By Eric Gimon

It’s easy to love electricity markets. Mathematical algorithms efficiently, safely and transparently dispatch grid resources to match supply and demand. Market signals drive the most valuable grid additions and retirements over time, providing customer savings and a stable investment environment incorporating technology and input cost changes.

PJM has led power market development, embracing rising trends like demand response and grid-scale battery storage. But lately, PJM has doubled down on a “solution” leading down an ever-more complicated and fractious path: its Reliability Pricing Model capacity market.

Electricity power markets are not perfect; critics often cite the “missing money” problem, which contends — with only marginal justification — that price signals balance markets but do not sustain adequate system resources to guarantee supply matches demand. To address this, PJM created a singular “capacity” commodity traded in the RPM, which loads must purchase.

While the RPM has been a boon for some resources, a singular definition of capacity never fairly captures everything the grid needs, and the RPM is open to three criticisms:

- First, it tends to overpay some resources without offering premiums to ones that provide more grid services than just megawatts. Imagine forcing a museum to purchase insurance on its art collection with a flat rate on a Rembrandt or a painting from a local artist.

- Second, with the RPM, PJM is eschewing part of its system optimizer role by requiring individual or self-assembled coalitions of resources to provide capacity products instead of assembling a diverse set of resources to meet reliability needs.

- Third, a conservative organization like PJM naturally tends to forecast higher demand, just in case, effectively forcing customers to buy too much insurance.

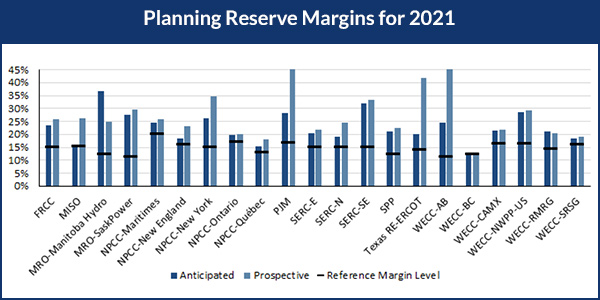

Predictably, the RPM has cannibalized energy market revenues in favor of capacity markets and allowed uneconomic legacy coal and nuclear assets to create a large capacity overhang (>30% reserve margin in summer 2018 against a desired ~16%).

Today’s power markets are also flawed by not pricing externalities. Seeing nuclear generators, which have provided free emissions mitigation, on the verge of going under, states like Illinois decided to provide direct financial support. These “out-of-market subsidies” (terminology that ignores other existing direct and indirect subsidies) became PJM’s new bugbear, which contends state-sponsored resources drive prices “too low.”

Last June, PJM wanted to double down on capacity markets by re-engineering them to force some resources to overbid at minimum offer prices to “mitigate” impacts of state policies, making customers double-pay for capacity instead of allowing markets to re-equilibrate by closing uneconomic resources.

Because of push back from FERC, which wants to allow matched resources and load to opt out of the RPM, PJM is doubling down again, striving to protect existing resources at all costs by proposing a two-stage capacity market called the extended Resource Carve-Out (RCO).

Extended RCO forces certain resources to offer into the capacity market at a higher price than their direct costs if they want to participate, or “allows” those resources to opt out of RPM by offering into the auction at a zero price. After this first stage of the two-stage capacity market, PJM determines which resources clear. In the second stage of the two-stage capacity market, PJM would then carve-out the opt-out resources and rerun the auction with the same demand curve to determine a higher clearing price to be paid to all non-carve-out resources that cleared in the first stage.

This would cause serious — and unnecessary — additional consumer expense.

Furthermore, extended RCO has yet another component: a payment to resources that would have cleared the second auction but not the first (the one that identified the actually needed capacity resources). This proposal extravagantly pays these so-called inframarginal resources even though they neither incur a capacity obligation nor provide capacity to PJM customers.

PJM committed the original sin of getting into capacity markets (Band-Aid solutions FERC historically expected to wither away). Over time, these capacity markets cannibalized energy markets, required constant “fixing,” and became the last refuge of increasingly uneconomic legacy assets.

When low natural gas prices and states interested in shaping their resource mixes started to fray this safety line, PJM took a protectionist line and started treating states like monopsonist market manipulators. Then, when FERC — unfortunately sympathetic to these protectionist views — tried to offer a fig leaf to states with opt-out, PJM doubled down on its twisted economic logic to make even that unworkable and expensive.

What should PJM do instead? At the very least, it should allow loads and grid resources to sort out capacity needs bilaterally and unfettered if the RPM seems unfair.

But when you’re in a hole, stop digging! Instead of doubling down on unworkable capacity constructs, PJM should double down on real markets and seek a new paradigm, working with states, that gets it out of the capacity business altogether.

Eric Gimon is a senior fellow with Energy Innovation Policy & Technology, which “works with national and regional decision makers to develop policies that will manage the grid’s transition to a cleaner, lower-carbon resource mix.” Eric holds a B.S. and M.S. from Stanford University in mathematics and physics, and a Ph.D. in physics from UC Santa Barbara.