By Rory D. Sweeney

FERC on Thursday approved some of the flexibility PJM has sought to address after the historic GreenHat Energy financial transmission rights portfolio default.

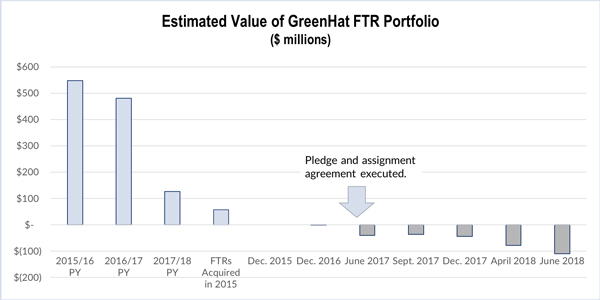

The commission accepted Tariff and Operating Agreement revisions that require defaulted FTR portfolios to go to settlement rather than being liquidated through auction (ER19-19). It was one of four requests PJM filed with FERC to attempt to mitigate the financial risk created by the default, which is expected to cost stakeholders more than $100 million to cover the losing bets. Stakeholders have criticized PJM for what they see as bungled handling of the issue. (See Advocacy Group Seeks CFTC Oversight of PJM FTRs.)

FERC’s approval is conditioned on PJM removing Tariff and OA language related to bilateral FTR transactions that is predicated on the commission accepting a related filing that received a deficiency letter requesting more information (ER19-24). FERC made the ruling effective Dec. 1, rendering moot another related filing that sought to ensure an effective date no later than Feb. 28, 2019 (ER19-25).

On Friday, FERC’s Office of Energy Market Regulation accepted by delegated authority the fourth filing, which clarified that a PJM member’s per capita portion of FTR default allocation assessments will not exceed $10,000 per calendar year, cumulative of all defaults, or more than once per each member’s ongoing default if default allocation assessment charges for a member’s ongoing default span multiple calendar years (ER19-23).

Settlement Order

FERC approved sending defaults to settlement rather than liquidation despite several protests, which argued that the requirement prolongs uncertainty, leaves PJM with no alternate ability to mitigate default losses, could increase the size of the default, inhibits liquidity by preventing the sale of valuable hedges and disrupts the orderly unwinding or reorganization of the defaulting entity.

“We acknowledge that inherent in these revisions, PJM stakeholders are exchanging one set of risks for another,” the commission said. “The commission recognizes that PJM, on behalf of the stakeholders who ultimately bear the cost of default, assessed such tradeoffs, including the risk tolerance of its stakeholders, and this proposal is the result of such an assessment. While we acknowledge that there are potential downsides to not liquidating defaulted portfolios through the FTR auctions, we cannot find that PJM’s choice to allow FTR positions to go to settlement is unjust and unreasonable.”

The commission said that while the GreenHat default may be an exceptional event that may never happen again, that doesn’t determine whether the rule changes stemming from it are unjust or unreasonable, nor does how other regions would handle such a situation.