as legal counsel to the Membership Subcommittee, wrote in an email last week. “They continue to work through those. Thus, the status of your application is that it is still pending.”

The changes have been submitted to the entire membership for a mail ballot ending this week. Assuming approval, they will be submitted to FERC.

Consent Agenda

The Participants Committee unanimously approved two items on its consent agenda:

- Revisions to the Tariff and Market Rule 1 to modify the allocation of costs of the Forward Capacity Auction and annual reconfiguration auction to improve the alignment with the auction clearing methodology under the marginal reliability impact demand curves. The changes include a new definition for “estimated capacity load obligation” and replace the use of the net regional clearing price and residual capacity transfer rights in the Forward Capacity Market settlement. The RTO will request an effective date of June 1, 2021, for the 12th Capacity Commitment Period. (Separately, the committee approved related changes to the RTO’s Financial Assurance Policy.)

- Retirement of Appendix C (Demand Response Holidays) of Operating Procedure 14 (Technical Requirements for Generation, Demand Resources and Asset Related Demands) to reflect the removal of demand response holidays because of the implementation of price-responsive demand, which had been recommended by the Reliability Committee on June 12.

No to New Winter Reliability Program

A proposal to re-establish a winter reliability program for future winter periods failed to pass, garnering only a 50% vote in favor. Energy New England (ENE), a Massachusetts cooperative owned by the municipalities Braintree, Taunton, Concord, Hingham and Wellesley, proposed the measure.

ENE proposed continuing the same program rules as were used for winters 2015/16 and 2017/18. It said the Pay-for-Performance program, which took effect June 1 to replace the winter program, provides “little incentive to materially increase stored fuels” because rates are too low and there is excess cleared capacity for winter 2018/19. The PFP program increased financial incentives for resource owners to make investments to ensure their resources’ reliability during periods of scarcity.

ENE said the winter reliability program should remain in effect until implementation of a “market-based solution.”

The proposal previously failed to gain endorsement by the Markets Committee, winning less than 30% support.

Fuel Security

Fuel security occupied most of the agenda for the second day of the meeting, with Paul J. Hibbard of Analysis Group moderating presentations by Professor Anji Seth of the University of Connecticut Institute for Resilience & Climate Adaptation and Phyllis Yoshida, Sasakawa Peace Foundation USA’s senior fellow for energy and technology and former Department of Energy deputy assistant secretary for Asia, Europe and the Americas.

Seth’s report addressed climate change, concluding that many currently rare extreme events will become more commonplace over the next few decades as the climate adjusts to greenhouse gases already emitted, while natural variability could amplify or suppress the warming signal regionally.

Yoshida looked at the impact of the Fukushima nuclear accident on Japan’s energy systems and extrapolated lessons for New England on how a region with insufficient domestic resources can provide a resilient energy supply in the face of unexpected events. She recommended that policymakers ensure that electricity and natural gas market deregulation is transparent, increases competition and creates opportunities for new actors and new technologies and practices.

External Monitor’s Fuel Security Assessment

ISO-NE’s External Market Monitor David Patton of Potomac Economics gave a presentation on his firm’s 2017 State of the Market report, which included a fuel security assessment for a two-week period of severe winter weather.

The EMM’s baseline scenario found that more than two-thirds of all potential LNG and oil storage capability will be needed if the Everett Marine (Distrigas) LNG terminal retires. Under a “severe pipeline contingency,” the market will be slightly short with Distrigas in 2023/24 and short by the equivalent of 2,500 MW for two weeks without the facility, Potomac Economics said.

Potomac Economics’ analysis of a two-week severe winter period found that more than two-thirds of all potential LNG and oil storage capability will be needed if Distrigas retires. In its pipeline contingency scenario, the Monitor found the market will be slightly short with Distrigas in 2023/24 and short by the equivalent of 2,500 MW for two weeks without the facility. | Potomac Economics

“Although the oil storage capacity and LNG import capability are high enough to satisfy the demand for these fuels during a severe winter event, it would require very high utilization rates — above those observed in the past,” the EMM said.

The system is projected to require a very high percentage of this capability if the Distrigas terminal is retired, the report said. “Additionally, even if this terminal does not retire, the demand for oil and gas will exceed the available supply under a severe pipeline contingency in the 2023/24 cold snap scenario. This suggests that under these conditions, ISO-NE would lose its ability to serve the load for an extended time frame.”

Continuing a long-term trend, New England saw the lowest electric demand in at least 18 years in 2017, driven by an increase in energy efficiency and, to a lesser extent, behind-the-meter solar. | ISO-NE

The EMM said “market design changes may be needed to ensure that generators have incentives to conserve limited fuel supplies and allow market prices to efficiently reflect these fuel limitations.”

(See related story, Patton Cites High Uplift, Capacity Concerns in ISO-NE.)

2017 Wholesale and Capacity Market Costs Rise Sharply

Jeff McDonald, the RTO’s vice president for market monitoring, presented the Internal Market Monitor report on 2017 market performance, which found that “energy, capacity and ancillary service markets performed well, exhibiting competitive outcomes.”

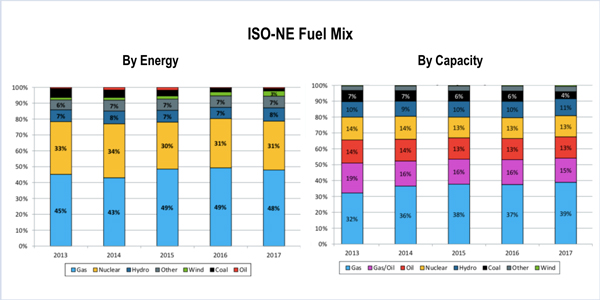

New England’s fuel mix in 2017 was similar to that since 2015, with natural gas claiming a 48% share of energy generation and 39% of capacity.| ISO-NE

Wholesale electricity prices reflected changes in underlying primary fuel prices and electricity demand, with costs last year totaling $9.1 billion, up 20% from the previous year, the report said. Capacity market costs were up 93% to $2.2 billion because of higher prices in FCA 8 in 2014, which covered the 2017/18 CCP.

The IMM reported 2017 energy market costs totaled $4.5 billion, up 9% from the previous year, while natural gas price averaged $3.72/MMBtu, up 19%. Electricity demand declined 2% for the year, and in Q3 dropped 8%, which helped offset the impact of higher natural gas prices.

New England’s fuel mix in 2017 was largely unchanged since 2015, with natural gas claiming a 48% share of energy generation and 39% of capacity.

Continuing a long-term trend, New England saw the lowest electric demand in at least 18 years in 2017, driven by an increase in energy efficiency and, to a lesser extent, behind-the-meter solar, the report said.