By Rory D. Sweeney

PJM may soon have to choose between continuing to greenlight its “largest-ever” congestion-reducing transmission project or risking a public relations war with opponents of the project who live in its proposed pathway and have gained influential allies in their fight to have it shelved.

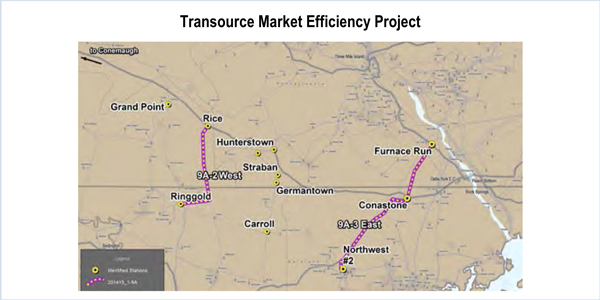

The $340.6 million project proposed by Transource Energy would consist of two separate 230-kV double-circuit lines, totaling about 42 miles, across the Maryland-Pennsylvania border — one between the Ringgold substation in Washington County, Md., and a new Rice substation in Franklin County, Pa.; and another between the Conastone substation in Harford County, Md., and a new Furnace Run substation in York County, Pa.

PJM and regulatory filings refer to the project as “9a,” while Transource has dubbed it the Independence Energy Connection.

“Until now, landowners have considered Transource to be their opponent, but unless PJM soon exercises its right to withdraw the project, we will hold PJM responsible,” wrote the opponents — consisting of three landowner groups in Harford, York and Franklin counties — in a June 30 letter to the RTO’s Board of Managers.

“PJM will become the target of our media outreach, our legislative efforts and, potentially, our legal efforts as we hold PJM responsible for the tremendous costs incurred by landowners who will ultimately emerge victorious,” the letter warned. “Further PJM support of this project will be viewed as an abuse of process.”

Project 9a

PJM selected Transource’s market efficiency proposal in August 2016 to reduce congestion along the RTO’s AP South interface. As part of PJM’s implementation of FERC Order 1000, the congested interface was included in its inaugural window for proposing such projects and received the most attention, attracting seven of the 17 total proposals submitted. (See AP South, Cleveland Draw Congestion Relief Proposals.)

At the time, PJM CEO Andy Ott called it “PJM’s largest-ever market efficiency project,” projecting it would save ratepayers $622 million in congestion costs over 15 years. The eastern portion would relieve the Graceton-Conastone 230-kV line, which was the most congested line in PJM’s 2016 long-term analysis. Its congestion costs in 2017 were $51.8 million and were expected to rise over the next 10 years to $68.88 million in 2027.

Another line leading into Graceton, the 230-kV Bagley-Graceton, was third on the list with $23.59 million in 2017 congestion costs and estimates of $59.57 million in 2027. A third line in the area, the 500-kV Peach Bottom-Conastone, was second on the current list with $32.78 million in congestion costs, which are expected to drop precipitously to $1.9 million in 2027.

FERC approved a formula rate for the project in January 2017 and a settlement this January on Transource’s return on equity, but it refused to reconsider whether the company should be allowed to make single-issue rate filings or recover all costs if the project is canceled through no fault of the company.

Transource received permission, starting on Jan. 31, 2017, to recover all “prudently incurred costs” if it must abandon the project for reasons “beyond Transource’s control.” All costs prior to that are subject to a cost-sharing policy FERC ordered in Opinion 295, through which Transource could recover 50% (ER17-419).

‘Do the Right Thing’

But opposition has developed among residents who live around the proposed paths, and they have orchestrated an awareness campaign that netted support from high-level elected officials on both sides of the state border. U.S. Rep. Scott Perry (R-Pa.) wrote a letter to FERC in March, calling on the commission to reconsider whether Order 1000 “puts impacted private citizens at a distinct disadvantage” in opposing projects. FERC Chairman Kevin McIntyre responded in April, outlining how projects are selected through Order 1000’s competitive solicitation process and assuring Perry that PJM re-evaluates its decisions annually.

Maryland Gov. Larry Hogan wrote to PJM’s Board of Managers on July 10 to “express concerns” that “the project will take prime agricultural land out of production, including land that is in permanent agricultural easements.” He sympathized with “the need to reduce power congestion in Maryland” but requested that the project be halted pending a re-evaluation or rerouting using existing rights of way, along with greater engagement with residents and state agricultural and energy agencies.

