By Michael Kuser

ICAP Manual Update Approved

NYISO’s Business Issues Committee on Wednesday approved revisions to the Installed Capacity (ICAP) Manual to reflect new capacity values for the upcoming 2019/20 capability year, particularly the amount of import capacity allowed from neighboring control areas.

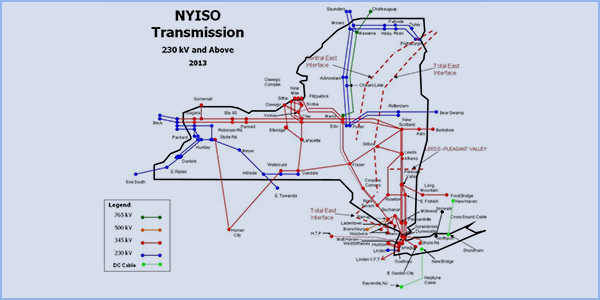

Hoël Wiesner, ICAP market operations analyst, told the BIC that GE Multi-Area Reliability Simulation program (MARS) simulations were performed on the locational minimum installed capacity requirements (LCR) MARS database to determine the volume of capacity imports allowed without violating the loss-of-load expectation (LOLE) criterion.

The analysis excluded interface facilities having unforced capacity deliverability rights, the controllable lines from PJM into New York and the Northport-Norwalk Harbor intertie 1385 line.

The methodology took the initial 2019/20 final installed reserve margin (IRM) database as updated for the LCR study and modeled grandfathered imports consistent with the IRM study, then determined the imports for each control area individually by increasing imports on ties until the LOLE levels in the base case were met, Wiesner said.

“Once we have these individual limits set, we perform a simultaneous run by increasing the ICAP imports based on the individual limits, beyond the grandfathered imports, until the LOLE levels in the base case are met,” he said.

“These ICAP imports, added to the grandfathered imports, determine the final limits on each control area interface,” Wiesner said.

The final values for the capability year are 1,112 MW for PJM; 279 MW for New England; 1,114 MW for Hydro-Quebec; and 128 MW for Ontario — for a total import limit of 2,633 MW.

The next steps are finalizing the values and publishing them to the automated market system by March 1, emailing the marketplace when those values are finalized, and beginning the first-come, first-serve import rights process March 6, he said.

Broader Regional Markets Report

NYISO on Jan. 27 implemented software to resolve technical issues related to offer caps under FERC Order 831, precluding the need for a requested waiver.

The ISO had implemented software to comply with Order 831 in December, while requesting a limited waiver to resolve an outstanding implementation issue, Rana Mukerji, senior vice president for market structures, told the BIC in presenting the monthly Broader Regional Markets report.

Mukerji also highlighted progress in clarifying the minimum deliverability requirements for external capacity from NYISO Business Issues Committee Briefs: Nov. 14, 2018.)

The ISO will continue discussions on the issue at future working group meetings, while targeting to seek stakeholder approval from the BIC and Management Committee by the end of the first quarter, Mukerji said.

Natural Gas Prices Spike 50% in January

NYISO locational-based marginal prices averaged $50.93/MWh in January, up by about 25% from December and down around 50% from the same month a year ago when natural gas prices surged during a severe cold snap, Mukerji said in delivering the monthly operations report. Day-ahead and real-time load-weighted LBMPs came in higher compared to December.

Year-to-date monthly energy prices averaged $52.99/MWh, a 48% decrease from a year ago. January’s average sendout was 449 GWh/day, compared with 425 GWh/day in December and 463 GWh/day a year earlier.

Transco Z6 hub natural gas prices averaged $6.11/MMBtu for the month, up 50% compared with December but down nearly 66% from a year ago.

Distillate prices rose compared to the previous month but were down 9.7% year-over-year. Jet Kerosene Gulf Coast averaged $13.25/MMBtu, up from $12.54/MMBtu in December. Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $13.20/MMBtu, up from $12.84/MMBtu.

January uplift increased to -25 cents/MWh from -29 cents in December, while total uplift costs, excluding the ISO’s cost of operations, came in higher than December.

The ISO’s local reliability share jumped to 32 cents/MWh in January from 23 cents the previous month, while the statewide share dropped to -57 cents/MWh from -52 cents.

The Thunderstorm Alert cost in New York City was $0, unchanged from December.