By Amanda Durish Cook

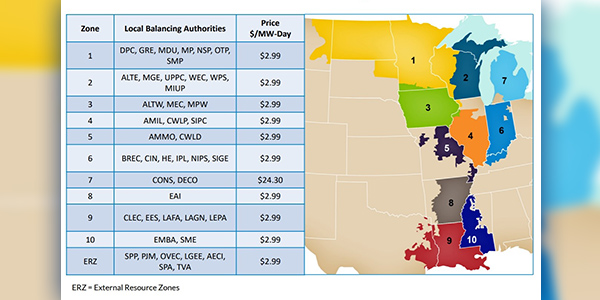

MISO’s seventh annual capacity auction cleared at $2.99/MW-day in all but one zone, a significant decline compared with last year’s nearly uniform $10 clearing price.

Zone 7 — representing the Lower Peninsula of Michigan — was the only area to deviate significantly, clearing instead at $24.30/MW-day.

MISO on Friday reported that it committed 134.7 GW worth of capacity for the 2019/20 planning year beginning June 1. The Planning Resource Auction was characterized by “lower offer prices from market participants in most of MISO,” the RTO said, but the volume of generation supply was “consistent” with the predictions from last year’s resource adequacy survey issued in partnership with the Organization of MISO States.

MISO received more than 142 GW worth of offers in this year’s auction, about 7 GW above the nearly 135-GW reserve margin requirement for June 2019 to May 2020.

“There is a surplus above our resource adequacy requirements to meet peak load,” Eric Thoms, MISO manager of capacity market administration, said during a media call Monday to discuss the results.

Market participants this year “simply offered in at a lower price” when compared to last year, Thoms said.

Having all but one local resource zone clearing at the same price is a familiar story for MISO auctions. Last year’s auction cleared at $10/MW-day, with the exception of Zone 1 — covering parts of Wisconsin, Minnesota and the Dakotas — which cleared at $1/MW-day. (See MISO Clears at $10/MW-day in 2018/19 Capacity Auction.)

Although higher than 2017/18’s single clearing price of $1.50/MW-day, last year’s $10 price tag elicited criticism from some market stakeholders as being too low. In his 2017 State of the Market report issued last June, MISO’s Independent Market Monitor David Patton said the “fundamental problem” with diminishing capacity can be traced to “the relatively low net revenues generated in MISO’s markets.” (See “Low Capacity Prices,” MISO to Address Growing Supply Shortage in New Year.)

Price Separation, Mitigation for Lower Michigan

The Monitor has reviewed and certified this year’s results but did have to enforce market mitigation for economic withholding in Zone 7. MISO said the IMM mitigated “several” offers representing about 1.5 MW, resulting in a 1 cent/MW-day impact in lower Michigan. It was the second time in the auction’s seven-year history that the Monitor had to enforce mitigation, with the first instance of enforcement occurring in 2013/14 planning year. “While IMM mitigation is rare, we’d like to note the process is working as designed,” MISO said in a statement.

Thoms said the mitigation was “interesting development.”

Speaking during a separate stakeholder call on the results Monday, Thoms said non-zero price offers, tight supply and a lower capacity import limit than last year contributed to price separation in lower Michigan. At nearly 22 GW, Zone 7 had the highest planning reserve margin requirement of MISO’s 10 local resource zones.

Michigan Public Service Commission staffer Bonnie Janssen asked if the price separation was at least in part the result of MISO no longer counting external resources towards satisfying the local clearing requirements for local zones. Thoms said the RTO would examine that as part of future presentations on the auction.

MISO also reported that more solar and wind generation cleared this year’s auction when compared to the 2018/19 planning year. The auction cleared 680 MW worth of solar, up 47% from last year, while wind capacity increased 21% to nearly 2.7 GW. The share of natural gas-fired capacity (38%) beat out coal (35%), which MISO said illustrates “the industry’s ongoing shift away from coal-fired generation and increasing reliance on gas-fired resources and renewables.”

Thoms said this auction was the first in which natural gas supplanted coal as the leading source of MISO capacity. He also called the increase in renewables capacity “significant.”

The PRA also cleared 15 GW of non-traditional resources, including demand response, energy efficiency, behind-the-meter generation and generation from external resources, compared with slightly more than 14 GW for those resource types last year. This was the first year that MISO included its newly created external resource zones in the auction. (See FERC OKs MISO External Capacity Zones, Dispute Deadlines.) Prior to its external zone creation, MISO treated external resources as if they were physically located within the nearest local resource zone. Even though external resources can clear at different prices than local resource zones, all external resource prices this year followed the $2.99/MW-day clearing price set by the planning reserve requirement.

MISO will go over more detailed PRA results with stakeholders at the May 8 Resource Adequacy Subcommittee meeting.