PJM says it never received Hogan’s letter.

“We have no record of receiving it,” PJM spokesperson Susan Buehler told RTO Insider in an email.

But the PJM board did receive the letter from opponents, who mentioned McIntyre’s “favorable response” and called for the project to be removed from the Regional Transmission Expansion Plan because the benefits have dropped substantially since the RTO last analyzed it.

“While we understand that PJM feels a responsibility to Transource to allow them to fail gracefully at the state level after a protracted review, the facts demand that PJM cancel this project immediately,” they wrote.

The opponents argued that near-universal local opposition and unknown environmental impacts should induce staff “to use your professional and moral judgment to do the right thing.”

Citing testimony from PJM’s Paul McGlynn to the Maryland Office of People’s Counsel (OPC), they argued system changes since last year’s annual analysis have reduced the potential benefits while costs have likely risen. The reference was to a data request from the OPC to PJM as part of the Maryland Public Service Commission’s review of Transource’s application for a certificate of public convenience and necessity for the project. In a portion of the data request provided to RTO Insider by the opposition, McGlynn appears to indicate that the congestion savings have fallen from the $620 million expected when the project was approved to $245.75 million in the most recent analysis.

However, that number is not a direct input in PJM’s analysis of such projects. That analysis, which was performed last September and posted in January, still produced a benefit-to-cost ratio of 1.32, exceeding PJM’s 1.25 threshold for considering a proposal. PJM was unable to independently verify the document cited by the opposition but confirmed that the information McGlynn would have used came from the analysis that resulted in the 1.32 benefit-cost ratio. Any changes in the variables will be included in the next analysis coming in September.

“PJM is currently conducting a third evaluation of the project, and we are using up-to-date data in doing so,” PJM spokesperson Jeff Shields said in an emailed statement. “In the past, the PJM board has canceled several major transmission projects in the region — including the [Mid-Atlantic Power Pathway] and [Potomac-Appalachian Transmission Highline] projects in 2012 — as a result of such re-evaluations.”

Impact on the Ground

The opposition argues that PJM does not give enough consideration to utilizing existing infrastructure. They point out that PPL’s existing Conastone-Otter Creek 230-kV line, which largely mirrors the proposal’s eastern path, has capacity to run another line.

PJM confirmed that PPL offered a proposal among the 41 submitted to address the AP South interface congestion, but its benefit-cost ratio did not meet the 1.25 threshold. A PPL representative said the company’s proposal “involved adding equipment to an existing substation.”

[Editor’s Note: An earlier version of this article incorrectly reported, based on information provided by PJM, that PPL had not submitted a proposal.]

Because it’s PJM’s largest market-efficiency project, “they want it to go through at any cost to land owners and local communities,” said Patti Hankins of Harford County, who joined the opposition in 2017 after learning property belonging to her husband’s cousin would be impacted.

Opponents are also concerned about the safety of high-voltage lines and the potential impact on destination agriculture, such as Shaw’s Orchard Farm Market in White Hall, Md., and other farm-to-table operations. New construction should be the last resort, they argue.

“The impact on the ground is so significant that there should be no new construction until it’s absolutely necessary,” said Aimee O’Neill, a Maryland resident and president of grassroots group Stop Transource Powerlines MD, a signatory to the opposition letter.

Political Action

O’Neill has been lobbying state legislators to pass five bills that would require developers to use existing transmission infrastructure where possible before building new. Opponents of the bills, which O’Neill hopes will be reintroduced in the legislature’s 2019 session following mid-term elections, argue that state regulatory oversight is satisfactory and that such laws would significantly upset plans to replace much of the regional grid that is nearing the end of its usable life.

“Maryland is not prepared to protect the interests of the people in the face of a changing energy environment,” O’Neill said. “There’s really nothing wrong with requiring those upgrades to be completed in existing easements with existing equipment, and what we’ve learned is that unless there is legislation requiring that … people [opposing new projects] are doomed to go through this time and again.”

Every property owner along the proposed routes has objected to the project, so Transource will need eminent domain authority to take them, O’Neill said. The company is currently working through permitting and eminent domain proceedings with regulators in both states.

A Transource representative said the company would not a comment on the opponents’ letter because it is directed to PJM.