By Rory D. Sweeney

Transmission constraints combined with PJM’s market design and Exelon’s control of local generation allow the company to name its price for capacity commitments in the Chicago area, according to an energy economist advising the state of Illinois.

“While PJM’s Base Residual Auction has many safeguards, it does not have an explicit ability to mitigate market power on the scale exerted by Exelon in Northern Illinois,” economist Robert McCullough wrote in an affidavit commissioned by Illinois Attorney General Lisa Madigan. “Overall, it seems very likely that Northern Illinois is not well served by the existing algorithm.”

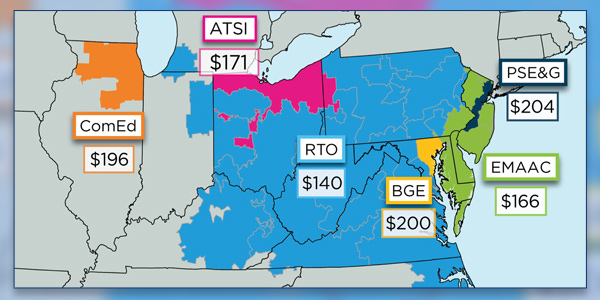

Madigan included the affidavit last week in Illinois’ brief in the FERC “paper hearing” on potential changes to PJM’s capacity market (EL18-178). Madigan’s brief said the high clearing prices in Exelon’s Commonwealth Edison zone in the Chicago area “are consistent with an economic withholding strategy.” (See related story, Little Common Ground in PJM Capacity Revamp Filings.)

At issue in the docket is whether generators that receive state or federal subsidies should have to remove the cost-lowering benefit of their subsidy from their offers into PJM’s capacity auctions.

McCullough, who has worked on RTO issues for more than three decades, says concerns over the market impacts of subsidized generation may not matter in the ComEd zone because Exelon already looms so large there. The capacity offers of individual Exelon units — such as the Quad Cities nuclear plant that receives $170 million through Illinois’ zero-emissions credit (ZEC) program — “is now irrelevant to the market clearing price in Northern Illinois,” he wrote.

“It is impossible for Northern Illinois to meet its reliability requirements without Exelon’s fleet of nuclear plants. Most importantly, the specific cost of any one of the plants is effectively irrelevant since four to five of those plants are required to meet the zone’s reliability requirements,” McCullough wrote. “Since Exelon’s portfolio determines the market price, the actual bid for Quad Cities has no impact on the outcome. Quad Cities’ capacity revenues will be set by the marginal Exelon resource. Exelon can also determine which plants will clear and which will not.”

It’s not the first time Exelon’s market power in PJM has been questioned. Five of the company’s nuclear units failed to clear in the 2014 capacity auction. But analysts said that actually boosted the company’s capacity revenues by almost $150 million because the additional supply would have dramatically reduced clearing prices. (See How Exelon Won by Losing.)

Exelon responded to the Illinois filing by insisting that its bidding strategy followed all market rules.

“In [the 2018] auction, Exelon offered its carbon-free nuclear generation at a competitive price based on each plant’s costs and risks of operation, and we did so in full compliance with all rules governing PJM capacity auctions,” the company said in an email Monday. “Because current rules treat emitting generation the same as clean generation, half of our fleet was not selected in the auction and did not earn any capacity revenues. As a result, most of the generation that ComEd customers paid for in the last auction was other generators’ fossil fuel-burning generation. That needs to change to protect customers and communities from the harmful effects of carbon and air pollution.”

Exelon threw its support in the docket behind a coalition of environmental groups, consumer advocates for Illinois and D.C., and generation companies with nuclear assets to advocate for allowing states to subsidize “clean” generation. (See Zero-Emissions Backers Propose PJM Capacity Principles.)

Three Requests

McCullough’s affidavit was developed to support the attorney general’s filing in the docket, which set a paper hearing to determine how to insulate PJM’s capacity auctions from price suppression created by subsidized generation. (See FERC Orders PJM Capacity Market Revamp.)

In her filing, Madigan urged FERC to require PJM to release bidding data from each auction as its neighbor in the state MISO does, while keeping bidders’ identities anonymous. She also asked FERC to implement a cap on what revenues subsidized resources can obtain under the fixed resource requirement (FRR) structure and to delay implementation of any changes until states can adjust their own policies to account for them. It also called for developing a minimum offer price rule (MOPR) for any subsidized resources and ensuring that units’ avoidable cost rates (ACRs) include all revenues, including those from subsidies and energy and ancillary services markets.

While other filings in the docket called for eliminating price suppression related to subsidies or ensuring that subsidized resources continue to count as capacity to cover a region’s demands, the attorney general focused on the impact of Exelon’s control of supply in the zone served by ComEd, which Exelon also owns.

