By Tom Kleckner

Commission Approves Revised 345-kV CenterPoint Project

The Public Utility Commission of Texas last week preliminarily approved a certificate of convenience and necessity for CenterPoint Energy’s proposed 345-kV project in the industrial Freeport area south of Houston, but not before quibbling over the wide range of cost estimates (Docket 48629).

CenterPoint provided ERCOT a revised estimate of $481 million to $695 million for a new 345-kV double-circuit transmission line over its preferred route connecting two substations and upgrading an existing 345-kV double circuit line. The grid operator filed a revised study with the PUC on Dec. 14 that still recommends CenterPoint’s preferred route.

“The range of cost estimates is still not terribly satisfying,” Commissioner Arthur D’Andrea said. “It’s no one’s fault but the ambiguity and uncertainty of doing these [studies].”

“Unsatisfying is an understatement for me,” PUC Chair DeAnn Walker said, “especially when the low end — the $481 million — depends on using state land that I’m not sure is even an option.”

In September, the commission had asked ERCOT to take a second look at the project in the face of rising costs.

ERCOT reviewed five options in its original study and 10 in the second. Its Board of Directors approved the project, which was estimated at $202 million, in December 2017. (See “Board Approves $246.7M Freeport Transmission Project,” ERCOT Board of Directors/Annual Meeting Briefs.)

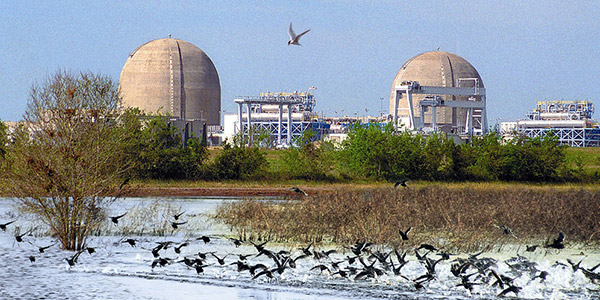

PUC Slashes NRG’s Nuke Decommission Costs

The commission approved a 65.2% reduction in the decommissioning costs for NRG South Texas’ share of the South Texas Project (STP) nuclear plant (Docket 48447).

With the order, NRG’s annual funding amounts will drop from $758,791 to $264,351.

The PUC “substantially reduced” the annual funding requirement in its last review in 2013, assuming a 20-year license extension for STP’s twin units from the original 2027 and 2028 expirations. The Nuclear Regulatory Commission approved the extensions last year.

NRG’s share of the decommissioning fund was $691.8 million at the end of 2017. The plant faces total decommissioning and dismantling costs of an estimated $2.5 billion.

The company owns a 44% share of STP. The plant’s other two owners are the city of San Antonio (40%) and the city of Austin (16%).

The nuclear plant’s two units have a combined capacity of almost 2.6 GW. They have been online since the late 1980s.

Hearing Schedule Set for Sempra-Oncor-Sharyland Deal

The commission will hold hearings April 10-12 on proposed transactions involving Sempra Energy, its Oncor subsidiary, Sharyland Utilities and Sharyland Distribution & Transmission Services (Docket 48929).

Staff filed a procedural schedule following a Dec. 18 prehearing conference.

In October, the parties announced deals worth $1.37 billion, with Sempra buying a 50% stake in Sharyland D&T and Oncor acquiring transmission owner InfraREIT. (See Sempra, Oncor Deals Target Texas Transmission.)

The transactions would result in Sharyland T&D becoming an indirect, wholly owned subsidiary of Oncor, owning transmission and distribution lines in central, north and west Texas. Sharyland Utilities would remain in South Texas, with Sempra owning an indirect 50% interest. The real estate investment trust (REIT) structure that holds Sharyland and Sharyland T&D would be terminated.

InfraREIT and Sharyland are both owned by Hunt Consolidated, which failed in a 2016 attempt to acquire Oncor.