By Michael Brooks and Rich Heidorn Jr.

VALLEY FORGE, Pa. — PJM’s proposed revisions to how it prices reserves in its energy market necessitates changes in the RTO’s capacity market to prevent substantial overpayment by customers for electricity and the exercise of market power by generators, Independent Market Monitor Joe Bowring said Friday.

Without a true-up, PJM’s package of changes, being developed under a Jan. 31 deadline imposed by the RTO’s Board of Managers, would result in the overpayment of at least $6 billion to generators over four years after its implementation, Bowring told the Energy Price Formation Senior Task Force (EPFSTF), as well as significantly higher overpayment after that without specific market design changes in the capacity market.

“PJM’s apparent goal is to shift revenue from the capacity market to the energy and reserve markets,” Bowring said in a presentation. If so, he said, “there must be a clear and verifiable mechanism to ensure that the shift occurs effectively, equitably and efficiently.”

The RTO has proposed raising the maximum price in the operating reserve demand curve (ORDC), used to set prices for reserve products, from $850 to $2,000. The proposed ORDC would raise both energy and reserve prices significantly. PJM would also use the same ORDC in the day-ahead and real-time markets for reserves, introducing the ability to procure primary reserves in the day-ahead and secondary reserves in the real-time. (See Section 206 Filing on PJM Reserve Pricing Likely.)

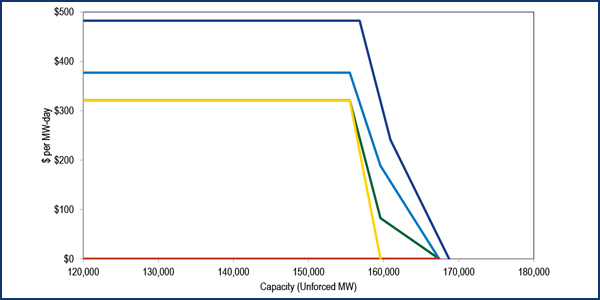

Bowring said increased energy market revenues won’t result in lower capacity prices without changes to the variable resource requirement (VRR) demand curve. The curve is based on the net cost of new entry (CONE), which considers all generator revenues from energy and ancillary services markets.

The Monitor proposed setting net CONE as the maximum price on the curve. As a result, Bowring said, capacity prices could be $0 under some circumstances when energy market revenues are high.

“You can’t have it both ways,” Bowring said. “If you shift this high level of revenue from the capacity market to the energy market, you’re effectively eliminating the capacity market.”

The Monitor first raised its concerns at the task force’s previous meeting Jan. 4, but Friday’s meeting marked the first time it made explicit its proposals for why the VRR curve needs to change in response to PJM’s proposal.

Capacity markets serve the same function as scarcity pricing, he said: to provide enough revenue to ensure there is adequate supply to meet demand. “I’m not arguing that we should get rid of the capacity market, but if PJM’s changes to increase energy and reserve prices are implemented, we have to make sure people are not paying twice for the same product.”

Bowring said PJM’s logic for the package of revisions “escapes me.” But, he said, if that was what the RTO wanted to do, his concerns would need to be addressed to prevent overpayments.

“I am not sure why PJM believes that there is urgency to this,” Bowring said in an email. “It is not a simple matter, and PJM’s approach has not been adopted by other RTO/ISOs.”

Bowring also said an increased reliance on the energy market will reduce PJM’s ability to “pick the reserve margin quite so precisely.”

“It’s the same lesson ERCOT learned,” he said of the Texas grid operator, which does not have a capacity market.

‘Radical Change’

Adam Keech, PJM executive director of market operations, did not directly dispute Bowring’s arguments. But he did take exception to the idea that the RTO was trying to eliminate the capacity market. “The goal [of PJM’s proposal] is not to shift revenue,” he said at the meeting. “The goal is to price energy and reserves correctly.”

Keech told RTO Insider after the meeting that PJM was waiting for information from the Monitor, “because we have thought about it and not been able to identify what the issues are that they see.”

Bowring said that PJM has explicitly ignored the potential revenue impact on the capacity market during the transition period. “In other words, PJM is proposing that customers pay twice for the same product during the transition period.”

The RTO proposes to use simulations to estimate the increase in energy revenue in defining the VRR curve in the capacity market auctions after the transition period. “PJM clearly has thought about the issues,” he said, “but they have a very different proposal than the IMM’s proposal.”

Stakeholder reaction to Bowring’s presentation was mixed. Brock Ondayko of American Electric Power said that, without further modifications to the VRR curve, he expected capacity to clear at lower prices under the proposed rules because of the increased energy and reserve revenues. Bowring’s predictions “just seem counterintuitive,” he said.

But consultants James Wilson and Roy Shanker, and Susan Bruce, attorney for the PJM Industrial Customers Coalition, agreed the IMM had identified a problem that needed to be addressed.

With the PJM board’s deadline looming, however, it may not matter.

“We’re in an interesting spot, both from a timing and scope perspective,” said Dave Anders, PJM director of stakeholder affairs and chair of the task force, explaining that the capacity market curve is out of scope under the issue charge the Markets and Reliability Committee approved. The MRC’s next meeting is Jan. 24, when the committee is expected to vote on PJM’s proposal.

Anders said stakeholders offering alternatives to PJM’s proposals should include any measures to address the capacity curve issue as an addendum, not as part of the packages to be voted on by task force members Jan. 17. “I don’t want to use the process to ignore what may be a significant issue,” he said.

Bowring said PJM would be foolish to ignore the impact of such a “radical change” to the energy market on the capacity market. “It is going to be part of the scope in front of FERC,” he said.

Transparency Proposal

Wilson, a consultant to consumer advocates in New Jersey, Pennsylvania, Maryland, Delaware and D.C., ended the session with a brief presentation in which he said PJM should make public appeals for conservation when administrative shortage prices reach a threshold so that customers know they are facing high prices and have an opportunity to reduce their consumption. He said the trigger could be the shortage price component hitting $300/MWh.

“It shouldn’t be just a quiet little press release on the PJM website,” Wilson said. “It ought to be on the nightly news.”

PJM’s current rules call for such appeals only when reliability is at risk.