By Tom Kleckner

ERCOT said Tuesday it confronts a historically low 8.1% planning reserve margin next summer in the face of continued high electricity demand from oil and gas producers in West Texas and the cancellation of several generation projects.

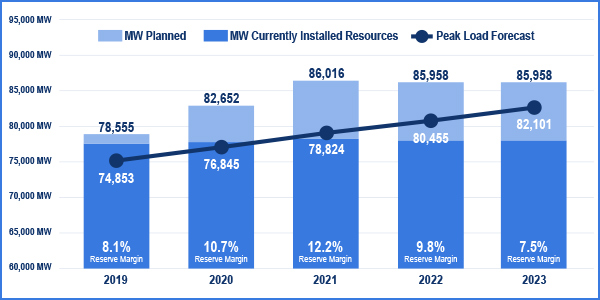

ERCOT’s December Capacity, Demand and Reserves (CDR) report shows more than 78 GW of operational generation capacity available next summer to meet expected demand of 74.9 GW. That marks a 600-MW increase in capacity over the May CDR forecast and a 1-GW jump above this summer’s record peak demand of 73.5 GW.

The ISO had an 11% reserve margin this past summer, when it met multiple demand peaks without resorting to emergency actions.

The grid operator has approved 1.7 GW of various resources for commercial operations since the May CDR. However, three proposed gas-fired projects totaling 1.8 GW of capacity and five wind projects totaling 1.1 GW have been canceled since May. Another 2.5 GW of gas, wind and solar projects have been delayed.

“The ERCOT market has experience in these cycles of [generation] retirements and resource investment,” Pete Warnken, the ISO’s manager of resource adequacy, said during a media conference call. “What we’re encountering now is nothing new.”

Warnken said ERCOT’s energy-only market is working as it was intended, with pricing signals incenting new generation. However, prices increased only slightly during the scarce times of the past summer.

“We are in a transition period where we’re facing lower reserve margins. Operationally speaking, we think the market is functioning the way it was designed,” Warnken said.

The report does indicate operating reserves will increase to 10.7% in 2020 and 12.2% in 2021, before falling again to 9.8% and 7.5% the following two years. More than 7.4 GW of installed capacity — all wind or solar, save for 100 MW of gas generation — is eligible for future inclusion in the CDR.

Warnken and Senior Director of System Operations Dan Woodfin worked hard to allay concerns during the call, reminding listeners that the CDR is a snapshot of resource availability “based on the latest information from resource owners and developers.”

Woodfin said ERCOT doesn’t view the shrinking reserve margin as a concern. He said the ISO can take several actions as operating reserves approach or drop below the minimum level of 2.3 GW, including using switchable resources in neighboring grids, procuring emergency responsive service, releasing ancillary services held in reserve and reducing load.

“Our role is to manage the grid and ensure it’s reliable on a systemwide basis. We certainly have the tools in place,” Woodfin said.

Asked whether ERCOT faces a greater risk of entering into an emergency situation, Warnken said, “We don’t know at the present time.” He said future CDR reports could show increases in capacity.

Warnken pointed to West Texas oil and gas development as driving the increased demand. ERCOT projects an 8% annual growth rate in West Texas peak demand through 2023, quadruple the ISO’s 2% systemwide load growth during the same time period.

Warnken admitted the oil and gas sector is volatile, but he said ERCOT has been in close contact with transmission and distribution providers about their service requests.

“Like the CDR in general, [ERCOT’s West Texas forecasts] are based on the current information we’ve been given,” he said.

“Industrial load growth has been central to ERCOT from the beginning,” CEO Bill Magness said last month in Houston. “That type of load comes in big chunks.”

ERCOT has a target planning reserve margin of 13.75%, which Warnken said is “purely informational” and not used to set requirements for generation standards.

Woodfin said ERCOT will be able to provide a clearer picture of summer expectations when it issues its next seasonal assessment of resource adequacy (SARA) in March. The SARA will include various scenario assessments, while the CDR relies on a 50/50 forecast with a 50% probability the peak will be higher or lower than predicted.

The ISO will release its next CDR report in May.