NYISO’s Management Committee should approve Tariff revisions on a new market design for distributed energy resources, the Business Issues Committee recommended Wednesday.

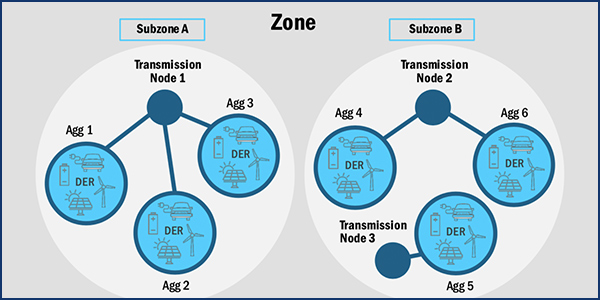

Michael Lavillotti, the ISO’s senior market design specialist, presented an outline of the new construct. The aspects range from electrically mapping each individual DER or facility for transmission node-level granularity, to authorizing entities to provide meter services to aggregations in the DER and reliability-based demand response programs.

The motion passed with 89.25% affirmative votes, despite concerns from several stakeholders about issues such as mitigation and the terms for dual participation, under which DERs that provide wholesale market services can also provide services to another entity such as a utility or host facility.

Couch White attorney Amanda De Vito Trinsey, representing New York City and Multiple Intervenors, a coalition of large industrial, commercial and institutional energy customers, said that despite concerns with several aspects of the market design and changes to capacity values for resources (including resources participating in the reliability-based DR program), her clients support the proposal.

NYISO Vice President for Market Operations Emilie Nelson and Senior Vice President for Market Structures Rana Mukerji said the ISO feels it struck a fair balance between reliability and market risk, and that stakeholders can help refine and adjust the Tariff rules as they all gain experience working with DERs.

“Don’t let the perfect become the enemy of the way better, and this is way better than what we started with,” said BIC Chair Aaron Breidenbaugh, who represents small consumers.

New External SRE Penalty

The BIC also recommended the MC approve a new external supplemental resource evaluation (SRE) penalty regime to improve the ISO’s ability to call on external resources that have sold into its markets. The changes would take effect in the third quarter.

Amanda Carney, NYISO capacity market design specialist, said all external capacity suppliers required to offer their energy at an external proxy must bid at the offer floor, be operating and available, and flow the scheduled transaction.

Under the new proposal, any external resource that fails to meet the criteria will be subject to the penalty, which is equal to 1.5 times the applicable spot price multiplied by the number of megawatts of shortfall and the percentage of the SRE call hours that a supplier fails to respond to.

External capacity suppliers would not be subject to the penalty if their failure to deliver is beyond their control, Carney said.

Howard Fromer, director of market policy for PSEG Power New York, thanked the ISO for the greater comparability in treatment of internal and external resources, and particularly for not penalizing external resources for failure to perform because of events beyond their control.

“Though the penalty is still draconian, we understand this is an interim measure to get the electrons here,” Fromer said. “We believe something could be done in the future to avoid using bidding gymnastics to achieve the goal and instead make bids that reflect costs in a more reasonable way to ensure reliability and performance.”

Under the new penalty provisions, the ISO will calculate deficiencies monthly, using the total number of SRE call hours in a given month that the resource could be online for and the total number of megawatts of shortfall in that month, Carney said.

External capacity suppliers are currently able to receive capacity payments without providing energy if their bids are uneconomic, even when called upon by NYISO during critical system conditions.

The BIC also approved changes to the accounting and billing manual, including to local reliability rule names, to be in line with changes made last May by the New York State Reliability Council.

LBMPs, Gas Prices up Slightly in March

NYISO locational-based marginal prices averaged $34.91/MWh in March, up about 4% from February and nearly 17% from the same month a year ago, Mukerji said in delivering the monthly operations report.

Year-to-date monthly energy prices averaged $42.54/MWh, a 29% decrease from a year ago.

Day-ahead and real-time load-weighted LBMPs came in higher compared to February. Average daily sendout was 411 GWh/day in March, compared with 436 GWh/day in February and 413 GWh/day in the same month a year ago.

Transco Z6 hub natural gas prices averaged $2.93/MMBtu for the month, up 6.5% from February and 2.6% from a year ago.

Distillate prices were up about 2.6% year over year and were mixed from the previous month, with Jet Kerosene Gulf Coast averaging $14.08/MMBtu, down from $14.21/MMBtu, while Ultra-low Sulfur No. 2 Diesel NY Harbor rose to $14.18/MMBtu, up from $14.02/MMBtu in February.

March uplift increased to -33 cents/MWh from -44 cents/MWh in February, while total uplift costs, excluding the ISO’s cost of operations, came in higher than the previous month.

The ISO’s 31-cents/MWh local reliability share in March was up from 11 cents/MWh the previous month, while the statewide share dropped to -64 cents/MWh from -55 cents/MWh in February.

The Thunderstorm Alert cost was 1 cent/MWh, up from the usual $0.

— Michael Kuser