“Exelon is a pivotal supplier with substantial market power to set the ComEd zone capacity price. The high clearing prices evident in the ComEd zone are consistent with an economic withholding strategy that aims to maximize revenues for a portfolio through strategic bidding of individual units,” Madigan wrote. “Under current capacity auction rules, in the ComEd zone Exelon has no incentive to adopt a bidding strategy that will result in a clearing price that is lower than a competitive price due to the thousands of megawatts of other Exelon capacity that will benefit from a higher, competitive clearing price. … There are insufficient non-nuclear resources for the ComEd zone to clear without some Exelon nuclear units clearing.”

McCullough noted that ComEd’s clearing prices increased from last year’s 2020/21 BRA that didn’t include ZECs to the most recent 2021/22 BRA that did, even though they should have fallen for at least three reasons: the ZEC law, the new tax law that substantially reduced generators’ federal taxes and the expansion of transmission capacity into ComEd.

“Notwithstanding the presence of a subsidized plant, the relatively high ComEd clearing price is consistent with the fact that the subsidized company (Exelon Generation) owns a total of 10,604 MW out of the 27,930.4 MW [that] were offered in the 2021/2022 auction,” the attorney general wrote. “With 40% of the generation owned by a single entity and a resulting [Hirschfield-Herfindahl Index] of 2,347, the ComEd zone is highly concentrated.” The index is used by federal agencies to measure the concentration of markets and considers anything about 2,500 to be “highly concentrated,” according to the Department of Justice’s Antitrust Division.

Flawed Algorithm

McCullough developed his analysis by plotting what the ComEd clearing prices would have been under several hypothetical scenarios published by PJM and its Monitor. The resulting prices and quantities “resemble a cloud of points rather than the traditional monotonic supply curve we see in actual markets” in which costs rise with output, he said.

In fact, he found that the hypothetical clearing price decreased in some scenarios where supply was added or removed, meaning that the final clearing price could have been lowered in the zone either by adding or subtracting supply and the actual price was higher than it necessarily could have been.

“By all appearances, the PJM algorithm does not work well for constrained markets,” he wrote. “The effect of ZECs or other major out-of-market payments on PJM’s capacity market is far from clear or direct. To avoid further market distortions and assure just and reasonable rates, all aspects of the market, including the market characteristics of constrained zones, market power and the details of the PJM algorithms must be part of any analysis.”

However, neither McCullough nor Madigan blamed Exelon for taking advantage of the situation. Instead, they argued it proves that the ZEC program is not suppressing prices.

McCullough said PJM staff incorrectly assumed prices would fall because Exelon would bid Quad Cities at $0/MW-day, when “Exelon could be expected to have simply adjusted its bids on other plants in its portfolio in the ComEd zone to offset the increase in supply and preserve the capacity price level.” So instead of producing the price suppression PJM predicted, “the outcome was actually the opposite to the forecasts from the PJM experts — in spite of significant cost reductions and the expansion of alternatives, the price in the ComEd zone increased from $188.12/MW-day [in the 2020/21 auction] to $195.55/MW-day [in the 2021/22 auction].”

A Complex Market

Because PJM doesn’t release bidding data, McCullough used his analysis to attempt to deconstruct PJM’s algorithm. He concurred with three issues previously identified by the Monitor that:

-

-

- Requiring the algorithm to solve within a specific amount of time can return different results based on the speed of the computers.

- The results can be impacted by small criteria changes.

- The algorithm can return more than one optimal result even with identical inputs and parameters.

-

“When only inflexible or very high-priced offers remain, none of the auction clearing procedures identified in [Reliability Pricing Model] documents are likely to lead to the competitive optimal price predicted by economic theory,” he wrote. “Given the complexity of the PJM capacity market — far more complex than the neighboring capacity market in MISO — it is critical that FERC apply clear and transparent rules to enable review and analysis of the capacity market data and results. … In Northern Illinois, where the same company dominates both the capacity market and owns the utility serving the major capacity loads, the FRR option opens the possibility of self-dealing. In the worst possible case, the FRR might well result in prices above competitive prices for consumers while depressing prices in the BRA.”

To address the issues, he suggested both a MOPR and an offer cap for FRR units set at the net ACR calculated for each unit individually.

“Absent that cap, the capacity market in Northern Illinois will continue to clear at an uncompetitively high level irrespective of the ZEC subsidies,” McCullough wrote. “This is necessary to return the Northern Illinois market to a state as close as possible to competitive conditions where capacity prices represent the net revenues needed to enable the resource to be a capacity resource, based on costs needed to operate but not covered by other revenues.”