By Christen Smith

PJM filed its energy price formation proposal with FERC on Friday, after a yearlong discussion with stakeholders produced no consensus.

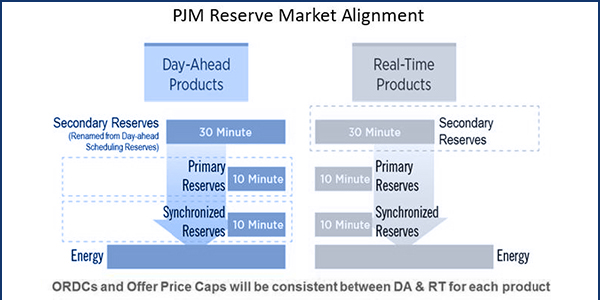

The RTO said its plan — submitted unilaterally under Section 206 of the Federal Power Act — appropriately values energy reserves during times of stress. It said the proposal relies on concepts that have been used successfully by other RTOs to capture the real-time actions of grid operators, including a revised operating reserve demand curve (ORDC); improved utilization of existing capability for locational reserve needs; alignment of the day-ahead and real-time markets; and increased penalty factors (EL19-58).

“Proper price formation is critical to ensuring that prices reflect the value of the reserves required to operate the system. PJM’s proposal represents a major step forward in the design of the market,” said Stu Bresler, senior vice president of operations and markets, in a press release Friday. “These resources are not just critical to reliability today and in the future, they will provide the backup flexibility needed so that the grid is prepared for the continued integration of alternative sources of energy.”

Bresler said renewable portfolio standards for D.C. and the RTO’s 13 states call for adding 25,000 MW of wind and 12,000 MW of solar by 2034, adding a level of complexity to reserves that existing rules don’t address. Ensuring reliability — and ultimately more competition and lower prices — depends on the reserve market reflecting the value of operator actions, Bresler said.

“There’s ample evidence that our reserve pricing needs to be reformed,” he told RTO Insider on Friday. In “41 out of the 48 hours of the polar vortex in January [2019], the price for synchronous reserve was at or near zero. To have the reserve price so close to zero, it doesn’t really make sense.”

Synchronized reserves are those able to provide power or remove demand within 10 minutes.

A Contentious Process

Despite meeting 23 times over 13 months beginning in January 2018, the Energy Price Formation Senior Task Force was unable to reach consensus. Tired of the stalemate, the PJM Board of Managers in December demanded staff move forward without member support if no consensus was reached by Jan. 31.

The Markets and Reliability Committee voted on five proposals in January, none of which cleared the two-thirds threshold required for a Section 205 filing under the FPA. Members protested the board’s deadline as “arbitrary,” but a last-ditch effort at compromise fell short on Feb. 6. (See Last Gasp Bid on Energy Price Formation Falls Short.)

The board agreed to submit staff’s proposal in mid-February. (See PJM Moves Forward with Own Energy Price Formation Plan.)

Staff, however, did grant the unusual step of seeking feedback from stakeholders on the filing before submitting it to FERC. The March 14 meeting produced “helpful” input, said Bresler, who noted that staff asked the commission for an extended 45-day comment period to give members ample time to weigh in.

“Frankly, I hope we never have to use this [Section 206] process again,” he said. “But we do think that it is beneficial to get stakeholder feedback, because they usually do point out things that are a benefit to clarify in the language.”

American Municipal Power CEO Marc Gerken said on Wednesday he believed the board’s deadline pressured staff into filing prematurely, leaving the door open for market flaws. (See related story, Rushing Price Formation Filing Unwise, AMP Tells PJM.)

He also criticized the RTO for tweaking the language in its proposal after the Jan. 24 MRC meeting. PJM posted slides detailing these revisions just 24 hours before the March 14 meeting, he said, which wasn’t enough time to review and respond to such “significant” alterations.

Bresler disagreed with Gerken’s characterizations of the process. “I think it’s reasonable to expect that with a proposal like this there are many details that fall under the major components, if you will, that are in constant flux. You saw that with the voting process during stakeholder meetings,” he said. “It’s reasonable to expect that that’s going to be the case. I think we were getting down to a level of detail that we needed to ensure that we had a complete proposal.”

Section 206 filings come with no statutory deadlines, though PJM requested the commission rule by Dec. 15 in order for the RTO to implement changes by June 1, 2020.