By Tom Kleckner

The Montana Public Service Commission’s final order approving Hydro One’s acquisition of Avista includes several conditions designed to prevent the early closure of the troubled Colstrip power plant.

Most notably, the order released late Tuesday points to pledges by corporate executives that the sale would not shorten the coal-fired plant’s operational life. The commission approved the sale by a 4-1 vote on June 12.

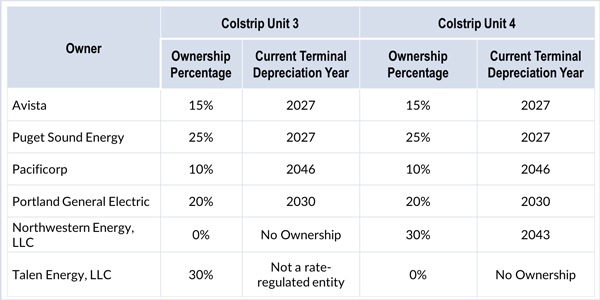

Avista owns 15% of Colstrip Units 3 and 4, which were built in the mid-1980s and have a combined net generating capacity of 1,480 MW. Low natural gas prices and regional opposition to coal resources have bedeviled the Colstrip plant in recent years. The plant’s operator, Pennsylvania-based Talen Energy, has been exposed to low power prices on the open market as a merchant generator.

Hydro One’s $5.3 billion acquisition would result in Spokane, Wash.-based Avista becoming a wholly owned indirect subsidiary of the Canadian power firm.

The sale, however, could be in jeopardy. Ontario Premier Doug Ford, who took office June 29, had campaigned on replacing Hydro One CEO Mayo Schmidt and the company’s board of directors. On Wednesday Schmidt retired and the board resigned under an agreement with the province of Ontario, which owns 47% of Hydro One.

Avista said Wednesday it was surprised by the moves, but didn’t say how they might affect the sale.

On Thursday, the Washington Utilities and Transportation Commission, which has yet to approve a settlement agreement filed in March that insulates Avista from Hydro One financial risk, said it wants Avista to address how the management changes will affect the merger.

Avista, an electric and gas utility with customers in Alaska, Idaho, Oregon and Washington, has only 32 retail electric customers in Montana, most of whom are affiliated with the company.

“As a result, a traditional examination of this sale and transfer is not appropriate,” the commission said. “Instead the commission examines this transaction under the public interest standard focusing on the potential impacts on electric generation as a whole in Montana.”

Under settlements in their Washington and Idaho merger dockets, Avista and Hydro One proposed a 2027 depreciation end date for Units 3 and 4, although the units’ expected 50-year lifespans would run through 2034 and 2036, respectively.

The PSC noted that accelerated depreciation is a strategy sometimes used to “facilitate premature retirement of disfavored utility generation assets” and said the practice “potentially creates regulatory and operational risks for the other Colstrip owners, as each has diverging economic incentives to operate their respective share of the assets.”

The other owners of Units 3 and 4 are Talen, Puget Sound Energy, PacifiCorp, Portland General Electric and NorthWestern Energy.

The commission said it approved the transaction because it had been assured “that the accelerated depreciation adopted in other jurisdictions will not result in an early or different retirement date for Colstrip Units 3 and 4.” It noted that the applicants committed that the units’ depreciation “will not deviate from the existing scheduled as currently approved.”

The PSC declined to endorse any depreciation schedule for the units, saying the issue would be addressed, if necessary, in future rate cases or other contested case proceedings before the commission. It asked Hydro One and Avista to provide the commissioners with their integrated resource plans for their Montana generating resources “when those plans became available.”

The commission also reserved the right to incorporate any increased commitments made in other jurisdictions into its own approval.

Along with the states in which Avista operates, the companies must gain regulatory approval of their merger from several federal agencies.

Colstrip’s other two units, owned by Talen and Puget Sound, are scheduled to be shut down by 2022 under the terms of a 2016 agreement with environmental groups. The units were built in the 1970s and can produce 614 MW of energy. (See Puget Sound Energy, Talen Agree to Close Colstrip Units.)