By Christen Smith

PJM wants FERC to toss out the Independent Market Monitor’s complaint about its default market seller offer cap (MSOC), saying the IMM’s February filing did not prove current rules encourage abuse of market power (ER19-47).

In an April 9 response filed with the commission, PJM said the Monitor didn’t provide enough evidence that its current cap — approved four years prior as part of the RTO’s Capacity Performance construct — and the results of Base Residual Auctions suddenly became unjust and unreasonable.

PJM said the commission’s order approving CP “explained that the default MSOC is just and reasonable because it reflects the amount that a competitive resource would accept to be committed as a capacity resource.”

“In particular, it is designed to allow capacity market sellers to recover the costs, investments and expenses needed to ensure that their resources can perform during emergencies occurring at any time of the year. In other words, the default MSOC is intended to reflect the opportunity cost that a resource faces when choosing whether to become a committed capacity resource,” PJM said.

The Monitor said in its initial filing that PJM’s MSOC has been inflated by the “unreasonable and unsupported” expectation of 30 performance assessment hours (PAHs) annually. As a result, the Monitor said, it has been prevented from effective mitigation of market power, able to subject only a small number of very high offers to unit-specific cost reviews. (See Monitor Asks FERC to Cut PJM Capacity Offer Cap.)

Unit-specific MSOCs are supposed to be based on the opportunity cost of taking on a CP obligation, with its expectations of bonus payments or penalties for performance during an emergency, PJM said. (The time span for measuring performance was changed from PAHs to five-minute performance assessment intervals (PAIs) in compliance with FERC Order 825 in 2018.)

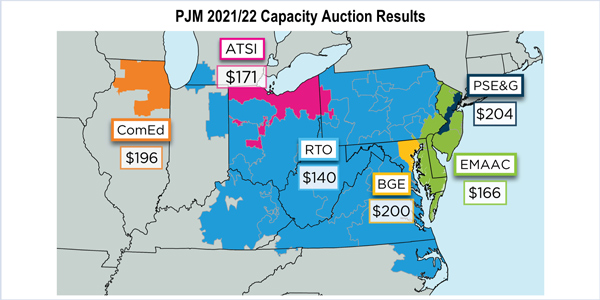

In August, the Monitor concluded that ratepayers were overcharged by $2.7 billion (41.5%) in the 2018 BRA because of economic withholding encouraged by the inflated MSOC. (See IMM: PJM 2018 Capacity Auction was ‘Not Competitive’.)

PJM asked the commission to reject the Monitor’s proposed replacement rate of 60 PAIs and instead adopt a method that applies the same measurement to equations for both the default MSOC and the nonperformance charge. This rate, the RTO asked, would not take effect until after the 2022/23 BRA, for which several compliance deadlines for market sellers have already passed.

“The Market Monitor’s proposal is unjust and unreasonable due to, among other reasons, the disconnect between the number of expected performance assessment intervals in the nonperformance charge rate and the default MSOC,” PJM said. “Retaining the same value of performance assessment intervals in both equations is essential to maintaining the underlying logic of the existing default MSOC equation.”