(Updated to include House hearing April 15.)

By Christen Smith

Pennsylvania senators waded into the debate over subsidizing the state’s nuclear fleet on Wednesday, questioning the owners’ need for a legislative solution at a time they are reporting substantial profits.

“You guys are not winning the war in my district,” State Sen. Mario Scavello (R) told a panel of nuclear executives during a public hearing on Senate Bill 510 on Wednesday. “When they are told their electricity bill is going to go up, that just gets to them.”

Exelon and FirstEnergy Solutions told the Senate Consumer Protection and Professional Licensure Committee that SB 510 levels the playing field for carbon-free energy sources unable to profit at low wholesale prices set by polluting fossil fuels. Both companies announced early retirements for nuclear facilities in Pennsylvania, including Three Mile Island in September and Beaver Valley in 2021.

“When the rules allow you to pollute for free, not show up when customers need the power, and get paid the same as power plants that don’t pollute and run 24/7, of course you like the rules,” said Kathleen Barron, senior vice president of government and regulatory affairs for Exelon. “Fossil generators have the luxury of having the costs of their pollution borne by society so they do not have to factor those costs into their market offers.”

Sen. Ryan Aument (R) introduced SB 510 on April 3, more than three weeks after a similar House of Representatives plan drew criticism for its perceived favoring of expensive, aging nuclear facilities instead of cheaper renewable resources or fossil fuels. (See Pa. Lawmakers Introduce 2nd Nuke Subsidy Bill.) Both proposals create a third tier within the state’s Alternative Energy Portfolio Standard (AEPS) program, from which suppliers must buy 50% of their power by 2021. Unlike the House version, however, the Senate bill directs the Public Utility Commission to set credit prices and guarantee between 17 and 23% of Tier III sources purchased include non-nuclear suppliers, like wind and solar. The first two tiers of the AEPS include 16 renewable resource types with targets of 8% and 10%, respectively.

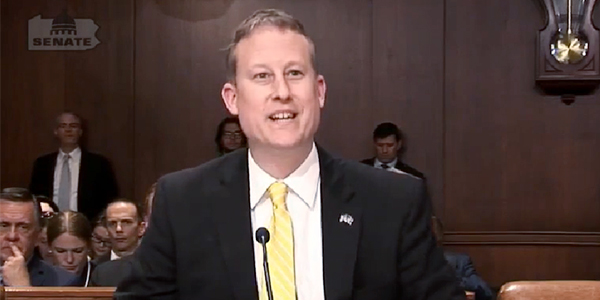

“It’s not a zero-sum game where only one resource, nuclear or renewables, can grow,” Aument said on Wednesday. “My bill makes sure there’s space in Tier III to build up a competitive renewable portfolio. I am not, nor have I ever been, interested in a direct government subsidy for the nuclear industry.”

In February, Exelon reported record-breaking production levels for its nuclear fleet in 2018. It anticipates operating earnings of $3 to $3.30/share in 2019 based on growth in utility revenue, the impact of zero-emission credits on its New Jersey nuclear plants and previously announced cost reductions.

Sen. Kim Ward (R) pressed Exelon about the billions in profits the nuclear industry collected last year and questioned whether the company supported the bill for financial or philosophical reasons.

Barron said the wholesale market values the cheapest price over the cleanest form of energy, saying it is an unfair comparison that leaves nuclear plants with their hands tied.

“We feel like it’s a financial question of what we are earning as a result of market rules,” she said.

Dave Griffing, senior vice president of government affairs for FirstEnergy Solutions, told Ward to look no further than his company’s latest bankruptcy filings.

“FirstEnergy Solutions wouldn’t have entered into Chapter 11 restructuring if this wasn’t a financial concern,” he said. “We have two sources of revenue — generation and capacity — and those are deflated, so yes it’s a financial concern for us.” (See Judge Rejects Liability Release in FirstEnergy Reorg.)

Critics of the bill insist the subsidies disrupt the competitive wholesale market. (See Critics Warn Pa. Lawmakers Against Nuke Subsidy Bill.)

“With respect to nuclear power plants, [financial problems have] largely been limited to single-reactor units that do not possess the efficiencies of scale to be economically competitive,” said David Spigelmyer, president of the Marcellus Shale Coalition. “Currently across the United States, six nuclear power facilities have announced retirement plans. Four of the facilities are single-reactor facilities, while the other two have announced retirements due to a variety of locally significant factors, including opposition from environmental organizations.”

PJM’s Independent Market Monitor said last month that three of the RTO’s 18 nuclear facilities face revenue shortfalls through 2021. The three plants — Davis-Besse, Perry and TMI — each operate just one reactor. The remaining multiunit facilities, including the subsidized Quad Cities in Illinois, will remain profitable. Even without ZECs, Quad Cities would cover its costs for the next three years, according to the Monitor. (See Monitor Says PJM’s Capacity Market not Competitive.)

An analysis from the National Conference of State Legislatures determined SB 510 would cost $550 million in tax credits at a rate of $6.68/MWh — far lower than the prices of subsidies in Illinois, New York and New Jersey. Pennsylvania’s sheer amount of eligible megawatt-hours — $83 million spread across nine nuclear reactors — would make it the largest subsidy program nationwide.

House Resumes Hearings

The House Consumer Affairs Committee drilled deeper into questions surrounding Exelon’s profits during a second hearing on the similarly structured HB 11 on Monday. Citing the Market Monitor’s estimates, Rep. Ryan Mackenzie (R) asked Barron whether Exelon’s other Pennsylvania plants — Limerick and Peach Bottom — earned nearly $350 million combined in 2018, compared to TMI’s $37 million loss.

Barron refused to detail individual unit costs and revenue forecasts and said the Monitor’s estimates are inaccurate.

“It is inaccurate to the extent that the data is based on industry averages in terms of costs,” she said. “The Market Monitor does not have unit-specific costs, as that is competitively sensitive information. The estimates assumed there will be no change in costs and costs will stay exactly the same. It also assumes there will be no risks.”

An analysis from the National Conference of State Legislatures determined SB 510 would cost $550 million in tax credits at a rate of $6.68/MWh — far lower than the prices of subsidies in Illinois, New York and New Jersey. Pennsylvania’s sheer number of eligible megawatt-hours — $83 million spread across nine nuclear reactors — would make it the largest subsidy program nationwide.

Discussion on HB 11 will continue April 29. Barron said if no policy solution passes the legislature before June 1, TMI will shut down.