By Amanda Durish Cook

CARMEL, Ind. — MISO stakeholders debating whether the RTO should embark on another regional transmission package said impact to customers and solid business cases should factor prominently.

MISO is asking whether it needs another long-term regional transmission plan like 2011’s multi-value project (MVP) portfolio as it experiences a changing fleet and an increasing need to access new resources. The topic was the focus of the Dec. 5 Advisory Committee’s quarterly hot topic discussion.

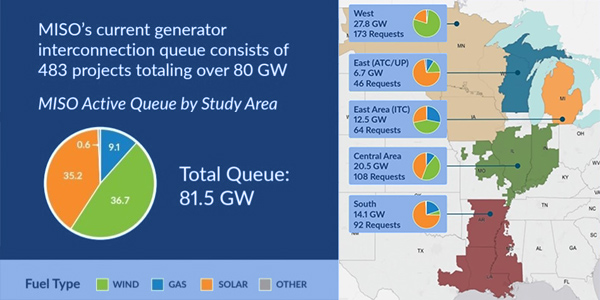

Aubrey Johnson, MISO executive director of system planning and competitive transmission, said the approximately 37 GW of wind projects under study in the queue cannot be supported by the RTO’s current system, even considering under-construction projects in the MVP portfolio. The majority of MISO’s 17-project portfolio will be online by the end of 2019.

MISO’s transmission queue contains 483 projects totaling about 80 GW. Executive Director of Resource Planning Patrick Brown said MISO may be reaching an economic “break point” where the costs of network upgrades render projects uneconomic, especially in the wind-heavy western portion of its footprint. “The general cost of network upgrades is going to drive them out,” Brown said.

Historically, 17% of proposed generators that enter MISO’s interconnection enter the generator interconnection agreement phase.

‘Stand by Me’

Per tradition, moderator Julia Johnson began the hot topic conversation with a song selection, this time Ben E. King’s “Stand by Me.”

“Blackout!” Johnson jokingly interjected while the lyrics “when the night has come, and the land is dark, and the moon is the only light we’ll see” played in the room. More seriously, she said the takeaway from the song was for industry players to remain unafraid and working together on regional planning.

Alliant Energy’s Mitchell Myhre said he didn’t think MISO would need an entirely new transmission planning playbook but that it should analyze transmission project alternatives and engage in conversations about them. He said more analysis on transmission project alternatives may have lessened the late-stage disagreements over at least two projects in this year’s Transmission Expansion Plan. (See related story, MISO Board OKs Full MTEP 18 Over Stakeholder Complaints.)

“We ask that those conversations [about alternatives] happen at the front end of the process so they don’t come up in the back end of the process,” Myhre said.

Multiple stakeholders said another possible crop of MVPs, if any, will need a new business case process, especially considering the fleet change that has occurred in the intervening years and the transmission cost allocation plan MISO will file at the end of the year.

“What if customers have had enough of transmission expansion? What if they’re tired of having transmission lines going across their farms, yards. … They have more options to bypass us completely. You can talk about MISO’s value until you’re blue in the face. What customers see is rising bills,” Madison Gas and Electric’s Megan Wisersky said.

She said customers might be better served by a reinforced distribution system than more transmission projects.

“We have to remember that these transmission lines do impose on communities,” said Coalition of Midwest Transmission Customers attorney Jim Dauphinais, who agreed that overbuilding transmission will result in more expensive bills.

Dauphinais said strong business cases are a must for new regional transmission.

“We think there needs to be a study; we think there needs to be a process” to see if a long-term regional transmission plan makes sense, Missouri Public Service Commissioner Daniel Hall agreed.

However, Kevin Murray, representing the Coalition of Midwest Transmission Customers, said a strong business case can’t be built on a speculative information about where resources might be constructed.

“We need to avoid the ‘build it and they will come’ sentiment. And we’ve seen hints of that in the past,” Murray said. He said some transmission projects might be more appropriately funded by interconnection customers for planned generation.

Clean Grid Alliance’s Beth Soholt said her company will continue to support the Cardinal Hickory Creek line project in Wisconsin, which she said had a “solid as ever” business case. She urged the MISO community no to get too hung up on the infeasibility of the entirety of the projects in the queue.

“We’re always going to have a queue. We’re always going to have projects entering because of economics,” Soholt said.

NRG Energy’s Tia Elliott, a representative of the Independent Power Producers sector, said grid buildout makes sense for a growing base of customers that prefer different resource options.

Soholt suggested that MTEP 15-year future scenarios should account for sustainability goals beyond renewable portfolio standards. Other stakeholders said MISO’s “limited fleet change” future scenario, which doesn’t anticipate widespread renewable use, is outdated and too improbable to be used in transmission planning. Although MISO staff said this year’s four future scenarios were developed for reuse over multiple planning cycles, some stakeholders said all of them should be revised. (See MISO to Recycle Tx Planning Scenarios for 2019.)

Others said accessing diverse resources may require the RTO’s own transmission pathway to connect MISO Midwest and MISO South. Dauphinais said the RTO should make “deeper dives” into chronic transmission constraints that don’t always show up in its annual market congestion planning study.