By Christen Smith

Unsound rules for calculating default market seller offer caps and other persistent structural flaws made PJM’s capacity market uncompetitive in 2018, the RTO’s Independent Market Monitor said Thursday.

“The offer cap is six times too high,” Monitor Joe Bowring said while presenting the annual State of the Market report. “The math doesn’t work the way PJM has it. The offer cap is way too high, permitting uncompetitive results.”

Bowring’s statements echoed the Monitor’s Monitor Asks FERC to Cut PJM Capacity Offer Cap.) Bowring suggests implementing a new market rule that mitigates those factors or reducing the number of performance assessment hours (PAH) used to calculate the minimum offer price rule (MOPR).

“The offer cap is too high because of the use of the wrong number of PAH,” he said. “We suggest implementing a sustainable market rule instead of MOPR … most units, even though they are being subsidized, would clear with truly competitive prices.”

The Monitor evaluated the capacity market design as “mixed,” citing several features of the Reliability Pricing Model that threaten competition, including a definition of demand response that permits inferior products to substitute for capacity, issues with replacement capacity, the definition of unit offer parameters, the inclusion of imports that are not substitutes for internal capacity resources and the definition of the default offer cap.

Bowring said DR should be removed from the capacity market entirely and redesigned to facilitate customers’ response to prices. Payments should be immediate, and the offer cap should mirror that for generation, he said.

Gas Outpaces Coal in Energy Market

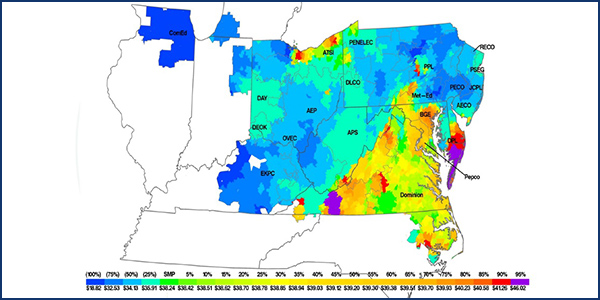

Gas-fired energy output exceeded coal in PJM’s market last year for the first time, Bowring said. Despite this, LMPs rose 23.4% and the fuel diversity index increased. Still, the Monitor characterized PJM’s energy market as being “competitive” in 2018.

Load spiked 4.3% — the biggest increase since 2012 — on account of frigid temperatures in January and other weather-related events in 2018, according to the report. PJM’s energy sources remain relatively balanced among gas (30.9%), coal (28.6%) and nuclear (34.2%), with renewables accounting for a small, but growing share of less than 3%.

“Energy prices have increased quite significantly,” Bowring said. “Even though gas and coal have crossed lines, coal is still a significant presence in PJM and is still setting the price about 25% of the time.”

The Monitor also suggests PJM prioritize a stakeholder process to clearly define criteria for operator approval of real-time security-constrained economic dispatch cases used to send dispatch signals to resources. The RTO should also implement a rules-based approach to pricing in order to minimize operator discretion, Bowring said.

“It’s at the core of the energy market and the rules aren’t clear how the market is run,” he said.

Energy uplift charges increased 56.5% last year, with combustion turbines and combined cycle gas units receiving $109.3 million and $20.3 million in credits, respectively — more than half the $198.5 million allocated last year. The Monitor wants to eliminate day-ahead operating reserve credits, include regulation offsets in the calculation of balancing operating reserves and calculate the need for balancing credits and lost opportunity cost credits on a daily basis for a $47.4 million reduction in credits overall.

‘Unsurprising’ Nuclear Retirement Signals

Three of PJM’s 18 nuclear facilities face revenue shortfalls through 2021, a natural reaction to competition, Bowring said.

“We have plenty of capacity,” he said. “We don’t need any particular unit to be reliable. If they can’t compete, they can’t compete. The fact that a unit is going to retire is not a surprising thing in a competitive market.”

The three facilities — Davis-Besse, Perry and Three Mile Island (TMI) — each operate just one reactor, which is the source of their financial strain, the Monitor said. The remaining multi-unit facilities, including the subsidized Quad Cities in Illinois, will remain profitable. Even without zero-emission credits, Quad Cities would cover its costs for the next three years, Bowring noted.

Bowring said ZECs could upset PJM’s competitive markets as Pennsylvania considers subsidizing TMI and its other nuclear plants after Exelon scheduled the plant for early retirement in September. (See PA Lawmakers Unveil $500M Nuke Subsidy Bill.)

“Providing subsidies is a bad idea,” he said. “It’s contagious.”

In addition, 24 coal-fired units with 12,017 MW of output are at risk of retirement as newer, more efficient technologies take over, the report pointed out.