By Amanda Durish Cook

MISO last week said it is reviewing stakeholder proposals to improve load forecasts and plan hourly energy delivery on its evolving system, rather than obtaining more forecasts from a Purdue University group.

Executive Director of System Planning Aubrey Johnson said CEO John Bear this summer asked to hold off on committing to continued use of the Purdue State Utility Forecasting Group’s independent load forecast so the RTO could collect alternative proposals for load forecasting from stakeholders.

“He asked us to step back and think about what we’re trying to accomplish,” Johnson said during a special Sept. 7 load forecasting workshop.

In the face of stakeholder criticism, MISO in June abandoned a proposal to have its 140-plus load-serving entities annually assemble four distinct 20-year load forecasts to align with each Transmission Expansion Plan. (See MISO Nixes LSE Load Forecast Plan.) However, stakeholders are now asking for more discussion about MISO’s alternative plan to order four versions of the Purdue forecast, each tailored to one of the futures used to inform MTEP.

MISO said it still plans to pursue four 20-year versions of Purdue’s forecast beginning with the 2020 MTEP, but now it says it wants the university to include monthly forecasts specific to each of the MTEP futures. The RTO is also looking into having third parties supply load shape information on behind-the-meter generation, electric vehicles, energy efficiency, demand response and distributed energy resources.

But MISO said it has been receiving alternative forecasting proposals from stakeholders since last month. Johnson said the RTO is currently working on ways to evaluate the proposals against one another and invited stakeholders to submit more through this week.

MISO now plans to make an announcement on a new load forecasting approach at the November Planning Advisory Committee meeting after holding two more workshops with stakeholders, Johnson said.

“What we’re attempting to do is start a conversation about … why” the forecast needs to change, Johnson said of the workshops.

‘All Hours’

MISO currently plans energy supply around a yearly peak hour on the hottest summer day in its forecasting, though RTO leadership has repeatedly said there is increasing evidence that peak risk occurs throughout the year in all seasons.

“All hours matter in this conversation. In the past … it’s been one peak hour, one dispatch,” said Director of Policy Studies J.T. Smith. “There are a lot of hours and generation mixes that are not being looked at.”

Smith said MISO’s current load modeling relies only on historical load shape data, but even MISO’s air conditioning load shape will shift in part because of smart thermostats and hotter days.

MISO adviser Ling Hua said consumption patterns are changing from that of a “sit-down restaurant where the lunch and dinner rushes can be anticipated” to that of a neighborhood bakery.

“In the neighborhood bakery, people walk in and walk out at any time,” Hua said.

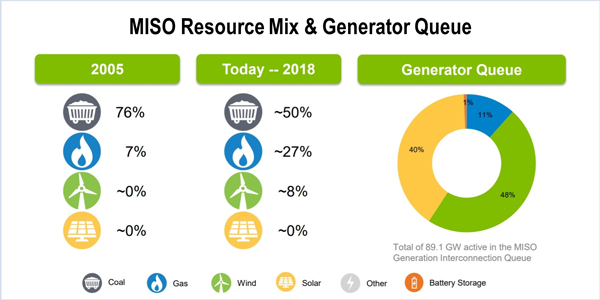

“There are risks in the planning environment that we’re not capturing today,” Smith said. “We’re seeing a very baseload-heavy environment turn into something not so baseload-heavy.” In the future, MISO may need to plan transmission for a more localized system, Smith said.

Monthly Forecasts

Hua said MISO hopes to have a 20-year forecast comprising monthly load peak demand and energy forecasts for a “more complete picture of the footprint.” She said the RTO needs more information, including energy efficiency, electric vehicle and load data from non-planning resources such as DR, DER and storage. “Those are really the disruptive technologies right now.”

But she also cautioned MISO not to overburden LSEs with data collection.

Some stakeholders continued to question why MISO needed such a detailed load forecast.

Indiana Utility Regulatory Commission staffer Dave Johnston pointed out that load forecasters failed to foresee the Great Recession that sunk load growth from about 2% to about 0.5% and the shale gas revolution that made natural gas so popular as a fuel source.

“I just throw those out as how different the load forecast can be,” Johnston said. “The need for transmission projects is low because we’re in this low growth era. … Do you have an idea of demand growth … 10 years in the future?”

Smith conceded the impossibility of predicting some trends but said that shouldn’t deter MISO from adopting a more comprehensive approach. He said it may end up that load growth becomes decoupled from economic growth.

“I’m not saying I’m going to be exactly right in my forecast. What I’m looking for is a breakdown of the information,” Smith said.

Alternatives

One stakeholder group has already offered an alternative to MISO’s forecasting proposal.

Members of the Coalition of Utilities with an Obligation to Serve in MISO (CUOS), an ad hoc group of MISO utilities and regulators that has been meeting since 2014, support providing one 20-year baseload forecast that includes monthly non-coincident peak forecasts and monthly energy forecasts. The LSEs’ forecasts would only be used in the MTEP “business as usual” future scenario.

Representing the group, WPPI Energy’s Valy Goepfrich said LSEs could pull from their forecasts and submit separate data on demand served by demand resources, energy efficiency planning resources and behind-the-meter planning resources. She added that, under the CUOS proposal, LSEs would not provide data on demand served by non-planning resources or energy efficiency programs.

Goepfrich stressed that LSE data is integral to whatever forecasting method MISO settles on.

“The LSEs have the best access to their data. That data is proprietary,” Goepfrich said.