By Rich Heidorn Jr.

VALLEY FORGE, Pa. — It was one of the shortest Market Implementation Committee meetings in memory Wednesday as stakeholders clocked out in only two and a half hours following discussions of the must-offer exception process, FERC’s energy storage order and PJM’s indemnification rules on bilateral trades of financial transmission rights. (See related story, Shell Energy Seeks to Avoid Liability in GreenHat Trades.)

PJM May Split Rule Changes on Must-offer Exceptions

PJM may seek approval of widely supported changes to the must-offer exception process while having further discussions on revisions that lack consensus, RTO officials told the MIC.

The MIC approved a package of rule changes proposed by PJM MRC Briefs: Dec. 20, 2018.)

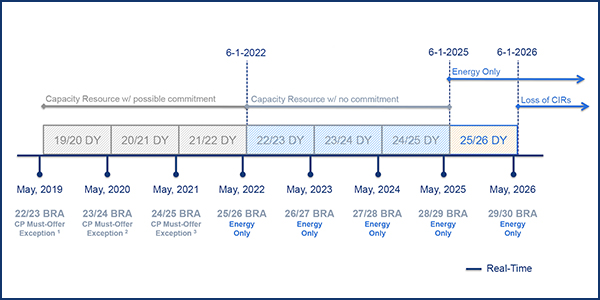

The process behind the rule changes was initiated by Exelon to investigate issues including the process for existing capacity resources with a must-offer requirement to become energy-only resources.

The changes with widest support would allow market participants to voluntarily remove a generator from its capacity resource status by making a request to PJM and the Independent Market Monitor. It would also permit participants to request exemptions from multiple auctions in a single exception request. It would allow such changes for new resources that cannot be completed by the start of the delivery year for which it cleared.

There is less consensus on a rule that would require generators to forfeit their capacity injection rights (CIRs) if they are repeatedly approved for CP must-offer exceptions and not offered in capacity auctions for three consecutive delivery years.

Monitor Joe Bowring said the proposed changes failed to strike the right balance.

Bowring said PJM should discourage generators from holding on to CIRs for a long period of time because “they can’t make up their mind” about being a capacity resource.

“If someone has a clear plan, and they’re following it, that’s fine,” Bowring said. “We think this [proposal] allows more than that.”

Carl Johnson, representing the PJM Public Power Coalition, was also critical. “I’m struggling to find anything I like about any of this,” he said. “This doesn’t hang together to me as an effective set of rules.”

Sharon Midgley of Exelon asked PJM to move forward on the parts of the package with wide support, saying the only issue in dispute was over the RTO involuntarily seizing CIRs from generators after three years of successive must-offer exception requests.

But Marji Philips of Direct Energy said her company would not support a “quick fix” based on what has been proposed to date. “The process as proposed is a little bit loose yet,” she said, adding that CIRs are “a very serious barrier to new entry.”

A few stakeholders rekindled an earlier debate over whether CIRs are generators’ “property rights.”

Gary Greiner of Public Service Enterprise Group said stakeholders need PJM’s opinion on the issue. “We’ve kind of danced on the periphery, but we’ve never come at it head on,” he said.

PJM’s Pat Bruno said the RTO may split the issue so it can seek approval of its non-controversial elements. He said the RTO will conduct additional discussions with stakeholders before the next MIC.

Electric Storage Rules Require Manual Changes

PJM’s Laura Walter gave stakeholders an update on the RTO’s implementation of rules opening its markets to electric storage, saying as many as 15 manuals may require revisions.

PJM made two filings to comply with FERC Order 841 on Dec. 3, one covering markets and operations (ER19-469) for which comments are due Feb. 7, and a second governing accounting (ER19-462), for which the comment period closed on Jan. 4. The RTO plans to implement the changes by Dec. 3.

Walter said stakeholders will be asked for feedback on energy storage cost offers at the February MIC meeting. Among the items to be discussed will be whether cost offers should be based on inventory cost (historical weighted average cost of stored energy available for discharge, adjusted for round-trip efficiency); opportunity costs (expected lost net revenue from operating in a given hour); or replacement cost (estimated future weighted average cost of charging energy over the next available operating period).

First drafts of manual revisions will be presented before July, Walter said.