By Rich Heidorn Jr.

PJM must unwind five months of settlements for GreenHat Energy financial transmission rights that should have been liquidated sooner, FERC ruled Wednesday (ER18-2068).

In addition to rejecting PJM’s request for a waiver of its liquidation rules, the commission also rebuffed the RTO’s request to retain $550,000 in collateral posted by one of GreenHat’s principals through a second company (ER18-1972).

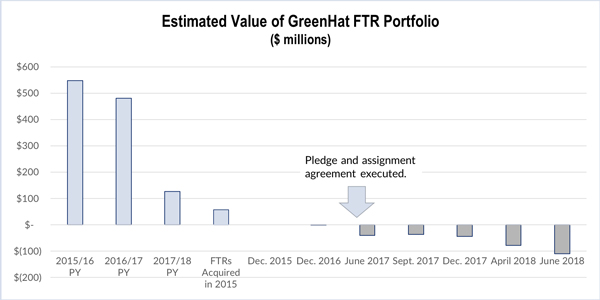

The two rulings complicate the RTO’s efforts to minimize the damage of GreenHat’s default, which left other PJM members liable for more than $100 million.

The commission also disclosed that its Office of Enforcement is conducting a nonpublic investigation into whether GreenHat engaged in market manipulation or violated other commission rules. “That investigation is ongoing. The commission will determine what further action, if any, may be appropriate after it considers the results of the staff investigation,” FERC said.

The RTO said it will ask the commission to reconsider its ruling on the liquidation waivers.

“PJM took the appropriate and immediate steps in the public interest, based on the legal vehicles and FERC precedents in effect, to stop a liquidation in an auction that was dysfunctional,” RTO spokesman Jeff Shields responded late Wednesday. “PJM is disappointed that FERC, in its order, may not have fully appreciated the magnitude of the impact to our members and to consumers. PJM intends to file a rehearing and/or clarification request, and a motion to stay the order. We will have a notification for members in the coming days.”

On Nov. 29, the commission had approved Tariff and Operating Agreement revisions that require defaulted FTR portfolios to go to settlement rather than being liquidated through auction (ER19-19). (See FERC OKs Key PJM Changes to Address GreenHat Default.)

But the commission on Wednesday declined to make those rule changes retroactive, saying the waivers could harm other FTR market participants who had relied on the RTO’s existing rules.

As described by FERC, PJM “paused aspects of” the July FTR auction after all bids and offers had been received, saying it was alarmed by a lack of liquidity and the size of risk premiums related to the GreenHat FTRs.

PJM said it would instead sell off the positions during the long-term FTR auction in September and the monthly auctions between July and October, offering only those positions effective in the prompt month (i.e., selling August FTR positions at the July auction, September FTR positions in the August auction, etc.)

The RTO asked FERC on July 26 for a waiver of Tariff rules requiring it to offer all of GreenHat’s FTR positions at a price designed “to maximize the likelihood of liquidation,” saying a slower liquidation of the company’s large portfolio would reduce losses to members.

FERC ruled that the request was not limited in scope.

“Changing the rules governing an already-commenced auction is a significant step that affects both the outcome of that particular auction as well as parties’ confidence in the rules governing future proceedings. That is particularly so here, where the record indicates that PJM proposed the waiver in order to avoid the outcome that the already-commenced auction would have produced,” FERC said.

“In addition, we note that PJM proposes to waive four discrete elements of the Tariff in order to potentially substitute new rules that were not yet formed, much less included in the record, at the time PJM made its waiver request. Such a significant change to multiple parameters of an already-commenced auction is not a remedy that is limited in scope. The record demonstrates that participants submitted bids in the July monthly FTR auction relying on the liquidation process that existed at the time PJM conducted the auction. Disrupting those settled expectations is likely to cause harm to third parties, even if doing so might produce [an] otherwise more efficient outcome, as PJM contends the waiver request would.

“To the extent PJM anticipated that the commission would grant the waiver request … PJM is required to reconcile any such actions by reinstating the original July auction results, or taking steps that are necessary to comply with the effective Tariff language when the July 2018 auction was conducted, and by unwinding settlements made for September, October, November, December and January positions that should have been liquidated.”

‘Unreasonably Harmed’

Separately, the commission also rejected PJM’s request to withhold $550,000 in collateral posted by Orange Avenue, a second company owned by one of the GreenHat principals.

PJM asked to retain the collateral for up to one year while it decides whether to take legal action against GreenHat and apply Orange’s collateral to GreenHat’s debts.

Orange posted the collateral in February 2018, but before doing any trading, it sought on June 4 to withdraw from PJM and recover the collateral.

When PJM sought more collateral from GreenHat as its losses mounted in April 2017, the company gave the RTO the rights to collect money it said Shell Energy owed it for purchasing some of its FTR portfolio. PJM was left emptyhanded, however, when Shell said it had already paid GreenHat all it owed. (See Shell Energy Seeks to Avoid Liability in GreenHat Trades.)

PJM said it is reviewing whether to take legal action against GreenHat over its representations in negotiating the pledge agreement.

FERC denied PJM’s request to hold Orange’s money in the interim, saying the company “would be unreasonably harmed.”

“While PJM states that it intends to investigate potential fraud with respect to the execution of the pledge agreement by the managing member of GreenHat, PJM fails to make any claim that Orange may have participated in any fraud, pointing out only that GreenHat and Orange have the same managing director. On the evidence submitted by PJM, therefore, we find that Orange would be unreasonably harmed by granting PJM a waiver request.”