By Rich Heidorn Jr.

ISO-NE CEO Gordon van Welie said Wednesday that his concerns about New England’s ability to keep the lights on continue to grow despite recently enacted market rule changes, predicting that energy security risks “could become a year-round concern.”

The region has benefited from a milder-than-normal 2018/19 winter and has not faced the severe, lengthy natural gas shortages that marked the two-week cold spell early last year. The RTO also has implemented its Pay-for-Performance incentives and held its first capacity auction under rules intended to mitigate price suppression by subsidized resources.

But speaking at his annual State of the Grid press call, van Welie said the transition to a “hybrid” grid with growing distributed and renewable generation means that “eventually nearly all resources in the fleet will have some energy limitations.”

In addition to limited oil and LNG supplies and just-in-time natural gas deliveries, the region will face new challenges as the shares of wind and solar generation grow. “As this contingent of energy-limited resources grows, the region’s energy-security risks could become a year-round concern,” he said. “New England’s power system is operating from a strong foundation, but the vulnerabilities we’ve discussed in previous briefings are still here, and still growing.”

The grid operator marked a milestone on April 21, 2018, a sunny day when — for the first time — net load peaked overnight because of strong solar power during mid-day.

“On the other hand, clouds and snow cover prevented solar panels from reaching their seasonal potential during last year’s historic 16-day cold spell, particularly during Winter Storm Grayson,” van Welie said. The cold snap also exposed the limits of energy storage, which van Welie said may eventually “help manage through day-to-day variations but may not be able to charge up again to help when bad weather lasts for multiple days.”

First Auction Under CASPR

Van Welie said he was pleased with the RTO’s first capacity auction under its Competitive Auctions for Sponsored Policy Resources rules. The February auction made ISO-NE the first grid operator to implement a market-based mechanism to accommodate state-sponsored resources. State-sponsored Vineyard Wind won a 54-MW capacity obligation from a retiring resource in the substitution auction under CASPR.

Forward Capacity Auction 13 cleared at the lowest price in six years, with high levels of new resources, including conventional generators and renewables. Sunrun’s home solar and battery aggregation project became the first in the nation to win a capacity commitment from a grid operator. (See ISO-NE Completes FCA 13 Despite Controversy.)

Van Welie said he expects capacity prices to rise as uneconomical resources retire and declining energy prices — a consequence of increasing renewables with no fuel costs — force generators to seek more revenue from other sources.

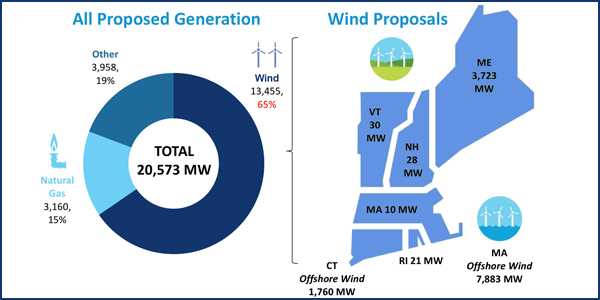

ISO-NE’s interconnection queue currently lists more than 150 projects totaling more than 20,000 MW, a level “we’ve rarely seen,” van Welie said. Wind generation represents about two-thirds of the proposed new capacity, more than half of it proposed for offshore. In the past, only about 30% of capacity that enters the queue has come to fruition, however.

Van Welie said New England states’ increasing renewable portfolio standards are “leading to complexities in market design as well as grid operations, thereby requiring adjustments to both.”

The RTO sees pricing carbon as an “elegant” solution to eliminating out-of-market contracts for renewable resources but has been unable to persuade policymakers to adopt it. “I’ve been a bit of a broken record on this,” said van Welie. He said the Regional Greenhouse Gas Initiative is an “excellent concept” but that its carbon prices are too low to be effective.

Retirements

In June, New England became the first region to price active demand response resources in the daily energy market alongside generators. DR and energy efficiency have been eligible for capacity payments since the start of the capacity market in 2006. In FCA 13, more than 4,000 MW of DR and EE cleared, more than 10% of the total.

Despite the growth in demand-side resources and renewables, however, New England is facing increasing challenges from plant retirements. The retirement of the 677-MW Pilgrim nuclear plant by June “will worsen the region’s energy security risks and its emissions profile,” van Welie said.

The region, which will see 5,200 MW of retirements between 2013 and 2022, could face another 5,000 MW of nuclear and coal-fired generation retirements, the RTO says. The region’s nuclear capacity will be reduced to 3,347 MW, with only the Millstone and Seabrook plants remaining.

The RTO is predicting a slight decrease in peak demand over the next 10 years because of EE but says the trend could reverse with the growth of electric transportation and heating. “We don’t expect electric vehicles or heat pumps to have a substantial effect on regional demand in the near future,” van Welie said.

Future Initiatives

Van Welie said the RTO is “facing reality” and does not expect any new gas pipeline capacity. “We have to operate with what we have,” he said, citing more transmission to deliver renewables and imports, and more oil and LNG storage as alternative answers.

Van Welie said the RTO’s Pay-for-Performance incentives, which took effect last June, “may not address all aspects of the region’s winter energy security challenges that have continued to intensify since the incentives were developed.”

Although it provides price signals for resources when the grid is at risk, it does not tell generators of fuel supply shortages days or weeks ahead. “We don’t have a regional fuel gauge that indicates how close we’re getting to the bottom of the fuel tank,” he said.

The RTO’s long-term solution for its winter energy security concerns would expand the current day-ahead market to a multiple day-ahead construct. It will seek to co-optimize its fuel and energy supplies to ride out a seven-day outage of the largest non-gas resource on the system.

“If it’s clear we have more than enough fuel for tomorrow but will run short before the end of the week, resources that can save energy for the end of the week will be properly compensated,” van Welie explained.

It also would include a forward market settlement against the multiday co-optimized market. “The forward market would be seasonal in nature, roughly six months ahead of winter,” he said.

The RTO opened discussions on the proposal in November and plans to provide more details in a white paper in April. It hopes for a FERC filing by November with implementation over three to five years. “This is a very complex project,” van Welie said. “Probably the most complicated thing we’ve done in the history of the ISO.”