By Michael Kuser

The generating arm pulled in $595 million, compared with $272 million a year earlier, but fluctuating prices in Texas and California squeezed the company’s retail business, which posted a loss of $127 million for the quarter.

CEO Mauricio Gutierrez said during a Nov. 8 earnings call that he was “pleased with the operational and financial performance of our integrated platform during a period of extreme price volatility. … During periods of high prices, our generation business benefits while our retail business experiences some margin compression.”

The company presentation highlighted the closing on the sale of NRG Yield and its Renewables platform as a milestone. It also announced an incremental $500 million stock repurchase in addition to the $1 billion announced earlier in the year, bringing total share repurchases to $1.5 billion.

Gutierrez said NRG expects to close on the sale of its 3,555-MW South Central portfolio of generation assets in Texas by year-end and the sale of its 500-MW Carlsbad Energy Center in California in the first quarter of next year.

Price Volatility and MOPR

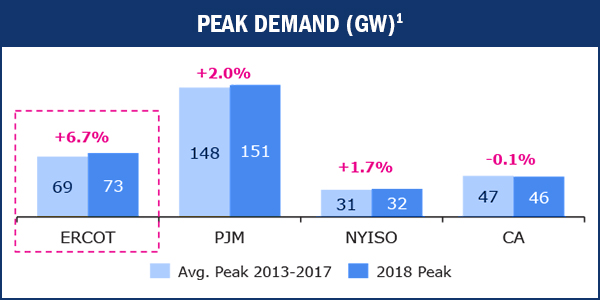

Warmer-than-normal weather across the company’s core markets led to higher demand last quarter, particularly in Texas, which set a new record peak load of 73 GW. Despite robust loads, actual prices were mixed across markets compared with expectations, with real-time prices in ERCOT coming in significantly lower than projected.

A combination of near perfect performance by generators during the July heat wave and milder temperatures in August resulted in prices 77% lower than expected at the beginning of the summer, Gutierrez said.

He noted that most of the current reserve margin in Texas is made up of capacity from renewable generation — non-dispatchable capacity that could potentially lead to fluctuations in the actual amount of generation available to serve load.

The California market was a different story, with prices settling well above expectations, mainly because of restricted gas deliverability, he said. The combination of once-through cooling unit retirements and the emergence of community choice aggregators have resulted in recent increases to Western capacity prices.

In the East, energy prices were pretty much in line with expectations, and the company’s focus is on both capacity and energy market reforms, Gutierrez said.

“As you know, FERC has stated that the existing capacity market in PJM is unjust and unreasonable, due to the negative impact of subsidized units,” Gutierrez said. “Let me reiterate that we believe a strong MOPR [minimum offer price rule] is the simplest and most effective way to reduce the harmful impact of subsidies on the capacity market.”

PJM and ISO-NE also are working on fuel security, which should lead to additional revenues for generators that have on-site fuel capabilities, he said.

“This is very much at play, but all these regulatory changes are designed to improve the current status quo and are positive for our portfolio,” Gutierrez said.

Call transcript courtesy of Seeking Alpha.