WESTBOROUGH, Mass. — Two of three economic study requests presented at ISO-NE’s Planning Advisory Committee meeting Thursday pertained to offshore wind development, while the other concerned transmission upgrades needed to accommodate onshore wind resources in Maine.

The New England States Committee on Electricity (NESCOE) requested that the RTO analyze various scenarios of the integration of OSW of up to 4,000 MW by 2030 and 7,000 MW by 2035.

“We’re trying to figure out the best place for these [offshore projects] to interconnect,” said Dorothy Capra, NESCOE director of regulatory services.

Transmission developer Anbaric Development Partners requested a study to review the impacts of OSW on energy market prices, emissions and regional fuel security in 2030.

Theodore Paradise, senior vice president of transmission strategy and counsel at Anbaric, predicted there will be between 8,000 and 12,000 MW of OSW nameplate capacity in New England by 2030, not including the current 9 GW target to serve New York loads.

“One of the great things we’ve done in New England over the past decade or so is spend $13 billion to $14 billion on infrastructure … so it looks like the system can handle the extra generation,” Paradise said.

One stakeholder, however, wondered whether the industry is reaching a level of irrational exuberance, with several parties potentially relying on the same resources for reliability.

RENEW Northeast Executive Director Francis Pullaro presented a request to evaluate the economic impact of two conceptual alternate transmission upgrades that would increase the hourly operating limits of the Orrington South interface in Maine.

If the study shows the expected production cost savings from one of the scenarios exceeds the expected cost of the upgrade, RENEW will ask the RTO to identify the project as a possible market efficiency transmission upgrade.

Eversource to Rebuild Conn. 69-kV Line

Eversource Energy is completely rebuilding 6.1 miles of the 69-kV 667 transmission line from the Falls Village substation to the Salisbury substation in Connecticut, with completion expected by year-end.

Eversource planning engineer John Case detailed the estimated $24 million project to replace 51 lattice towers, and one wood tower, with 18 engineered and 35 light-duty weathered steel structures. The line, designed for 115 kV, was built in 1926.

The project will also add one light-duty structure outside the Falls Village substation to improve clearances, replace steel-reinforced aluminum conductor with steel-supported aluminum conductor and replace existing shield wire with new optical ground wire.

Final 2019 Load Forecast

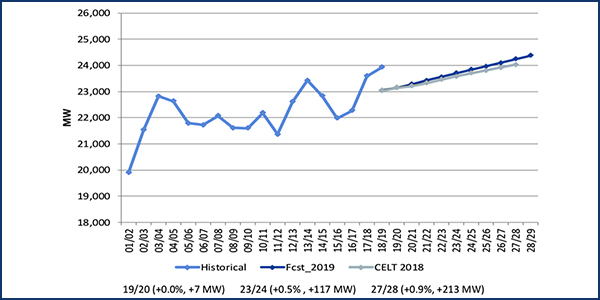

ISO-NE’s 2019 Capacity, Energy, Loads and Transmission (CELT) winter forecasts are slightly higher relative to last year, with the 2027 winter 50/50 gross demand forecast up about 1.1% and the net demand forecast for that year about 1.2% higher.

ISO-NE implemented monthly energy modeling for this year’s forecast, rather than annual, Manager of Load Forecasting Jon Black said.

“We did that intentionally so that we could capture seasonal trends as they diverge,” Black said.

The RTO revised and updated the winter demand models, replacing dry-bulb temperature with effective temperature — to include the effect of wind on heating demand — and incorporating heating degree days as a second weather variable.

The historical weather period used to generate a probabilistic forecast was shortened from 40 to 25 years, now covering 1991-2015.

Black said the 2019 model demonstrates improved performance relative to 2018 based on a comparison of mean absolute percentage errors: 1.1% during January 2019 non-holiday weekdays from 2.2% a year earlier.

“So this is really good feedback and shows we’re on the right track,” Black said. “If batteries come into our market, that’s not a load forecasting problem. All indicators suggest that the outlook for out-of-market batteries across the region are still too small to be a significant forecasting influence.”

Cutting Tx Review Periods to Save Time

ISO-NE will shave two months from its typically yearlong — and sometimes much longer — transmission planning process by halving the typical stakeholder review period for the Needs Assessment and Solutions Study documents.

“Stakeholders have said the transmission planning process takes far too long,” said Director of Transmission Planning Brent Oberlin, presenting a summary of the changes.

“Previous comments from stakeholders were to automate, automate, automate … which has been helped by a move to cloud computing,” Oberlin said.

Reducing the time for document review will provide further time savings. The RTO currently allows for 120 days of stakeholder document review in the planning process: 30 days for the draft scope of each document, followed by 30 days to review each final draft. But staff have determined that neither the Tariff nor the Transmission Planning Process Guide specify a duration requirement for the two review periods, enabling it to reduce those periods by half, in part because of redundancies within the documents.

The RTO expects to use similar time periods for stakeholder review of public policy and competitive solicitation materials generated by ISO-NE, unless otherwise mandated by the Tariff.

Tx Opportunity Reminder

Oberlin also reminded stakeholders of the qualified transmission project sponsor (QTPS) application process ahead of the release of ISO-NE’s first RFP in late 2019 or early 2020 for a competitive transmission solution based on the Boston Needs Assessment.

The RTO attempts to complete its review of QTPS applications within 90 days of the application being deemed complete, so any company planning to participate in the potential Boston RFP — or any other future competitive solution RFP — should apply soon, Oberlin said.

Eastern Conn. 2029 Needs Assessment Scope

ISO-NE Transmission Planning Engineer Jon Breard explained the changes between the 2027 and 2029 Eastern Connecticut (ECT) Assessments, noting that the RTO suspended the ECT 2027 Solutions Study process because of the changes in the 2019 CELT data.

Breard said the net load being used in the 2027 Solutions Study was too high given the change in estimated load, energy efficiency and solar PV from the 2017 CELT to the 2019 forecast.

The ECT 2029 Needs Assessment notably includes a scenario to capture stakeholder feedback on the 800-MW offshore Vineyard Wind project interconnecting to Southeast Massachusetts and the 1,090-MW New England Clean Energy Connect project interconnecting to the Larrabee Road substation in Maine, both selected in state-sponsored solicitations.

Stakeholders must submit comments on the ECT 2029 Needs Assessment to pacmatters@iso-ne.com by May 12. ISO-NE will post the assessment’s intermediate study files in the second quarter and post the report in the third or fourth quarter this year.

— Michael Kuser